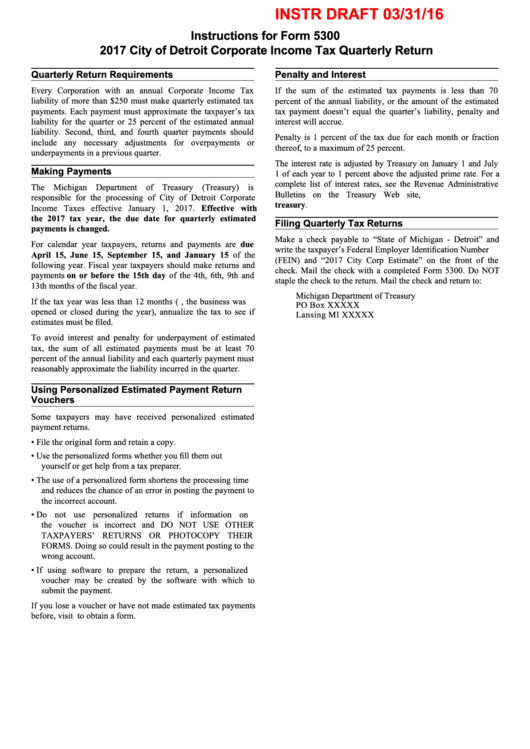

Instructions For Form 5300 - City Of Detroit Corporate Income Tax Quarterly Return - 2017

ADVERTISEMENT

INSTR DRAFT 03/31/16

Instructions for Form 5300

2017 City of Detroit Corporate Income Tax Quarterly Return

Quarterly Return Requirements

Penalty and Interest

Every Corporation with an annual Corporate Income Tax

If the sum of the estimated tax payments is less than 70

liability of more than $250 must make quarterly estimated tax

percent of the annual liability, or the amount of the estimated

payments. Each payment must approximate the taxpayer’s tax

tax payment doesn’t equal the quarter’s liability, penalty and

liability for the quarter or 25 percent of the estimated annual

interest will accrue.

liability. Second, third, and fourth quarter payments should

Penalty is 1 percent of the tax due for each month or fraction

include any necessary adjustments for overpayments or

thereof, to a maximum of 25 percent.

underpayments in a previous quarter.

The interest rate is adjusted by Treasury on January 1 and July

Making Payments

1 of each year to 1 percent above the adjusted prime rate. For a

complete list of interest rates, see the Revenue Administrative

The Michigan Department of Treasury (Treasury) is

Bulletins on the Treasury Web site,

responsible for the processing of City of Detroit Corporate

treasury.

Income Taxes effective January 1, 2017. Effective with

the 2017 tax year, the due date for quarterly estimated

Filing Quarterly Tax Returns

payments is changed.

Make a check payable to “State of Michigan - Detroit” and

For calendar year taxpayers, returns and payments are due

write the taxpayer’s Federal Employer Identification Number

April 15, June 15, September 15, and January 15 of the

(FEIN) and “2017 City Corp Estimate” on the front of the

following year. Fiscal year taxpayers should make returns and

check. Mail the check with a completed Form 5300. Do NOT

payments on or before the 15th day of the 4th, 6th, 9th and

staple the check to the return. Mail the check and return to:

13th months of the fiscal year.

Michigan Department of Treasury

If the tax year was less than 12 months (e.g., the business was

PO Box XXXXX

opened or closed during the year), annualize the tax to see if

Lansing MI XXXXX

estimates must be filed.

To avoid interest and penalty for underpayment of estimated

tax, the sum of all estimated payments must be at least 70

percent of the annual liability and each quarterly payment must

reasonably approximate the liability incurred in the quarter.

Using Personalized Estimated Payment Return

Vouchers

Some taxpayers may have received personalized estimated

payment returns.

• File the original form and retain a copy.

• Use the personalized forms whether you fill them out

yourself or get help from a tax preparer.

• The use of a personalized form shortens the processing time

and reduces the chance of an error in posting the payment to

the incorrect account.

• Do not use personalized returns if information on

the voucher is incorrect and DO NOT USE OTHER

TAXPAYERS’ RETURNS OR PHOTOCOPY THEIR

FORMS. Doing so could result in the payment posting to the

wrong account.

• If using software to prepare the return, a personalized

voucher may be created by the software with which to

submit the payment.

If you lose a voucher or have not made estimated tax payments

before, visit citytax to obtain a form.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1