Form Pv82 - Fiduciary Extension Payment - Minnesota Department Of Revenue - 2000, Form Pv43 - Fiduciary Return Payment - Minnesota Department Of Revenue - 2000

ADVERTISEMENT

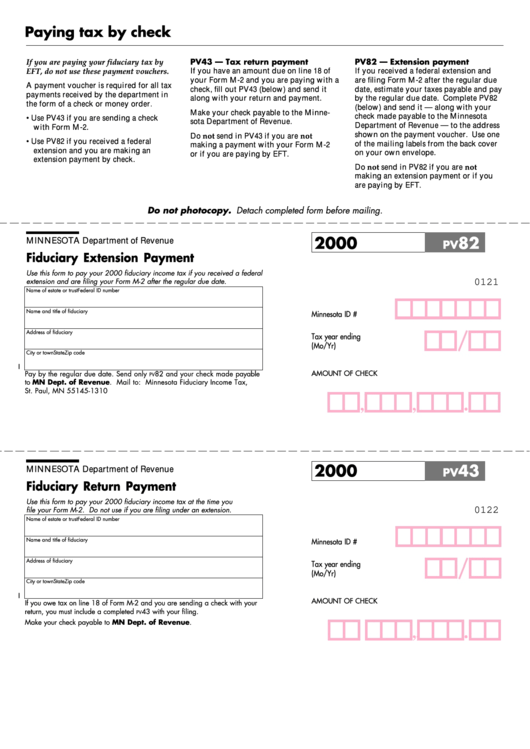

Paying tax by check

PV43 — Tax return payment

PV82 — Extension payment

If you are paying your fiduciary tax by

If you have an amount due on line 18 of

If you received a federal extension and

EFT, do not use these payment vouchers.

your Form M-2 and you are paying with a

are filing Form M-2 after the regular due

A payment voucher is required for all tax

check, fill out PV43 (below) and send it

date, estimate your taxes payable and pay

payments received by the department in

along with your return and payment.

by the regular due date. Complete PV82

the form of a check or money order.

(below) and send it — along with your

Make your check payable to the Minne-

check made payable to the Minnesota

• Use PV43 if you are sending a check

sota Department of Revenue.

Department of Revenue — to the address

with Form M-2.

shown on the payment voucher. Use one

Do not send in PV43 if you are not

• Use PV82 if you received a federal

of the mailing labels from the back cover

making a payment with your Form M-2

extension and you are making an

on your own envelope.

or if you are paying by EFT.

extension payment by check.

Do not send in PV82 if you are not

making an extension payment or if you

are paying by EFT.

Do not photocopy. Detach completed form before mailing.

2000

82

MINNESOTA Department of Revenue

PV

Fiduciary Extension Payment

Use this form to pay your 2000 fiduciary income tax if you received a federal

extension and are filing your Form M-2 after the regular due date.

0121

Name of estate or trust

Federal ID number

Name and title of fiduciary

Minnesota ID #

Address of fiduciary

Tax year ending

(Mo/Yr)

City or town

State

Zip code

I

AMOUNT OF CHECK

Pay by the regular due date. Send only

82 and your check made payable

PV

to MN Dept. of Revenue. Mail to: Minnesota Fiduciary Income Tax,

St. Paul, MN 55145-1310

.

,

,

2000

43

MINNESOTA Department of Revenue

PV

Fiduciary Return Payment

Use this form to pay your 2000 fiduciary income tax at the time you

file your Form M-2. Do not use if you are filing under an extension.

0122

Name of estate or trust

Federal ID number

Name and title of fiduciary

Minnesota ID #

Address of fiduciary

Tax year ending

(Mo/Yr)

City or town

State

Zip code

I

AMOUNT OF CHECK

If you owe tax on line 18 of Form M-2 and you are sending a check with your

return, you must include a completed

43 with your filing.

PV

Make your check payable to MN Dept. of Revenue.

.

,

,

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1