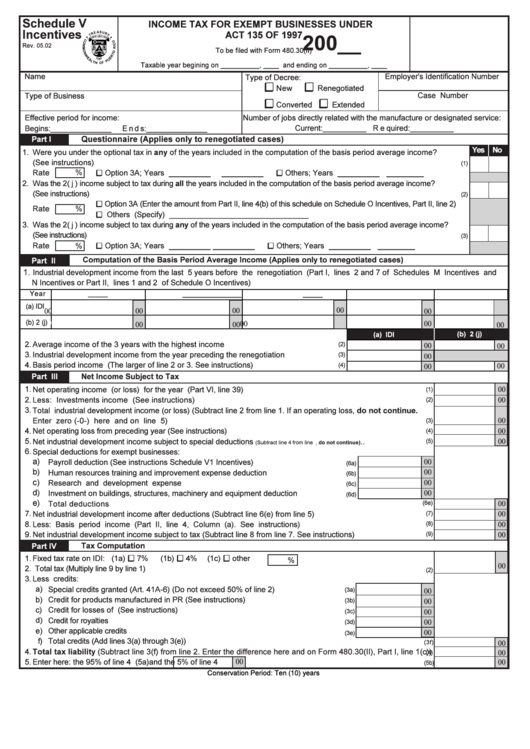

Schedule V Incentives - Income Tax For Exempt Businesses Under Act 135 Of 1997

ADVERTISEMENT

Schedule V

INCOME TAX FOR EXEMPT BUSINESSES UNDER

Incentives

ACT 135 OF 1997

200__

Rev. 05.02

To be filed with Form 480.30(II)

Taxable year begining on __________, ____ and ending on __________, ____

Name

Employer's Identification Number

Type of Decree:

<

<

New

Renegotiated

Case Number

Type of Business

<

<

Converted

Extended

Effective period for income:

Number of jobs directly related with the manufacture or designated service:

Begins:______________

Ends:______________

Current:__________

Required:__________

Questionnaire (Applies only to renegotiated cases)

Part I

Yes No

1.

Were you under the optional tax in any of the years included in the computation of the basis period average income?

...............................................................................................................

(See instructions).............................................

(1)

%

<

_________

_________

<

_________ ________

Rate

Option 3A; Years

Others; Years

2.

Was the 2( j ) income subject to tax during all the years included in the computation of the basis period average income?

(See instructions).....................................................................................................................................................................................................

(2)

<

Option 3A (Enter the amount from Part II, line 4(b) of this schedule on Schedule O Incentives, Part II, line 2)

Rate

%

<

Others (Specify) ________________________________

3.

Was the 2( j ) income subject to tax during any of the years included in the computation of the basis period average income?

(See instructions).............................................................................................................................................................................................................

(3)

<

_________

_________

<

_________ ________

Rate

%

Option 3A; Years

Others; Years

Computation of the Basis Period Average Income (Applies only to renegotiated cases)

Part II

1.

Industrial development income from the last 5 years before the renegotiation (Part I, lines 2 and 7 of Schedules M Incentives and

N Incentives or Part II, lines 1 and 2 of Schedule O Incentives)

Year

_____

_____

_____

_____

_____

(a) IDI

00

00

00

00

00

(b) 2 (j)

)

00

00

00

00

00

(b) 2 (j)

(a) IDI

..........................................

2.

Average income of the 3 years with the highest income

(2)

00

00

.................

3.

Industrial development income from the year preceding the renegotiation

(3)

00

.............................

4.

Basis period income (The larger of line 2 or 3. See instructions)

(4)

00

00

Part

IIII

Net Income Subject to Tax

1.

....................................................................

00

Net operating income (or loss) for the year (Part VI, line 39)

(1)

2.

..........................................................................................

00

Less: Investments income (See instructions)

(2)

3.

Total industrial development income (or loss) (Subtract line 2 from line 1. If an operating loss, do not continue.

........................................................................................................

00

Enter zero (-0-) here and on line 5)

(3)

4.

00

Net operating loss from preceding year (See instructions)................................................................................................

(4)

5.

..

00

Net industrial development income subject to special deductions

(5)

(Subtract line 4 from line 3.If it is equal or smaller than 0, do not continue)

6.

Special deductions for exempt businesses:

a)

.....................................

00

Payroll deduction (See instructions Schedule V1 Incentives)

(6a)

b)

00

Human resources training and improvement expense deduction ...............................

(6b)

c)

..............................

00

Research and development expense deduction.........................

(6c)

d)

.............

00

Investment on buildings, structures, machinery and equipment deduction

(6d)

e)

.......................................................................................................................

Total deductions

(6e)

00

7.

Net industrial development income after deductions (Subtract line 6(e) from line 5)..................................................

(7)

00

....................................................

8.

Less: Basis period income (Part II, line 4, Column (a). See instructions)

(8)

00

Net industrial development income subject to tax (Subtract line 8 from line 7. See instructions)

......................

9.

(9)

00

Part IV

Tax Computation

<

<

<

1.

Fixed tax rate on IDI: (1a)

7%

(1b)

4%

(1c)

other

%

00

2.

Total tax (Multiply line 9 by line 1) ...........................................................................................................................................

(2)

3.

Less credits:

a)

Special credits granted (Art. 41A-6) (Do not exceed 50% of line 2) ................................

(3a)

00

b)

Credit for products manufactured in PR (See instructions) ..............................................

(3b)

00

c)

Credit for losses of U.S. parent company (See instructions) ...........................................

00

(3c)

d)

Credit for royalties .....................................................................................................................

00

(3d)

e)

Other applicable credits ..........................................................................................................

00

(3e)

f)

Total credits (Add lines 3(a) through 3(e)) .....................................................................................................................

(3f)

00

4.

Total tax liability (Subtract line 3(f) from line 2. Enter the difference here and on Form 480.30(II), Part I, line 1(c))

00

(4)

00

5.

Enter here: the 95% of line 4 ........... (5a)

and the 5% of line 4 ............................................

00

(5b)

Conservation Period: Ten (10) years

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2