Cca Form 120-18 - Application For Refund

ADVERTISEMENT

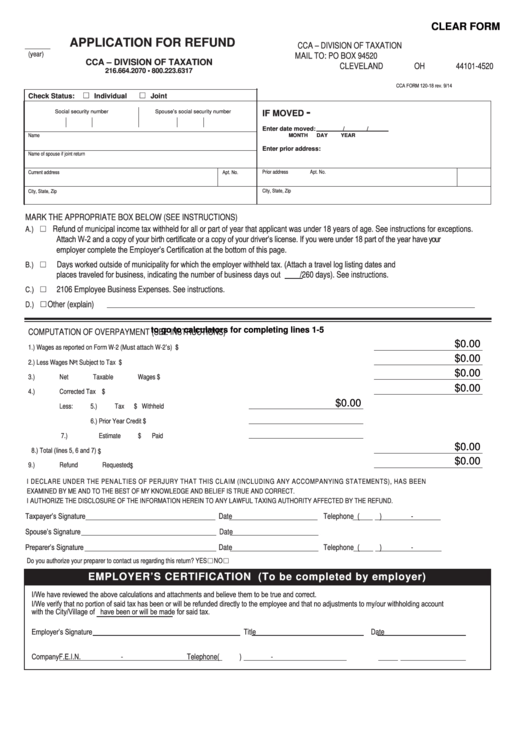

CLEAR FORM

APPLICATION FOR REFUND

CCA – DIVISION OF TAXATION

(year)

MAIL TO:

PO BOX 94520

CCA – DIVISION OF TAXATION

CLEVELAND OH 44101-4520

216.664.2070 • 800.223.6317

Check Status:

Individual

Joint

-

Social security number

Spouse’s social security number

IF MOVED

Enter date moved:

/

/

.

Name

MONTH

DAY

YEAR

Enter prior address:

Name of spouse if joint return

Prior address

Apt. No.

MARK THE APPROPRIATE BOX BELOW (SEE INSTRUCTIONS)

Refund of municipal income tax withheld for all or part of year that applicant was under 18 years of age. See instructions for exceptions.

A.)

B.)

/260 days). See instructions.

2106 Employee Business Expenses. See instructions.

Other (explain)

D.)

COMPUTATION OF OVERPAYMENT (SEE INSTRUCTIONS)

Click here to go to calculators for completing lines 1-5

$0.00

1.)

Wages as reported on Form W-2 (Must attach W-2’s) .......................................................................................................... $

$0.00

2.)

Less Wages Not Subject to Tax .............................................................................................................................................. $

$0.00

3.)

Net Taxable Wages .................................................................................................................................................................. $

$0.00

........................................................................................................................................................................... $

$0.00

Less:

5.) Tax Withheld ..................................................................

$

$

.............................................................

7.) Estimate Paid ................................................................

$

$0.00

..................................................................................................................................... $

$0.00

9.)

Refund Requested ................................................................................................................................................................... $

I DECLARE UNDER THE PENALTIES OF PERJURY THAT THIS CLAIM (INCLUDING ANY ACCOMPANYING STATEMENTS), HAS BEEN

EXAMINED BY ME AND TO THE BEST OF MY KNOWLEDGE AND BELIEF IS TRUE AND CORRECT.

I AUTHORIZE THE DISCLOSURE OF THE INFORMATION HEREIN TO ANY LAWFUL TAXING AUTHORITY AFFECTED BY THE REFUND.

Date

Telephone (

)

-

.

Date

.

Date

Telephone (

)

-

.

Do you authorize your preparer to contact us regarding this return? YES

NO

EMPLOYER’S CERTIFICATION (To be completed by employer)

Title

Date

.

-

Telephone(

)

-

.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2