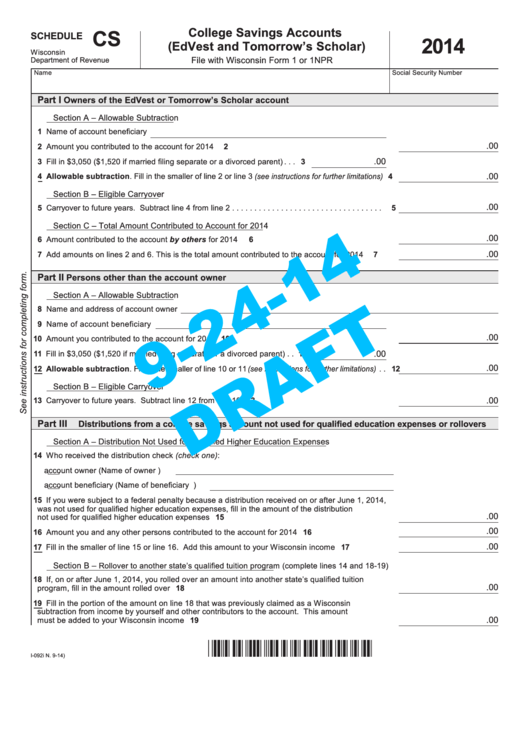

Form I-092i Draft - Schedule Cs - College Savings Accounts (Edvest And Tomorrow'S Scholar) - 2014

ADVERTISEMENT

College Savings Accounts

CS

SCHEDULE

2014

(EdVest and Tomorrow’s Scholar)

Wisconsin

File with Wisconsin Form 1 or 1NPR

Department of Revenue

Name

Social Security Number

Part I

Owners of the EdVest or Tomorrow’s Scholar account

Section A – Allowable Subtraction

1 Name of account beneficiary

.00

2 Amount you contributed to the account for 2014 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2

.00

3 Fill in $3,050 ($1,520 if married filing separate or a divorced parent) . . . 3

4 Allowable subtraction. Fill in the smaller of line 2 or line 3 (see instructions for further limitations)

4

.00

Section B – Eligible Carryover

.00

5 Carryover to future years. Subtract line 4 from line 2 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5

Section C – Total Amount Contributed to Account for 2014

.00

6 Amount contributed to the account by others for 2014 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6

.00

7 Add amounts on lines 2 and 6. This is the total amount contributed to the account for 2014 . . . .

7

Part II

Persons other than the account owner

Section A – Allowable Subtraction

8 Name and address of account owner

9 Name of account beneficiary

.00

10 Amount you contributed to the account for 2014 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10

.00

11 Fill in $3,050 ($1,520 if married filing separate or a divorced parent) . . 11

.00

12 Allowable subtraction . Fill in the smaller of line 10 or 11 (see instructions for further limitations) . . 12

Section B – Eligible Carryover

13 Carryover to future years. Subtract line 12 from line 10 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13

.00

Part III

Distributions from a college savings account not used for qualified education expenses or rollovers

Section A – Distribution Not Used for Qualified Higher Education Expenses

14 Who received the distribution check (check one):

account owner (Name of owner

)

account beneficiary (Name of beneficiary

)

15 If you were subject to a federal penalty because a distribution received on or after June 1, 2014,

was not used for qualified higher education expenses, fill in the amount of the distribution

.00

not used for qualified higher education expenses . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 15

.00

16 Amount you and any other persons contributed to the account for 2014 . . . . . . . . . . . . . . . . . . . 16

.00

17 Fill in the smaller of line 15 or line 16. Add this amount to your Wisconsin income . . . . . . . . . . 17

Section B –

Rollover to another state’s qualified tuition program (complete lines 14 and 18-19)

18 If, on or after June 1, 2014, you rolled over an amount into another state’s qualified tuition

.00

program, fill in the amount rolled over . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 18

19 Fill in the portion of the amount on line 18 that was previously claimed as a Wisconsin

subtraction from income by yourself and other contributors to the account. This amount

.00

must be added to your Wisconsin income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 19

I-092i N. 9-14)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1