Form Pa-8453-C Instructions - Pa Corporate Net Income Tax Declaration For A State E-File Report

ADVERTISEMENT

Page 2

Form PA-8453-C

•

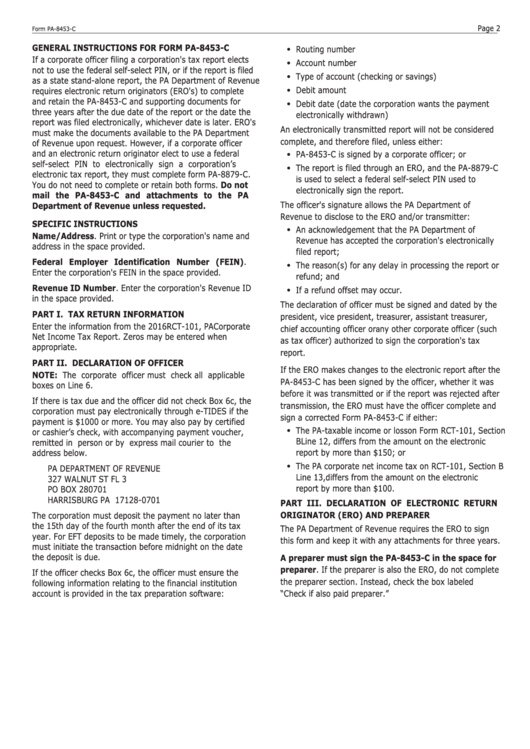

gENEral iNStructioNS For Form Pa-8453-c

•

Routing number

If a corporate officer filing a corporation's tax report elects

Account number

•

not to use the federal self-select PIN, or if the report is filed

Type of account (checking or savings)

•

as a state stand-alone report, the PA Department of Revenue

•

Debit amount

requires electronic return originators (ERO's) to complete

and retain the PA-8453-C and supporting documents for

Debit date (date the corporation wants the payment

three years after the due date of the report or the date the

electronically withdrawn)

report was filed electronically, whichever date is later. ERO's

An electronically transmitted report will not be considered

must make the documents available to the PA Department

•

complete, and therefore filed, unless either:

of Revenue upon request. However, if a corporate officer

and an electronic return originator elect to use a federal

•

PA-8453-C is signed by a corporate officer; or

self-select PIN to electronically sign a corporation’s

The report is filed through an ERO, and the PA-8879-C

electronic tax report, they must complete form PA-8879-C.

is used to select a federal self-select PIN used to

You do not need to complete or retain both forms. Do not

electronically sign the report.

mail the Pa-8453-c and attachments to the Pa

The officer's signature allows the PA Department of

Department of revenue unless requested.

•

Revenue to disclose to the ERO and/or transmitter:

SPEciFic iNStructioNS

An acknowledgement that the PA Department of

Name/address. Print or type the corporation's name and

Revenue has accepted the corporation's electronically

address in the space provided.

•

filed report;

Federal Employer identification Number (FEiN).

The reason(s) for any delay in processing the report or

Enter the corporation's FEIN in the space provided.

refund; and

•

revenue iD Number. Enter the corporation's Revenue ID

If a refund offset may occur.

in the space provided.

The declaration of officer must be signed and dated by the

Part i. tax rEturN iNFormatioN

president, vice president, treasurer, assistant treasurer,

chief accounting officer or any other corporate officer (such

Enter the information from the 2016 RCT-101, PA Corporate

Net Income Tax Report. Zeros may be entered when

as tax officer) authorized to sign the corporation's tax

appropriate.

report.

Part ii. DEclaratioN oF oFFicEr

If the ERO makes changes to the electronic report after the

NotE: The corporate officer must check all applicable

PA-8453-C has been signed by the officer, whether it was

boxes on Line 6.

before it was transmitted or if the report was rejected after

If there is tax due and the officer did not check Box 6c, the

transmission, the ERO must have the officer complete and

corporation must pay electronically through e-TIDES if the

•

sign a corrected Form PA-8453-C if either:

payment is $1000 or more. You may also pay by certified

The PA-taxable income or loss on Form RCT-101, Section

or cashier’s check, with accompanying payment voucher,

B Line 12, differs from the amount on the electronic

remitted in person or by express mail courier to the

•

report by more than $150; or

address below.

The PA corporate net income tax on RCT-101, Section B

PA DEPARTMENT OF REVENUE

Line 13, differs from the amount on the electronic

327 WALNUT ST FL 3

report by more than $100.

PO BOX 280701

HARRISBURG PA 17128-0701

Part iii. DEclaratioN oF ElEctroNic rEturN

origiNator (Ero) aND PrEParEr

The corporation must deposit the payment no later than

the 15th day of the fourth month after the end of its tax

The PA Department of Revenue requires the ERO to sign

year. For EFT deposits to be made timely, the corporation

this form and keep it with any attachments for three years.

must initiate the transaction before midnight on the date

the deposit is due.

a preparer must sign the Pa-8453-c in the space for

preparer. If the preparer is also the ERO, do not complete

If the officer checks Box 6c, the officer must ensure the

the preparer section. Instead, check the box labeled

following information relating to the financial institution

account is provided in the tax preparation software:

“Check if also paid preparer.”

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1