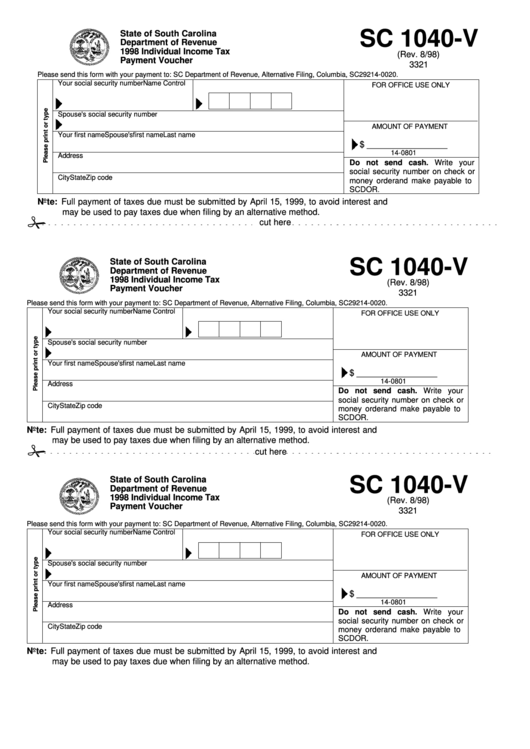

SC 1040-V

State of South Carolina

Department of Revenue

1998 Individual Income Tax

(Rev. 8/98)

Payment Voucher

3321

Please send this form with your payment to: SC Department of Revenue, Alternative Filing, Columbia, SC 29214-0020.

Your social security number

Name Control

FOR OFFICE USE ONLY

Spouse's social security number

AMOUNT OF PAYMENT

Your first name

Spouse's first name

Last name

$ _________________

14-0801

Address

Do not send cash. Write your

social security number on check or

City

State

Zip code

money order and make payable to

SCDOR.

Note: Full payment of taxes due must be submitted by April 15, 1999, to avoid interest and penalties. SC 1040-V

may be used to pay taxes due when filing by an alternative method.

�

cut here

SC 1040-V

State of South Carolina

Department of Revenue

1998 Individual Income Tax

(Rev. 8/98)

Payment Voucher

3321

Please send this form with your payment to: SC Department of Revenue, Alternative Filing, Columbia, SC 29214-0020.

Your social security number

Name Control

FOR OFFICE USE ONLY

Spouse's social security number

AMOUNT OF PAYMENT

Your first name

Spouse's first name

Last name

$ _________________

14-0801

Address

Do not send cash. Write your

social security number on check or

City

State

Zip code

money order and make payable to

SCDOR.

Note: Full payment of taxes due must be submitted by April 15, 1999, to avoid interest and penalties. SC 1040-V

may be used to pay taxes due when filing by an alternative method.

�

cut here

SC 1040-V

State of South Carolina

Department of Revenue

1998 Individual Income Tax

(Rev. 8/98)

Payment Voucher

3321

Please send this form with your payment to: SC Department of Revenue, Alternative Filing, Columbia, SC 29214-0020.

Your social security number

Name Control

FOR OFFICE USE ONLY

Spouse's social security number

AMOUNT OF PAYMENT

Your first name

Spouse's first name

Last name

$ _________________

14-0801

Address

Do not send cash. Write your

social security number on check or

City

State

Zip code

money order and make payable to

SCDOR.

Note: Full payment of taxes due must be submitted by April 15, 1999, to avoid interest and penalties. SC 1040-V

may be used to pay taxes due when filing by an alternative method.

1

1