Sales Tax Return - Town Of Mt. Crested Butte - 2011

ADVERTISEMENT

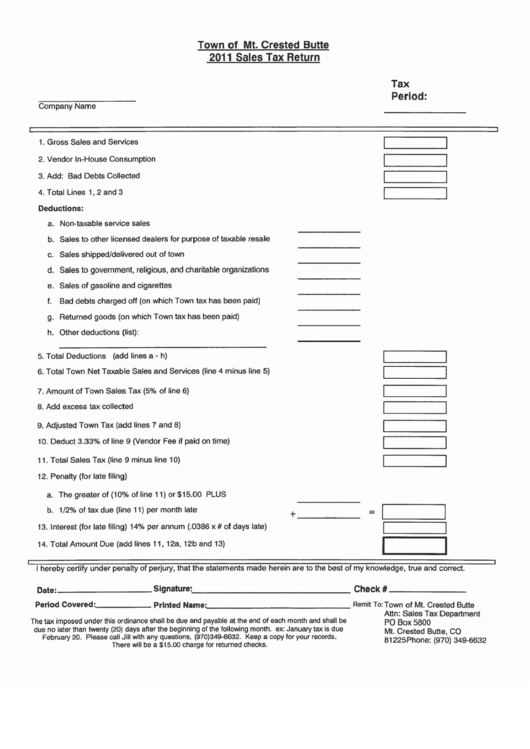

Town of Mt. Crested Butte

2011 Sales Tax Return

Tax

Period:

Company Name

1. Gross Sales and Services

2. Vendor In-House Consumption

3. Add: Bad Debts Collected

4. Total Lines 1,2 and 3

Deductions:

a. Non-taxable service sales

b. Sales to other licensed dealers for purpose of taxable resale

c. Sales shipped/delivered out of town

d. Sales to government, religious, and charitable organizations

e. Sales of gasoline and cigarettes

f.

Bad debts charged off (on which Town tax has been paid)

g. Returned goods (on which Town tax has been paid)

h. Other deductions (list):

5. Total Deductions (add lines a - h)

6. Total Town Net Taxable Sales and Services (line 4 minus line 5)

7. Amount of Town Sales Tax (5% of line 6)

8. Add excess

tax

collected

9. Adjusted Town Tax (add lines 7 and 8)

10. Deduct 3.33% of line 9 (Vendor Fee if paid on time)

11. Total Sales Tax (line 9 minus line 10)

12. Penalty (for late filing)

a. The greater of (10% of line 11) or $15.00 PLUS

b. 1/2% of tax due (line 11) per month late

13. Interest (for late filing) 14% per annum (.0386 x

#

of days late)

14. Total Amount Due (add lines 11, 12a, 12b and 13)

+------

=

I

I

~I=====~I

I

I

The tax imposed under this ordinance shall be due and payable at the end of each month and shall be

due no later than twenty (20) days after the beginning of the following month. ex: January tax is due

February 20. Please call Jill with any questions, (970)349-6632. Keep a copy for your records.

There will be a $15.00 charge for returned checks.

I hereby certify under penalty of perjury, that the statements made herein are to the best of my knowledge, true and correct.

Date:

Signature:.

Check

#

_

Period Covered:

Printed Name... :

Remit To:

Town of Mt. Crested Butte

Attn: Sales Tax Department

PO Box 5800

Mt. Crested Butte, CO

81225Phone: (970) 349-6632

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1