Form Dp-132-We - Combined Net Operating Loss (Nol) Deduction

ADVERTISEMENT

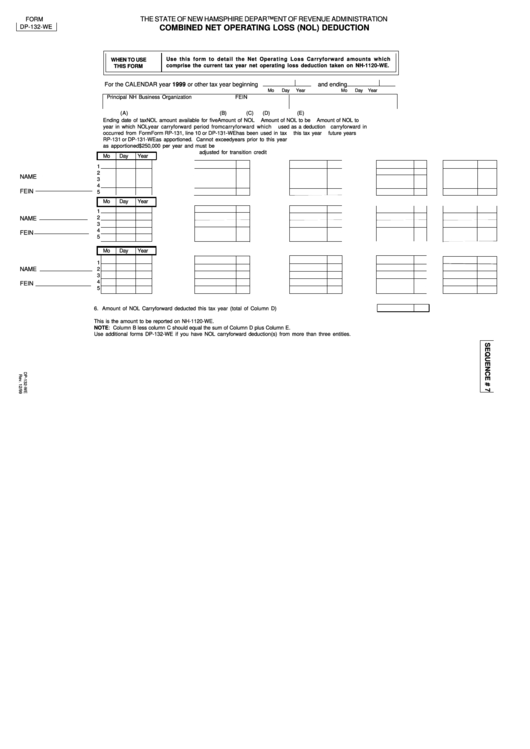

THE STATE OF NEW HAMSPHIRE DEPARTMENT OF REVENUE ADMINISTRATION

FORM

DP-132-WE

COMBINED NET OPERATING LOSS (NOL) DEDUCTION

Use this form to detail the Net Operating Loss Carryforward amounts which

WHEN TO USE

comprise the current tax year net operating loss deduction taken on NH-1120-WE.

THIS FORM

For the CALENDAR year 1999 or other tax year beginning

and ending

Mo

Day

Year

Mo

Day

Year

Principal NH Business Organization

FEIN

(A)

(B)

(C)

(D)

(E)

Ending date of tax

NOL amount available for five

Amount of NOL

Amount of NOL to be

Amount of NOL to

year in which NOL

year carryforward period from

carryforward which

used as a deduction

carryforward in

occurred from Form

Form RP-131, line 10 or DP-131-WE

has been used in tax

this tax year

future years

RP-131 or DP-131-WE

as apportioned. Cannot exceed

years prior to this year

as apportioned

$250,000 per year and must be

adjusted for transition credit

Mo

Day

Year

1

2

NAME

3

4

FEIN

5

Mo

Day

Year

1

2

NAME

3

4

FEIN

5

Mo

Day

Year

1

NAME

2

3

4

FEIN

5

6. Amount of NOL Carryforward deducted this tax year (total of Column D)..................................................................

This is the amount to be reported on NH-1120-WE.

NOTE: Column B less column C should equal the sum of Column D plus Column E.

Use additional forms DP-132-WE if you have NOL carryforward deduction(s) from more than three entities.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1