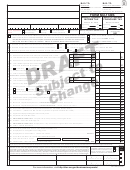

S CORPORATION WITH OTHER INCOME AND DEDUCTIONS

FORM

NEBRASKA SCHEDULE II — Adjustments to Ordinary Income

1120-SN

nebraska

• Read instructions

department

• Enter amounts from Schedule K, Federal Form 1120S

of revenue

Name as Shown on Form 1120-SN

Nebraska Identification Number

24 —

ADJUSTMENTS INCREASING ORDINARY INCOME

TOTAL

1 Net income from rental real estate activities ........................................................................................ 1

2 Net income from other rental activities................................................................................................. 2

3 Portfolio income:

a Interest income ................................................................................................................................ 3 a

b Dividend income .............................................................................................................................. 3 b

c Royalty income ................................................................................................................................ 3 c

d Net short-term capital gain .............................................................................................................. 3 d

e Net long-term capital gain................................................................................................................ 3 e

f Other portfolio income ..................................................................................................................... 3 f

4 Net gain under Section 1231 (other than casualty or theft) ................................................................. 4

5 Non-Nebraska state and local bond interest and dividend income (see instructions) ......................... 5

6 Bonus depreciation add-back (see instructions)

Total federal bonus depreciation $ _____________ x .85 = $_____________. Enter on line 6 .......... 6

7 Enhanced Section 179 expense deduction add-back (see instructions) Total federal Section 179

expense deduction $ _____________ – $25,000 = $______________ Enter on line 7. If less than

zero, enter zero .................................................................................................................................... 7

8 Other income (attach schedule)........................................................................................................... 8

9 TOTAL adjustments increasing ordinary income (total of lines 1 through 8). Enter here and on

line 2, Form 1120-SN........................................................................................................................... 9

ADJUSTMENTS DECREASING ORDINARY INCOME

TOTAL

10 Income from U.S. government obligations (see instructions) ............................................................... 10

11 Net loss from rental real estate activities ............................................................................................. 11

12 Net loss from other rental activities...................................................................................................... 12

13 Portfolio loss:

a Net short-term capital loss............................................................................................................... 13 a

b Net long-term capital loss ................................................................................................................ 13 b

c Other portfolio loss .......................................................................................................................... 13 c

14 Net loss under Section 1231................................................................................................................ 14

15 Other loss not included in lines 11 through 14..................................................................................... 15

16 Charitable contributions ....................................................................................................................... 16

17 Section 179 expense deduction ........................................................................................................... 17

18 Other deductions (attach schedule) ..................................................................................................... 18

19 TOTAL adjustments decreasing ordinary income (total of lines 10 through 18). Enter here and

on line 4, Form 1120-SN...................................................................................................................... 19

11-2005

8-289-1974 Rev.

Supersedes 8-289-1974 Rev. 11-2003

1

1 2

2 3

3 4

4