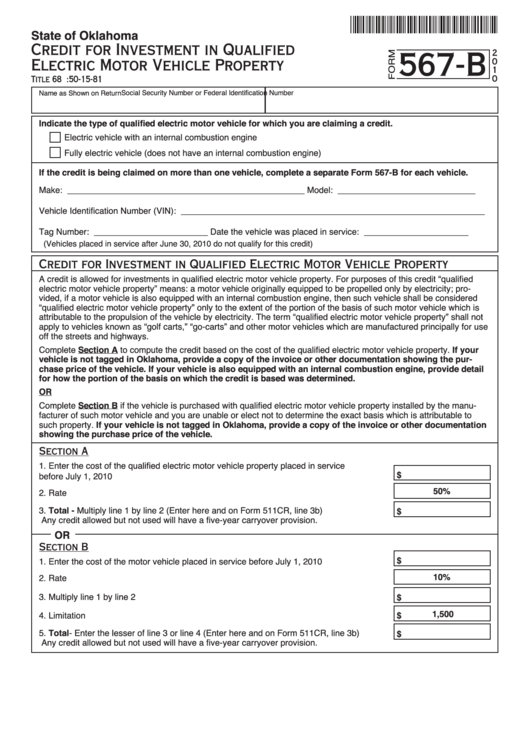

State of Oklahoma

b

Credit for Investment in Qualified

567-

2

Electric Motor Vehicle Property

0

1

0

Title 68 O.S. Section 2357.22 and Rule 710:50-15-81

Social Security Number or Federal Identification Number

Name as Shown on Return

Indicate the type of qualified electric motor vehicle for which you are claiming a credit.

Electric vehicle with an internal combustion engine

Fully electric vehicle (does not have an internal combustion engine)

If the credit is being claimed on more than one vehicle, complete a separate Form 567-B for each vehicle.

Make: __________________________________________________

Model: _____________________________

Vehicle Identification Number (VIN): ________________________________________________________________

Tag Number: ________________________

Date the vehicle was placed in service: ______________________

(Vehicles placed in service after June 30, 2010 do not qualify for this credit)

Credit for Investment in Qualified Electric Motor Vehicle Property

A credit is allowed for investments in qualified electric motor vehicle property. For purposes of this credit “qualified

electric motor vehicle property” means: a motor vehicle originally equipped to be propelled only by electricity; pro-

vided, if a motor vehicle is also equipped with an internal combustion engine, then such vehicle shall be considered

“qualified electric motor vehicle property” only to the extent of the portion of the basis of such motor vehicle which is

attributable to the propulsion of the vehicle by electricity. The term “qualified electric motor vehicle property” shall not

apply to vehicles known as “golf carts,” “go-carts” and other motor vehicles which are manufactured principally for use

off the streets and highways.

Complete Section A to compute the credit based on the cost of the qualified electric motor vehicle property. If your

vehicle is not tagged in Oklahoma, provide a copy of the invoice or other documentation showing the pur-

chase price of the vehicle. If your vehicle is also equipped with an internal combustion engine, provide detail

for how the portion of the basis on which the credit is based was determined.

OR

Complete Section B if the vehicle is purchased with qualified electric motor vehicle property installed by the manu-

facturer of such motor vehicle and you are unable or elect not to determine the exact basis which is attributable to

such property. If your vehicle is not tagged in Oklahoma, provide a copy of the invoice or other documentation

showing the purchase price of the vehicle.

Section A

1. Enter the cost of the qualified electric motor vehicle property placed in service

$

before July 1, 2010 ............................................................................................................

50%

2. Rate ...................................................................................................................................

3. Total - Multiply line 1 by line 2 (Enter here and on Form 511CR, line 3b) .........................

$

Any credit allowed but not used will have a five-year carryover provision.

OR

Section B

$

1. Enter the cost of the motor vehicle placed in service before July 1, 2010 .........................

10%

2. Rate ...................................................................................................................................

3. Multiply line 1 by line 2 .......................................................................................................

$

1,500

4. Limitation ............................................................................................................................

$

5. Total - Enter the lesser of line 3 or line 4 (Enter here and on Form 511CR, line 3b) .........

$

Any credit allowed but not used will have a five-year carryover provision.

1

1