General Tax Filing Information - City Of Hubbard Income Tax Department

ADVERTISEMENT

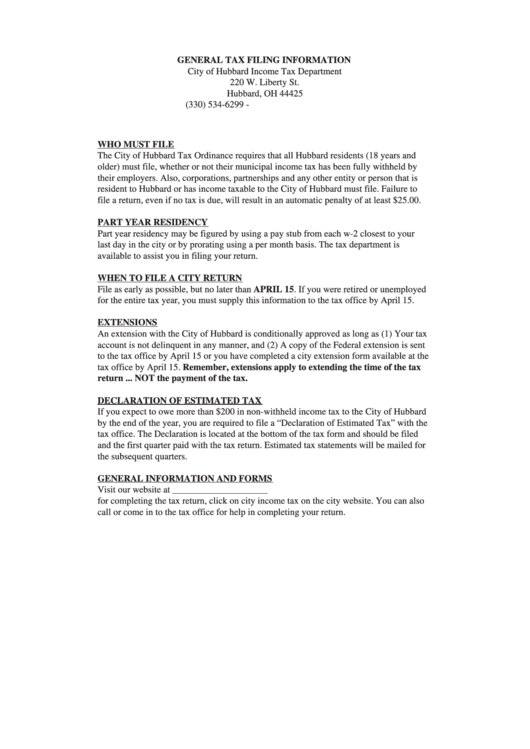

GENERAL TAX FILING INFORMATION

City of Hubbard Income Tax Department

220 W. Liberty St.

Hubbard, OH 44425

(330) 534-6299 -

WHO MUST FILE

The City of Hubbard Tax Ordinance requires that all Hubbard residents (18 years and

older) must file, whether or not their municipal income tax has been fully withheld by

their employers. Also, corporations, partnerships and any other entity or person that is

resident to Hubbard or has income taxable to the City of Hubbard must file. Failure to

file a return, even if no tax is due, will result in an automatic penalty of at least $25.00.

PART YEAR RESIDENCY

Part year residency may be figured by using a pay stub from each w-2 closest to your

last day in the city or by prorating using a per month basis. The tax department is

available to assist you in filing your return.

WHEN TO FILE A CITY RETURN

File as early as possible, but no later than APRIL 15. If you were retired or unemployed

for the entire tax year, you must supply this information to the tax office by April 15.

EXTENSIONS

An extension with the City of Hubbard is conditionally approved as long as (1) Your tax

account is not delinquent in any manner, and (2) A copy of the Federal extension is sent

to the tax office by April 15 or you have completed a city extension form available at the

tax office by April 15. Remember, extensions apply to extending the time of the tax

return ... NOT the payment of the tax.

DECLARATION OF ESTIMATED TAX

If you expect to owe more than $200 in non-withheld income tax to the City of Hubbard

by the end of the year, you are required to file a “Declaration of Estimated Tax” with the

tax office. The Declaration is located at the bottom of the tax form and should be filed

and the first quarter paid with the tax return. Estimated tax statements will be mailed for

the subsequent quarters.

GENERAL INFORMATION AND FORMS

Visit our website at to obtain forms. For interactive directions

for completing the tax return, click on city income tax on the city website. You can also

call or come in to the tax office for help in completing your return.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1