Form Pr-26 - Personal Property Return - 2013

ADVERTISEMENT

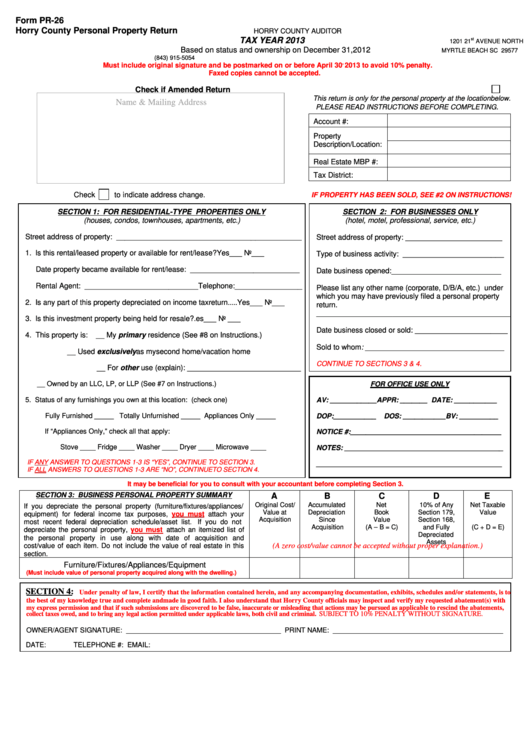

Form PR-26

Horry County Personal Property Return

HORRY COUNTY AUDITOR

TAX YEAR 2013

st

1201 21

AVENUE NORTH

Based on status and ownership on December 31, 2012

MYRTLE BEACH SC 29577

(843) 915-5054

,

Must include original signature and be postmarked on or before April 30

2013 to avoid 10% penalty.

Faxed copies cannot be accepted.

Check if Amended Return

This return is only for the personal property at the location below.

Name & Mailing Address

.

PLEASE READ INSTRUCTIONS BEFORE COMPLETING

Account #:

Property

Description/Location:

Real Estate MBP #:

Tax District:

Check

to indicate address change.

IF PROPERTY HAS BEEN SOLD, SEE #2 ON INSTRUCTIONS!

SECTION 1: FOR RESIDENTIAL-TYPE PROPERTIES ONLY

SECTION 2: FOR BUSINESSES ONLY

(houses, condos, townhouses, apartments, etc.)

(hotel, motel, professional, service, etc.)

Street address of property: ____________________________________________

Street address of property: _______________________

1. Is this rental/leased property or available for rent/lease?................Yes___ No___

Type of business activity: ________________________

Date property became available for rent/lease: __________________________

Date business opened: __________________________

Rental Agent: ___________________________Telephone:________________

Please list any other name (corporate, D/B/A, etc.) under

which you may have previously filed a personal property

2. Is any part of this property depreciated on income tax return.........Yes___ No___

return.

______________________________________________

3. Is this investment property being held for resale?..........................Yes___ No ___

Date business closed or sold: ______________________

4. This property is:

__ My primary residence (See #8 on Instructions.)

Sold to whom: __________________________________

__ Used exclusively as my second home/vacation home

CONTINUE TO SECTIONS 3 & 4.

__ For other use (explain): ___________________________

__ Owned by an LLC, LP, or LLP (See #7 on Instructions.)

FOR OFFICE USE ONLY

5. Status of any furnishings you own at this location: (check one)

AV: ____________ APPR: _______ DATE: ___________

Fully Furnished _____ Totally Unfurnished _____ Appliances Only _____

DOP:___________

DOS: ___________ BV: __________

If “Appliances Only,” check all that apply:

NOTICE #:_______________________________________

Stove ____ Fridge ____ Washer ____ Dryer ____ Microwave ____

NOTES: _________________________________________

IF ANY ANSWER TO QUESTIONS 1-3 IS “YES”, CONTINUE TO SECTION 3.

________________________________________________

IF ALL ANSWERS TO QUESTIONS 1-3 ARE “NO”, CONTINUE TO SECTION 4.

It may be beneficial for you to consult with your accountant before completing Section 3.

SECTION 3: BUSINESS PERSONAL PROPERTY SUMMARY

A

B

C

D

E

Original Cost/

Accumulated

Net

10% of Any

Net Taxable

If you depreciate the personal property (furniture/fixtures/appliances/

Value at

Depreciation

Book

Section 179,

Value

equipment) for federal income tax purposes,

you must

attach your

Acquisition

Since

Value

Section 168,

most recent federal depreciation schedule/asset list.

If you do not

Acquisition

(A – B = C)

and Fully

(C + D = E)

depreciate the personal property,

you must

attach an itemized list of

Depreciated

the personal property in use along with date of acquisition and

Assets

cost/value of each item. Do not include the value of real estate in this

(A zero cost/value cannot be accepted without proper explanation.)

section.

Furniture/Fixtures/Appliances/Equipment

(Must include value of personal property acquired along with the dwelling.)

SECTION 4:

Under penalty of law, I certify that the information contained herein, and any accompanying documentation, exhibits, schedules and/or statements, is to

the best of my knowledge true and complete and made in good faith. I also understand that Horry County officials may inspect and verify my requested abatement(s) with

my express permission and that if such submissions are discovered to be false, inaccurate or misleading that actions may be pursued as applicable to rescind the abatements,

collect taxes owed, and to bring any legal action permitted under applicable laws, both civil and criminal.

SUBJECT TO 10% PENALTY WITHOUT SIGNATURE.

OWNER/AGENT SIGNATURE: ________________________________________ PRINT NAME: ____________________________________________

DATE:

TELEPHONE #:

EMAIL:

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1