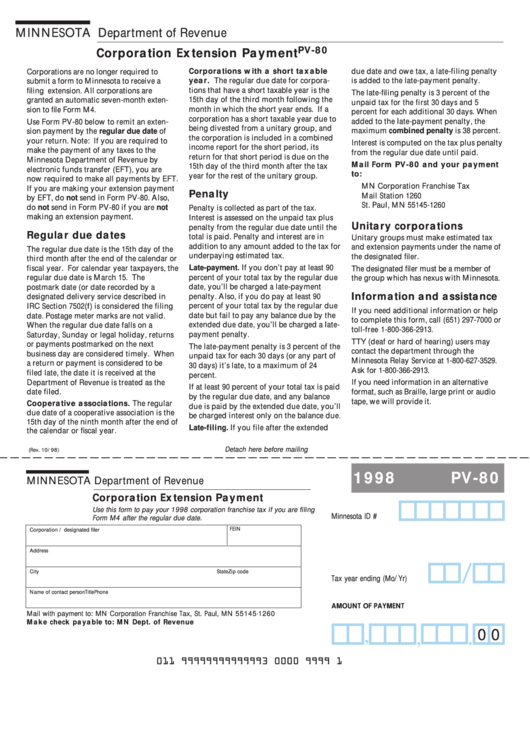

MINNESOTA Department of Revenue

PV-80

Corporation Extension Payment

Corporations with a short taxable

Corporations are no longer required to

due date and owe tax, a late-filing penalty

year. The regular due date for corpora-

is added to the late-payment penalty.

submit a form to Minnesota to receive a

tions that have a short taxable year is the

filing extension. All corporations are

The late-filing penalty is 3 percent of the

15th day of the third month following the

granted an automatic seven-month exten-

unpaid tax for the first 30 days and 5

month in which the short year ends. If a

sion to file Form M4.

percent for each additional 30 days. When

corporation has a short taxable year due to

added to the late-payment penalty, the

Use Form PV-80 below to remit an exten-

being divested from a unitary group, and

maximum combined penalty is 38 percent.

sion payment by the regular due date of

the corporation is included in a combined

your return. Note: If you are required to

Interest is computed on the tax plus penalty

income report for the short period, its

make the payment of any taxes to the

from the regular due date until paid.

return for that short period is due on the

Minnesota Department of Revenue by

Mail Form PV-80 and your payment

15th day of the third month after the tax

electronic funds transfer (EFT), you are

to:

year for the rest of the unitary group.

now required to make all payments by EFT.

MN Corporation Franchise Tax

If you are making your extension payment

Penalty

Mail Station 1260

by EFT, do not send in Form PV-80. Also,

St. Paul, MN 55145-1260

do not send in Form PV-80 if you are not

Penalty is collected as part of the tax.

making an extension payment.

Interest is assessed on the unpaid tax plus

Unitary corporations

penalty from the regular due date until the

Regular due dates

total is paid. Penalty and interest are in

Unitary groups must make estimated tax

addition to any amount added to the tax for

and extension payments under the name of

The regular due date is the 15th day of the

underpaying estimated tax.

the designated filer.

third month after the end of the calendar or

fiscal year. For calendar year taxpayers, the

Late-payment. If you don’t pay at least 90

The designated filer must be a member of

percent of your total tax by the regular due

regular due date is March 15. The U.S.

the group which has nexus with Minnesota.

date, you’ll be charged a late-payment

postmark date (or date recorded by a

Information and assistance

penalty. Also, if you do pay at least 90

designated delivery service described in

percent of your total tax by the regular due

IRC Section 7502(f) is considered the filing

If you need additional information or help

date but fail to pay any balance due by the

date. Postage meter marks are not valid.

to complete this form, call (651) 297-7000 or

extended due date, you’ll be charged a late-

When the regular due date falls on a

toll-free 1-800-366-2913.

payment penalty.

Saturday, Sunday or legal holiday, returns

TTY (deaf or hard of hearing) users may

or payments postmarked on the next

The late-payment penalty is 3 percent of the

contact the department through the

business day are considered timely. When

unpaid tax for each 30 days (or any part of

Minnesota Relay Service at 1-800-627-3529.

a return or payment is considered to be

30 days) it’s late, to a maximum of 24

Ask for 1-800-366-2913.

filed late, the date it is received at the

percent.

Department of Revenue is treated as the

If you need information in an alternative

If at least 90 percent of your total tax is paid

date filed.

format, such as Braille, large print or audio

by the regular due date, and any balance

tape, we will provide it.

Cooperative associations. The regular

due is paid by the extended due date, you’ll

due date of a cooperative association is the

be charged interest only on the balance due.

15th day of the ninth month after the end of

Late-filing. If you file after the extended

the calendar or fiscal year.

Detach here before mailing

(Rev. 10/98)

1998

PV-80

MINNESOTA Department of Revenue

Corporation Extension Payment

Use this form to pay your 1998 corporation franchise tax if you are filing

Minnesota ID #

Form M4 after the regular due date.

FEIN

Corporation / designated filer

Address

City

State

Zip code

Tax year ending (Mo/Yr)

Name of contact person

Title

Phone

AMOUNT OF PAYMENT

Mail with payment to: MN Corporation Franchise Tax, St. Paul, MN 55145-1260

Make check payable to: MN Dept. of Revenue

0 0

,

.

,

011 99999999999993 0000 9999 1

1

1