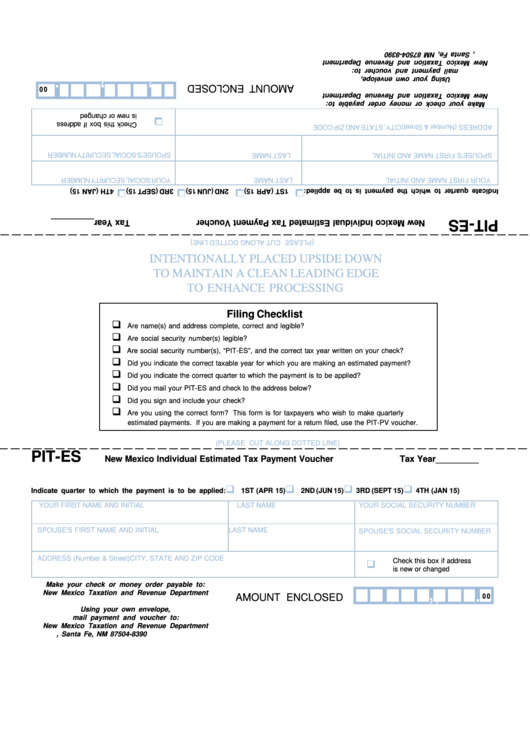

Form Pit-Es - New Mexico Individual Estimated Tax Payment Voucher

ADVERTISEMENT

INTENTIONALLY PLACED UPSIDE DOWN

TO MAINTAIN A CLEAN LEADING EDGE

TO ENHANCE PROCESSING

Filing Checklist

Are name(s) and address complete, correct and legible?

Are social security number(s) legible?

Are social security number(s), “PIT-ES”, and the correct tax year written on your check?

Did you indicate the correct taxable year for which you are making an estimated payment?

Did you indicate the correct quarter to which the payment is to be applied?

Did you mail your PIT-ES and check to the address below?

Did you sign and include your check?

Are you using the correct form? This form is for taxpayers who wish to make quarterly

estimated payments. If you are making a payment for a return filed, use the PIT-PV voucher.

(PLEASE CUT ALONG DOTTED LINE)

PIT-ES

New Mexico Individual Estimated Tax Payment Voucher

Tax Year_________

Indicate quarter to which the payment is to be applied:

1ST (APR 15)

2ND (JUN 15)

3RD (SEPT 15)

4TH (JAN 15)

YOUR FIRST NAME AND INITIAL

LAST NAME

YOUR SOCIAL SECURITY NUMBER

SPOUSE'S FIRST NAME AND INITIAL

LAST NAME

SPOUSE'S SOCIAL SECURITY NUMBER

ADDRESS (Number & Street)

CITY, STATE AND ZIP CODE

Check this box if address

is new or changed

Make your check or money order payable to:

,

,

.

New Mexico Taxation and Revenue Department

AMOUNT ENCLOSED

0 0

Using your own envelope,

mail payment and voucher to:

New Mexico Taxation and Revenue Department

P.O. Box 8390, Santa Fe, NM 87504-8390

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1