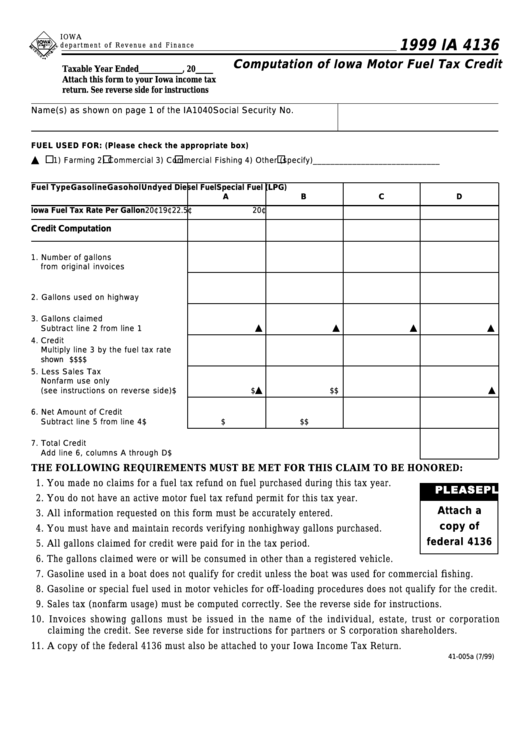

Form Ia 4136 - Computation Of Iowa Motor Fuel Tax Credit - 1999

ADVERTISEMENT

I OWA

1999 IA 4136

d e p a r t me nt o f R eve n u e a n d F i n a n c e

Computation of Iowa Motor Fuel Tax Credit

Taxable Year Ended __________ , 20____

Attach this form to your Iowa income tax

return. See reverse side for instructions

Name(s) as shown on page 1 of the IA1040

Social Security No.

FUEL USED FOR: (Please check the appropriate box)

1) Farming

2) Commercial

3) Commercial Fishing

4) Other (specify) _____________________________

Fuel Type

Gasoline

Gasohol

Undyed Diesel Fuel Special Fuel (LPG)

A

B

C

D

Iowa Fuel Tax Rate Per Gallon

20¢

19¢

22.5¢

20¢

Credit Computation

1. Number of gallons

from original invoices ...........................

2. Gallons used on highway .....................

3. Gallons claimed

Subtract line 2 from line 1 ...................

4. Credit

Multiply line 3 by the fuel tax rate

shown above .......................................... $

$

$

$

5. Less Sales Tax

Nonfarm use only

(see instructions on reverse side) ...... $

$

$

$

6. Net Amount of Credit

Subtract line 5 from line 4 ................... $

$

$

$

7. Total Credit

Add line 6, columns A through D .................................................................................................................... $

THE FOLLOWING REQUIREMENTS MUST BE MET FOR THIS CLAIM TO BE HONORED:

1. You made no claims for a fuel tax refund on fuel purchased during this tax year.

PLEASE

PLEASE

PLEASE

PLEASE

PLEASE

2. You do not have an active motor fuel tax refund permit for this tax year.

Attach a

3. All information requested on this form must be accurately entered.

copy of

4. You must have and maintain records verifying nonhighway gallons purchased.

federal 4136

5. All gallons claimed for credit were paid for in the tax period.

6. The gallons claimed were or will be consumed in other than a registered vehicle.

7. Gasoline used in a boat does not qualify for credit unless the boat was used for commercial fishing.

8. Gasoline or special fuel used in motor vehicles for off-loading procedures does not qualify for the credit.

9. Sales tax (nonfarm usage) must be computed correctly. See the reverse side for instructions.

10. Invoices showing gallons must be issued in the name of the individual, estate, trust or corporation

claiming the credit. See reverse side for instructions for partners or S corporation shareholders.

11. A copy of the federal 4136 must also be attached to your Iowa Income Tax Return.

41-005a (7/99)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1