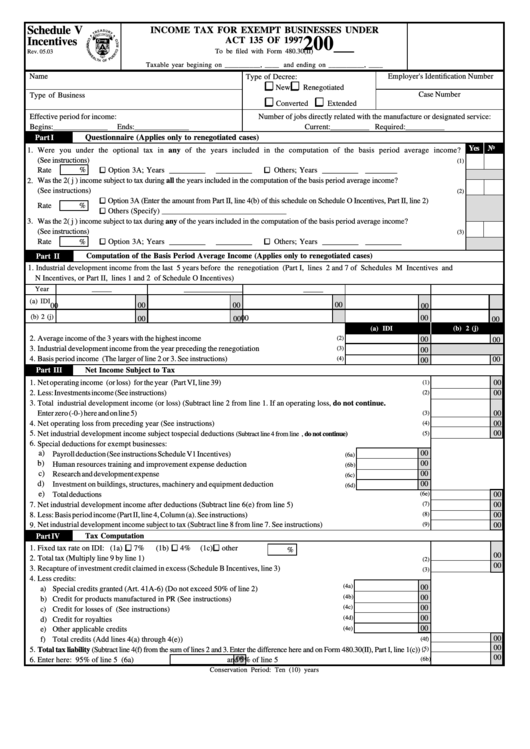

Schedule V Incentives - Income Tax For Exempt Businesses Under Act 135 Of 1997 - To Be Filed With Form 480.30(Ii) - Puerto Rico Department Of Treasury

ADVERTISEMENT

Schedule V

INCOME TAX FOR EXEMPT BUSINESSES UNDER

200__

ACT 135 OF 1997

Incentives

To be filed with Form 480.30(II)

Rev. 05.03

Taxable year begining on __________, ____ and ending on __________, ____

Name

Employer's Identification Number

Type of Decree:

<

<

New

Renegotiated

Case Number

Type of Business

<

<

Converted

Extended

Number of jobs directly related with the manufacture or designated service:

Effective period for income:

Current:__________ Required:__________

Begins:______________

Ends:______________

Questionnaire (Applies only to renegotiated cases)

Part I

Yes

No

1.

Were you under the optional tax in any of the years included in the computation of the basis period average income?

...............................................................................................................................................

(See instructions).............................................

(1)

<

<

%

_________

_________

_________ ________

Rate

Option 3A; Years

Others; Years

2.

Was the 2( j ) income subject to tax during all the years included in the computation of the basis period average income?

(See instructions)......................................................................................................................................................................................................

(2)

<

Option 3A (Enter the amount from Part II, line 4(b) of this schedule on Schedule O Incentives, Part II, line 2)

Rate

%

<

Others (Specify) ________________________________

3.

Was the 2( j ) income subject to tax during any of the years included in the computation of the basis period average income?

(See instructions).......................................................................................................................................................................................................

(3)

<

<

Rate

Option 3A; Years

_________

_________

Others; Years

_________ _________

%

Computation of the Basis Period Average Income (Applies only to renegotiated cases)

Part II

1.

Industrial development income from the last 5 years before the renegotiation (Part I, lines 2 and 7 of Schedules M Incentives and

N Incentives, or Part II, lines 1 and 2 of Schedule O Incentives)

_____

Year

_____

_____

_____

_____

(a) IDI

00

00

00

00

00

(b) 2 (j)

)

00

00

00

00

00

(b) 2 (j)

(a) IDI

2.

Average income of the 3 years with the highest income

....................................................................

(2)

00

00

3.

Industrial development income from the year preceding the renegotiation

......................................

(3)

00

4.

Basis period income (The larger of line 2 or 3. See instructions)

.......................................................

(4)

00

00

Part

IIII

Net Income Subject to Tax

1.

Net operating income (or loss) for the year (Part VI, line 39)

....................................................................................................

00

(1)

2.

Less: Investments income (See instructions)

.................................................................................................................................

00

(2)

3.

Total industrial development income (or loss) (Subtract line 2 from line 1. If an operating loss, do not continue.

Enter zero (-0-) here and on line 5)

.................................................................................................................................................

00

(3)

4.

Net operating loss from preceding year (See instructions).............................................................................................................

00

(4)

5.

Net industrial development income subject to special deductions

00

(5)

(Subtract line 4 from line 3.If it is equal or smaller than 0, do not continue)

6.

Special deductions for exempt businesses:

a)

00

.......................................................

Payroll deduction (See instructions Schedule V1 Incentives)

(6a)

b)

00

Human resources training and improvement expense deduction .................................................

(6b)

c)

00

....................................................

Research and development expense deduction.........................

(6c)

d)

00

.................................

Investment on buildings, structures, machinery and equipment deduction

(6d)

e)

..................................................................................................................................................................

(6e)

00

Total deductions

7.

(7)

00

Net industrial development income after deductions (Subtract line 6(e) from line 5) ...................................................................

8.

......................................................................................

(8)

00

Less: Basis period income (Part II, line 4, Column (a). See instructions)

.................................................

9.

Net industrial development income subject to tax (Subtract line 8 from line 7. See instructions)

(9)

00

Tax Computation

Part IV

<

<

<

1.

Fixed tax rate on IDI: (1a)

7%

(1b)

4%

(1c)

other

%

00

2.

Total tax (Multiply line 9 by line 1) ................................................................................................................................................

(2)

00

3.

Recapture of investment credit claimed in excess (Schedule B Incentives, line 3) ..........................................................................

(3)

4.

Less credits:

(4a)

00

a)

Special credits granted (Art. 41A-6) (Do not exceed 50% of line 2) ............................................

(4b)

00

b)

Credit for products manufactured in PR (See instructions) .........................................................

(4c)

00

c)

Credit for losses of U.S. parent company (See instructions) .......................................................

00

(4d)

d)

Credit for royalties .......................................................................................................................

00

(4e)

e)

Other applicable credits ...............................................................................................................

00

(4f)

f)

Total credits (Add lines 4(a) through 4(e)) ............................................................................................................................

00

(5)

5.

Total tax liability (Subtract line 4(f) from the sum of lines 2 and 3. Enter the difference here and on Form 480.30(II), Part I, line 1(c)) ..

00

00

(6b)

6.

Enter here: 95% of line 5 ................... (6a)

and 5% of line 5 ........................................................

Conservation Period: Ten (10) years

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2