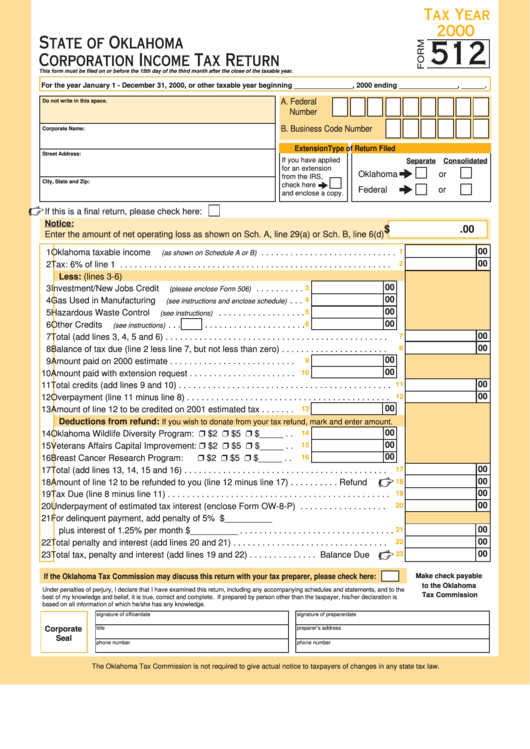

Form 512 - Corporation Income Tax Return - 2000

ADVERTISEMENT

Tax Year

2000

State of Oklahoma

512

Corporation Income Tax Return

This form must be filed on or before the 15th day of the third month after the close of the taxable year.

For the year January 1 - December 31, 2000, or other taxable year beginning _______________, 2000 ending _______________, ______.

A. Federal I.D.

Do not write in this space.

Number

B. Business Code Number

Corporate Name:

Extension

Type of Return Filed

Street Address:

If you have applied

Separate

Consolidated

for an extension

Oklahoma

or

from the IRS,

City, State and Zip:

check here

Federal

or

and enclose a copy.

If this is a final return, please check here:

Notice:

$

.00

Enter the amount of net operating loss as shown on Sch. A, line 29(a) or Sch. B, line 6(d)

00

1 Oklahoma taxable income

. . . . . . . . . . . . . . . . . . . . . . . . . . . .

1

(as shown on Schedule A or B)

00

2 Tax: 6% of line 1 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2

Less: (lines 3-6)

00

3 Investment/New Jobs Credit

. . . . . . . . . .

3

(please enclose Form 506)

00

4 Gas Used in Manufacturing

. . .

4

(see instructions and enclose schedule)

00

5 Hazardous Waste Control

. . . . . . . . . . . . . . . . . .

5

(see instructions)

00

6 Other Credits

. . .

. . . . . . . . . . . . . . . . . . . . .

6

(see instructions)

00

7

7 Total (add lines 3, 4, 5 and 6) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

00

8 Balance of tax due (line 2 less line 7, but not less than zero) . . . . . . . . . . . . . . . . . . . . . .

8

00

9 Amount paid on 2000 estimate . . . . . . . . . . . . . . . . . . . . . . . . . .

9

00

10 Amount paid with extension request . . . . . . . . . . . . . . . . . . . . . .

10

00

11 Total credits (add lines 9 and 10) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

11

00

12 Overpayment (line 11 minus line 8) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

12

00

13 Amount of line 12 to be credited on 2001 estimated tax . . . . . . .

13

Deductions from refund:

If you wish to donate from your tax refund, mark and enter amount.

00

14 Oklahoma Wildlife Diversity Program:

$2

$5

$_____ . .

14

00

15 Veterans Affairs Capital Improvement:

$2

$5

$_____ . .

15

00

16 Breast Cancer Research Program:

$2

$5

$_____ . .

16

00

17

17 Total (add lines 13, 14, 15 and 16) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

00

18 Amount of line 12 to be refunded to you (line 12 minus line 17) . . . . . . . . . . Refund

18

00

19 Tax Due (line 8 minus line 11) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

19

00

20

20 Underpayment of estimated tax interest (enclose Form OW-8-P) . . . . . . . . . . . . . . . . . .

21 For delinquent payment, add penalty of 5% $__________

00

plus interest of 1.25% per month $__________ . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

21

00

22 Total penalty and interest (add lines 20 and 21) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

22

00

23

23 Total tax, penalty and interest (add lines 19 and 22) . . . . . . . . . . . . . . Balance Due

If the Oklahoma Tax Commission may discuss this return with your tax preparer, please check here:

Make check payable

to the Oklahoma

Under penalties of perjury, I declare that I have examined this return, including any accompanying schedules and statements, and to the

Tax Commission

best of my knowledge and belief, it is true, correct and complete. If prepared by person other than the taxpayer, his/her declaration is

based on all information of which he/she has any knowledge.

signature of officer

date

signature of preparer

date

title

preparer’s address

Corporate

Seal

phone number

phone number

The Oklahoma Tax Commission is not required to give actual notice to taxpayers of changes in any state tax law.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4