Worksheet For Enterprise Zone (Ez) Tax Credit - San Francisco Payroll Expense Tax - 2012

ADVERTISEMENT

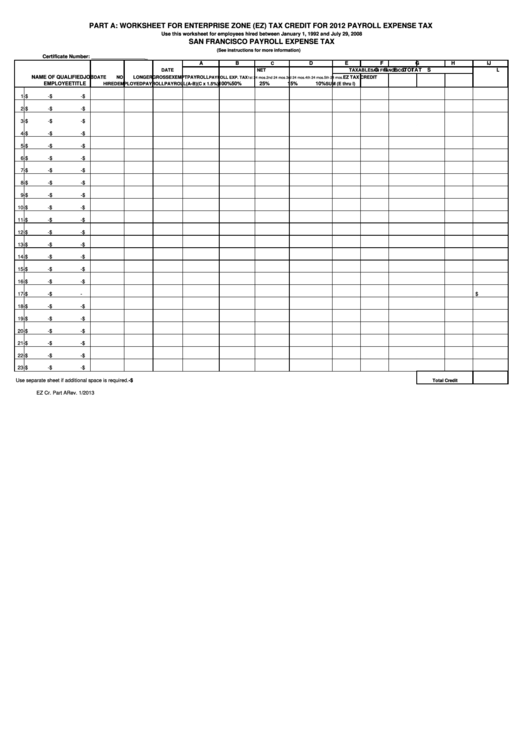

PART A: WORKSHEET FOR ENTERPRISE ZONE (EZ) TAX CREDIT FOR 2012 PAYROLL EXPENSE TAX

Use this worksheet for employees hired between January 1, 1992 and July 29, 2008

SAN FRANCISCO PAYROLL EXPENSE TAX

(See instructions for more information)

Certificate Number:

____________________

A

B

D

E

F

G

H

I

J

C

C

R

E

D

I

T

S

TOTAL

DATE

NET TAXABLE

SAN FRANCISCO

NAME OF QUALIFIED

JOB

DATE

NO LONGER

GROSS

EXEMPT

PAYROLL

EZ TAX CREDIT

PAYROLL EXP. TAX

1st 24 mos.

2nd 24 mos.

3rd 24 mos.

4th 24 mos.

5th 24 mos.

EMPLOYEE

TITLE

100%

50%

25%

15%

10%

HIRED

EMPLOYED

PAYROLL

PAYROLL

(A-B)

(C x 1.5%)

SUM (E thru I)

1

$

-

$

-

$

-

2

$

-

$

-

$

-

3

$

-

$

-

$

-

4

$

-

$

-

$

-

5

$

-

$

-

$

-

6

$

-

$

-

$

-

7

$

-

$

-

$

-

8

$

-

$

-

$

-

9

$

-

$

-

$

-

10

$

-

$

-

$

-

11

$

-

$

-

$

-

12

$

-

$

-

$

-

13

$

-

$

-

$

-

14

$

-

$

-

$

-

15

$

-

$

-

$

-

16

$

-

$

-

$

-

17

$

-

$

-

$

-

18

$

-

$

-

$

-

19

$

-

$

-

$

-

20

$

-

$

-

$

-

21

$

-

$

-

$

-

22

$

-

$

-

$

-

23

$

-

$

-

$

-

Use separate sheet if additional space is required.

$

-

Total Credit

EZ Cr. Part A

Rev. 1/2013

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4