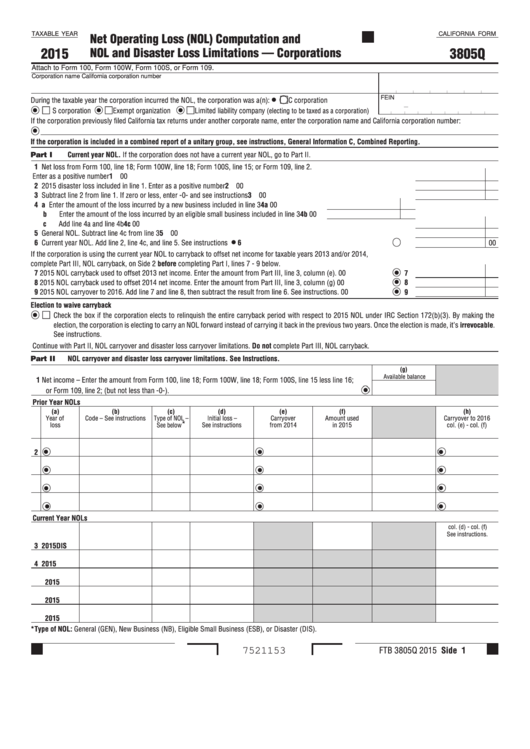

TAXABLE YEAR

Net Operating Loss (NOL) Computation and

CALIFORNIA FORM

2015

3805Q

NOL and Disaster Loss Limitations — Corporations

Attach to Form 100, Form 100W, Form 100S, or Form 109.

Corporation name

California corporation number

FEIN

During the taxable year the corporation incurred the NOL, the corporation was a(n):

C corporation

S corporation

Exempt organization

Limited liability company

(electing to be taxed as a corporation)

If the corporation previously filed California tax returns under another corporate name, enter the corporation name and California corporation number:

If the corporation is included in a combined report of a unitary group, see instructions, General Information C, Combined Reporting.

Part I

Current year NOL. If the corporation does not have a current year NOL, go to Part II.

1 Net loss from Form 100, line 18; Form 100W, line 18; Form 100S, line 15; or Form 109, line 2.

Enter as a positive number. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1

00

2 2015 disaster loss included in line 1. Enter as a positive number . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2

00

3 Subtract line 2 from line 1. If zero or less, enter -0- and see instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3

00

4 a Enter the amount of the loss incurred by a new business included in line 3 . . . . . . . . . . . . . 4a

00

b Enter the amount of the loss incurred by an eligible small business included in line 3 . . . . . 4b

00

c Add line 4a and line 4b . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4c

00

5 General NOL. Subtract line 4c from line 3 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5

00

6 Current year NOL. Add line 2, line 4c, and line 5. See instructions. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6

00

If the corporation is using the current year NOL to carryback to offset net income for taxable years 2013 and/or 2014,

complete Part III, NOL carryback, on Side 2 before completing Part I, lines 7 - 9 below.

7 2015 NOL carryback used to offset 2013 net income. Enter the amount from Part III, line 3, column (e). . . . . . . . . . . . .

7

00

8 2015 NOL carryback used to offset 2014 net income. Enter the amount from Part III, line 3, column (g) . . . . . . . . . . . . .

8

00

9 2015 NOL carryover to 2016. Add line 7 and line 8, then subtract the result from line 6. See instructions.. . . . . . . . . . . .

9

00

Election to waive carryback

Check the box if the corporation elects to relinquish the entire carryback period with respect to 2015 NOL under IRC Section 172(b)(3). By making the

election, the corporation is electing to carry an NOL forward instead of carrying it back in the previous two years. Once the election is made, it’s irrevocable.

See instructions.

Continue with Part II, NOL carryover and disaster loss carryover limitations. Do not complete Part III, NOL carryback.

Part II

NOL carryover and disaster loss carryover limitations. See Instructions.

(g)

Available balance

1 Net income – Enter the amount from Form 100, line 18; Form 100W, line 18; Form 100S, line 15 less line 16;

or Form 109, line 2; (but not less than -0-).. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Prior Year NOLs

(a)

(b)

(c)

(d)

(e)

(f)

(h)

Year of

Code – See instructions

Type of NOL –

Initial loss –

Carryover

Amount used

Carryover to 2016

*

loss

See below

See instructions

from 2014

in 2015

col. (e) - col. (f)

2

Current Year NOLs

col. (d) - col. (f)

See instructions.

3 2015

DIS

4 2015

2015

2015

2015

*Type of NOL: General (GEN), New Business (NB), Eligible Small Business (ESB), or Disaster (DIS).

FTB 3805Q 2015 Side 1

7521153

1

1 2

2