Instructions - Cca Form 120-18

ADVERTISEMENT

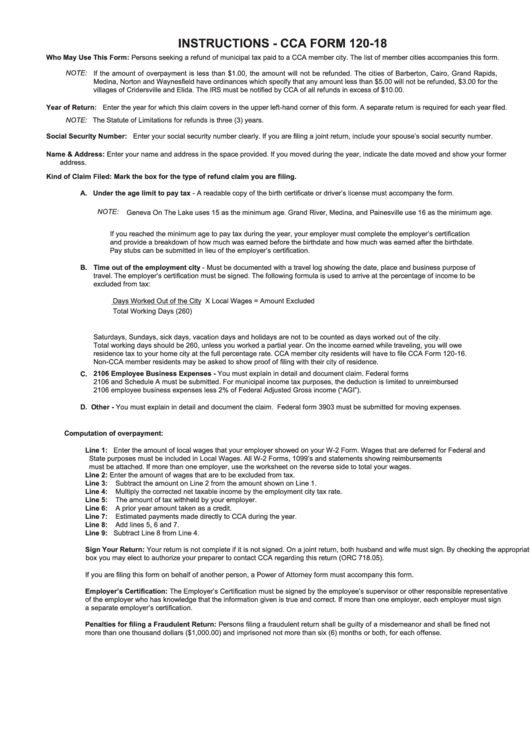

INSTRUCTIONS - CCA FORM 120-18

Who May Use This Form: Persons seeking a refund of municipal tax paid to a CCA member city. The list of member cities accompanies this form.

NOTE:

If the amount of overpayment is less than $1.00, the amount will not be refunded. The cities of Barberton, Cairo, Grand Rapids,

Medina, Norton and Waynesfield have ordinances which specify that any amount less than $5.00 will not be refunded, $3.00 for the

villages of Cridersville and Elida. The IRS must be notified by CCA of all refunds in excess of $10.00.

Year of Return: Enter the year for which this claim covers in the upper left-hand corner of this form. A separate return is required for each year filed.

NOTE: The Statute of Limitations for refunds is three (3) years.

Social Security Number: Enter your social security number clearly. If you are filing a joint return, include your spouse’s social security number.

Name & Address: Enter your name and address in the space provided. If you moved during the year, indicate the date moved and show your former

address.

Kind of Claim Filed: Mark the box for the type of refund claim you are filing.

A. Under the age limit to pay tax - A readable copy of the birth certificate or driver’s license must accompany the form.

NOTE:

Geneva On The Lake uses 15 as the minimum age. Grand River, Medina, and Painesville use 16 as the minimum age.

If you reached the minimum age to pay tax during the year, your employer must complete the employer’s certification

and provide a breakdown of how much was earned before the birthdate and how much was earned after the birthdate.

Pay stubs can be submitted in lieu of the employer’s certification.

B.

Time out of the employment city - Must be documented with a travel log showing the date, place and business purpose of

travel. The employer’s certification must be signed. The following formula is used to arrive at the percentage of income to be

excluded from tax:

Days Worked Out of the City X Local Wages = Amount Excluded

Total Working Days (260)

Saturdays, Sundays, sick days, vacation days and holidays are not to be counted as days worked out of the city.

Total working days should be 260, unless you worked a partial year. On the income earned while traveling, you will owe

residence tax to your home city at the full percentage rate. CCA member city residents will have to file CCA Form 120-16.

Non-CCA member residents may be asked to show proof of filing with their city of residence.

2106 Employee Business Expenses - You must explain in detail and document claim. Federal forms

C.

2106 and Schedule A must be submitted. For municipal income tax purposes, the deduction is limited to unreimbursed

2106 employee business expenses less 2% of Federal Adjusted Gross income (“AGI”).

D. Other - You must explain in detail and document the claim. Federal form 3903 must be submitted for moving expenses.

Computation of overpayment:

Line 1:

Enter the amount of local wages that your employer showed on your W-2 Form. Wages that are deferred for Federal and

State purposes must be included in Local Wages. All W-2 Forms, 1099’s and statements showing reimbursements

must be attached. If more than one employer, use the worksheet on the reverse side to total your wages.

Line 2:

Enter the amount of wages that are to be excluded from tax.

Line 3:

Subtract the amount on Line 2 from the amount shown on Line 1.

Line 4:

Multiply the corrected net taxable income by the employment city tax rate.

Line 5:

The amount of tax withheld by your employer.

Line 6:

A prior year amount taken as a credit.

Line 7:

Estimated payments made directly to CCA during the year.

Line 8:

Add lines 5, 6 and 7.

Line 9:

Subtract Line 8 from Line 4.

Sign Your Return: Your return is not complete if it is not signed. On a joint return, both husband and wife must sign. By checking the appropriate

box you may elect to authorize your preparer to contact CCA regarding this return (ORC 718.05).

If you are filing this form on behalf of another person, a Power of Attorney form must accompany this form.

Employer’s Certification: The Employer’s Certification must be signed by the employee’s supervisor or other responsible representative

of the employer who has knowledge that the information given is true and correct. If more than one employer, each employer must sign

a separate employer’s certification.

Penalties for filing a Fraudulent Return: Persons filing a fraudulent return shall be guilty of a misdemeanor and shall be fined not

more than one thousand dollars ($1,000.00) and imprisoned not more than six (6) months or both, for each offense.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2