San Francisco Business Receipts And Payroll Tax Worksheet For Summer Youth Employment Tax Credit For The Year 1999

ADVERTISEMENT

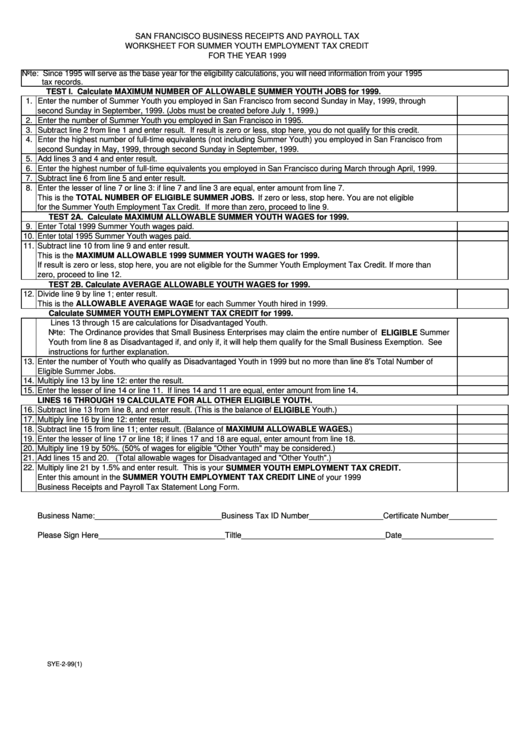

SAN FRANCISCO BUSINESS RECEIPTS AND PAYROLL TAX

WORKSHEET FOR SUMMER YOUTH EMPLOYMENT TAX CREDIT

FOR THE YEAR 1999

Note: Since 1995 will serve as the base year for the eligibility calculations, you will need information from your 1995

tax records.

tax records.

TEST I. Calculate MAXIMUM NUMBER OF ALLOWABLE SUMMER YOUTH JOBS for 1999.

1. Enter the number of Summer Youth you employed in San Francisco from second Sunday in May, 1999, through

second Sunday in September, 1999. (Jobs must be created before July 1, 1999.)

2. Enter the number of Summer Youth you employed in San Francisco in 1995.

3. Subtract line 2 from line 1 and enter result. If result is zero or less, stop here, you do not qualify for this credit.

4. Enter the highest number of full-time equivalents (not including Summer Youth) you employed in San Francisco from

second Sunday in May, 1999, through second Sunday in September, 1999.

5. Add lines 3 and 4 and enter result.

6. Enter the highest number of full-time equivalents you employed in San Francisco during March through April, 1999.

7. Subtract line 6 from line 5 and enter result.

8. Enter the lesser of line 7 or line 3: if line 7 and line 3 are equal, enter amount from line 7.

This is the TOTAL NUMBER OF ELIGIBLE SUMMER JOBS. If zero or less, stop here. You are not eligible

for the Summer Youth Employment Tax Credit. If more than zero, proceed to line 9.

TEST 2A. Calculate MAXIMUM ALLOWABLE SUMMER YOUTH WAGES for 1999.

9. Enter Total 1999 Summer Youth wages paid.

10. Enter total 1995 Summer Youth wages paid.

11. Subtract line 10 from line 9 and enter result.

This is the MAXIMUM ALLOWABLE 1999 SUMMER YOUTH WAGES for 1999.

If result is zero or less, stop here, you are not eligible for the Summer Youth Employment Tax Credit. If more than

zero, proceed to line 12.

TEST 2B. Calculate AVERAGE ALLOWABLE YOUTH WAGES for 1999.

12. Divide line 9 by line 1; enter result.

This is the ALLOWABLE AVERAGE WAGE for each Summer Youth hired in 1999.

Calculate SUMMER YOUTH EMPLOYMENT TAX CREDIT for 1999.

Lines 13 through 15 are calculations for Disadvantaged Youth.

Note: The Ordinance provides that Small Business Enterprises may claim the entire number of ELIGIBLE Summer

Youth from line 8 as Disadvantaged if, and only if, it will help them qualify for the Small Business Exemption. See

instructions for further explanation.

13. Enter the number of Youth who qualify as Disadvantaged Youth in 1999 but no more than line 8's Total Number of

Eligible Summer Jobs.

14. Multiply line 13 by line 12: enter the result.

15. Enter the lesser of line 14 or line 11. If lines 14 and 11 are equal, enter amount from line 14.

LINES 16 THROUGH 19 CALCULATE FOR ALL OTHER ELIGIBLE YOUTH.

16. Subtract line 13 from line 8, and enter result. (This is the balance of ELIGIBLE Youth.)

17. Multiply line 16 by line 12: enter result.

18. Subtract line 15 from line 11; enter result. (Balance of MAXIMUM ALLOWABLE WAGES.)

19. Enter the lesser of line 17 or line 18; if lines 17 and 18 are equal, enter amount from line 18.

20. Multiply line 19 by 50%. (50% of wages for eligible "Other Youth" may be considered.)

21. Add lines 15 and 20. (Total allowable wages for Disadvantaged and "Other Youth".)

22. Multiply line 21 by 1.5% and enter result. This is your SUMMER YOUTH EMPLOYMENT TAX CREDIT.

Enter this amount in the SUMMER YOUTH EMPLOYMENT TAX CREDIT LINE of your 1999

Business Receipts and Payroll Tax Statement Long Form.

Business Name:_____________________________Business Tax ID Number_________________Certificate Number___________

Please Sign Here_____________________________Tiltle_________________________________Date_____________________

SYE-2-99(1)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1