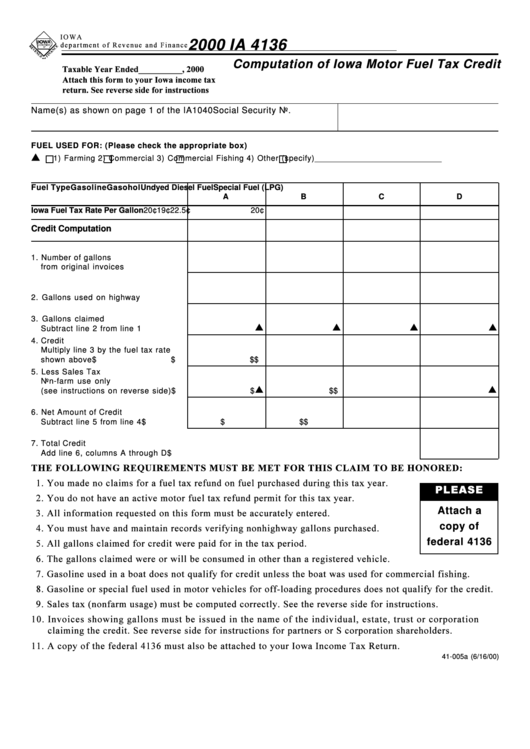

Form Ia 4136 - Computation Of Iowa Motor Fuel Tax Credit - 2000

ADVERTISEMENT

I OWA

2000 IA 4136

d e p a r t m e nt o f R e ve n ue a n d F i n a nc e

Computation of Iowa Motor Fuel Tax Credit

Taxable Year Ended __________ , 2000

Attach this form to your Iowa income tax

return. See reverse side for instructions

Name(s) as shown on page 1 of the IA1040

Social Security No.

FUEL USED FOR: (Please check the appropriate box)

s

1) Farming

2) Commercial

3) Commercial Fishing

4) Other (specify) _____________________________

Fuel Type

Gasoline

Gasohol

Undyed Diesel Fuel Special Fuel (LPG)

A

B

C

D

Iowa Fuel Tax Rate Per Gallon

20¢

19¢

22.5¢

20¢

Credit Computation

1. Number of gallons

from original invoices ...........................

2. Gallons used on highway ....................

3. Gallons claimed

s

s

s

s

Subtract line 2 from line 1 ...................

4. Credit

Multiply line 3 by the fuel tax rate

shown above .......................................... $

$

$

$

5. Less Sales Tax

Non-farm use only

s

s

s

s

(see instructions on reverse side) ...... $

$

$

$

6. Net Amount of Credit

Subtract line 5 from line 4 ................... $

$

$

$

7. Total Credit

Add line 6, columns A through D .................................................................................................................... $

THE FOLLOWING REQUIREMENTS MUST BE MET FOR THIS CLAIM TO BE HONORED:

PLEASE

Attach a

copy of

federal 4136

41-005a (6/16/00)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1