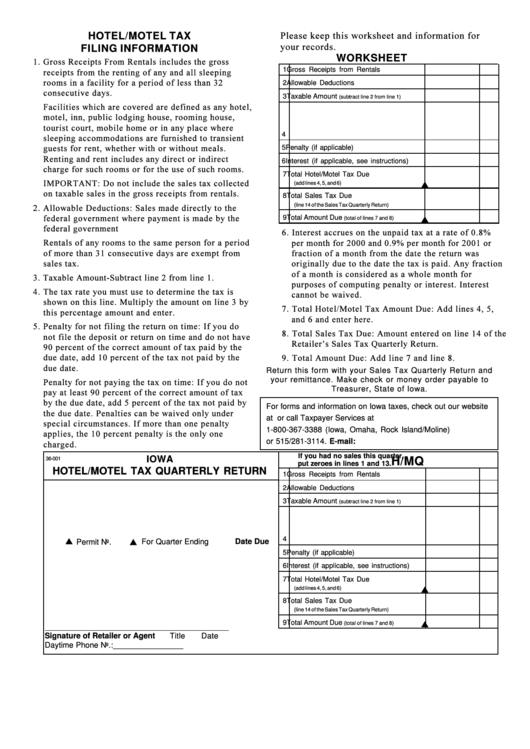

Form 36-001 (H/mq) - Hotel/motel Tax Quarterly Return

ADVERTISEMENT

Please keep this worksheet and information for

HOTEL/MOTEL TAX

your records.

FILING INFORMATION

WORKSHEET

1 Gross Receipts from Rentals

2 Allowable Deductions

3 Taxable Amount

(subtract line 2 from line 1)

4

5 Penalty (if applicable)

6 Interest (if applicable, see instructions)

7 Total Hotel/Motel Tax Due

s

(add lines 4, 5, and 6)

8 Total Sales Tax Due

(line 14 of the Sales Tax Quarterly Return)

s

9 Total Amount Due

(total of lines 7 and 8)

Return this form with your Sales Tax Quarterly Return and

your remittance. Make check or money order payable to

Treasurer, State of Iowa

.

For forms and information on Iowa taxes, check out our website

at or call Taxpayer Services at

1-800-367-3388 (Iowa, Omaha, Rock Island/Moline)

or 515/281-3114. E-mail: idrf@idrf.state.ia.us

If you had no sales this quarter,

IOWA

36-001

H/MQ

put zeroes in lines 1 and 13.

HOTEL/MOTEL TAX QUARTERLY RETURN

1 Gross Receipts from Rentals

2 Allowable Deductions

3 Taxable Amount

(subtract line 2 from line 1)

s

s

4

Date Due

Permit No.

For Quarter Ending

5 Penalty (if applicable)

6 Interest (if applicable, see instructions)

7 Total Hotel/Motel Tax Due

s

(add lines 4, 5, and 6)

8 Total Sales Tax Due

(line 14 of the Sales Tax Quarterly Return)

s

9 Total Amount Due

(total of lines 7 and 8)

Signature of Retailer or Agent

Title

Date

Daytime Phone No.: ________________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1