Form D-1 - Declaration Of Estimated Income Tax - 2003

ADVERTISEMENT

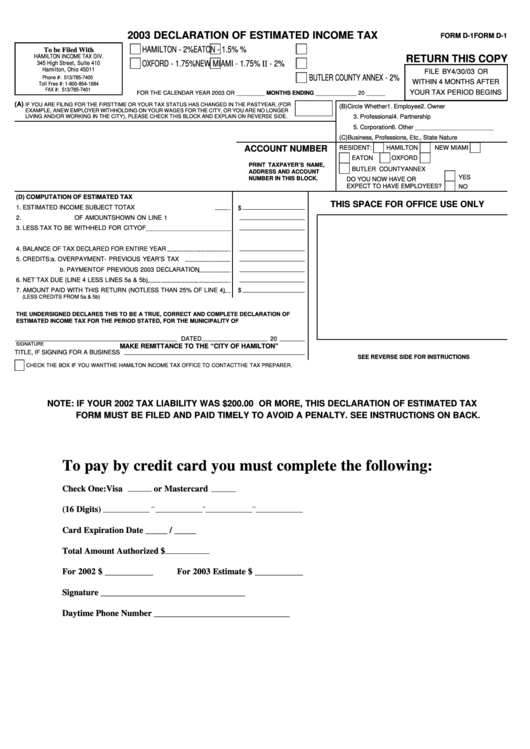

2003 DECLARATION OF ESTIMATED INCOME TAX

FORM D-1

FORM D-1

HAMILTON - 2%

EATON - 1.5%

J.E.D.D. - 2%

To be Filed With

HAMILTON INCOME TAX DIV.

RETURN THIS COPY

OXFORD - 1.75%

NEW MIAMI - 1.75%

J.E.D.D. II - 2%

345 High Street, Suite 410

Hamilton, Ohio 45011

FILE BY4/30/03 OR

BUTLER COUNTY ANNEX - 2%

Phone #: 513/785-7400

WITHIN 4 MONTHS AFTER

Toll Free #: 1-800-854-1684

FAX #: 513/785-7401

YOUR TAX PERIOD BEGINS

FOR THE CALENDAR YEAR 2003 OR _________ MONTHS ENDING _____________ 20 ______

(A)

IF YOU ARE FILING FOR THE FIRSTTIME OR YOUR TAX STATUS HAS CHANGED IN THE PASTYEAR, (FOR

(B) Circle Whether

1. Employee

2. Owner

EXAMPLE, A NEW EMPLOYER WITHHOLDING ON YOUR WAGES FOR THE CITY, OR YOU ARE NO LONGER

LIVING AND/OR WORKING IN THE CITY), PLEASE CHECK THIS BLOCK AND EXPLAIN ON REVERSE SIDE.

3. Professional

4. Partnership

5. Corporation

6. Other _______________________

(C) Business, Professions, Etc., State Nature

ACCOUNT NUMBER

RESIDENT:

HAMILTON

NEW MIAMI

J.E.D.D.

EATON

OXFORD

J.E.D.D. II

PRINT TAXPAYER’S NAME,

BUTLER COUNTYANNEX

ADDRESS AND ACCOUNT

YES

NUMBER IN THIS BLOCK.

DO YOU NOW HAVE OR

EXPECT TO HAVE EMPLOYEES?

NO

(D) COMPUTATION OF ESTIMATED TAX

THIS SPACE FOR OFFICE USE ONLY

1. ESTIMATED INCOME SUBJECT TO

TAX

$

2.

OF AMOUNTSHOWN ON LINE 1

3. LESS TAX TO BE WITHHELD FOR CITYOF_________________________

4. BALANCE OF TAX DECLARED FOR ENTIRE YEAR

5. CREDITS:

a. OVERPAYMENT- PREVIOUS YEAR’S TAX

b. PAYMENTOF PREVIOUS 2003 DECLARATION

6. NET TAX DUE (LINE 4 LESS LINES 5a & 5b)

7. AMOUNT PAID WITH THIS RETURN (NOTLESS THAN 25% OF LINE 4)

$

(LESS CREDITS FROM 5a & 5b)

THE UNDERSIGNED DECLARES THIS TO BE A TRUE, CORRECT AND COMPLETE DECLARATION OF

ESTIMATED INCOME TAX FOR THE PERIOD STATED, FOR THE MUNICIPALITY OF

DATED

20

SIGNATURE

MAKE REMITTANCE TO THE “CITY OF HAMILTON”

TITLE, IF SIGNING FOR A BUSINESS

SEE REVERSE SIDE FOR INSTRUCTIONS

CHECK THE BOX IF YOU WANTTHE HAMILTON INCOME TAX OFFICE TO CONTACTTHE TAX PREPARER.

NOTE: IF YOUR 2002 TAX LIABILITY WAS $200.00 OR MORE, THIS DECLARATION OF ESTIMATED TAX

FORM MUST BE FILED AND PAID TIMELY TO AVOID A PENALTY. SEE INSTRUCTIONS ON BACK.

To pay by credit card you must complete the following:

Check One: Visa

or Mastercard

(16 Digits)

Card Expiration Date _____ / _____

Total Amount Authorized $

For 2002 $ ___________

For 2003 Estimate $ ___________

Signature _________________________________

Daytime Phone Number _______________________________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2