Request For Motor Vehicle Sales/use Tax Refund - Wyoming Department Of Revenue

ADVERTISEMENT

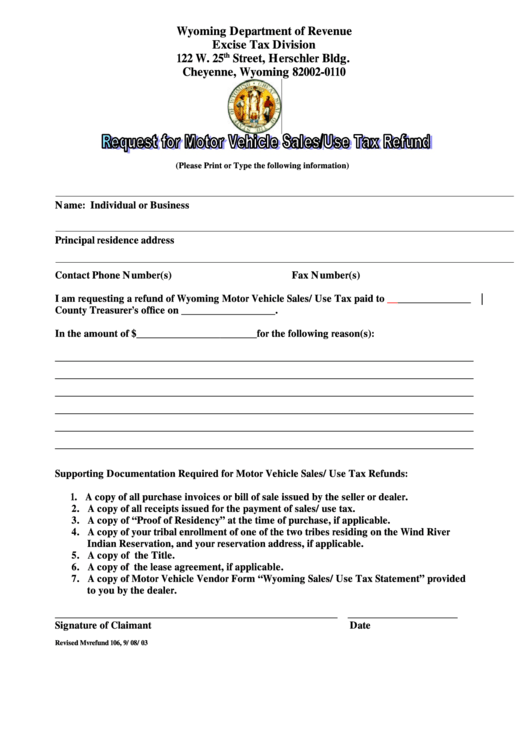

Wyoming Department of Revenue

Excise Tax Division

122 W. 25

th

Street, Herschler Bldg.

Cheyenne, Wyoming 82002-0110

(Please Print or Type the following information)

Name: Individual or Business

Principal residence address

Contact Phone Number(s)

Fax Number(s)

I am requesting a refund of Wyoming Motor Vehicle Sales/Use Tax paid to ________________

County Treasurer’s office on __________________.

In the amount of $_______________________for the following reason(s):

________________________________________________________________________________

________________________________________________________________________________

________________________________________________________________________________

________________________________________________________________________________

________________________________________________________________________________

________________________________________________________________________________

Supporting Documentation Required for Motor Vehicle Sales/Use Tax Refunds:

1. A copy of all purchase invoices or bill of sale issued by the seller or dealer.

2. A copy of all receipts issued for the payment of sales/use tax.

3. A copy of “Proof of Residency” at the time of purchase, if applicable.

4. A copy of your tribal enrollment of one of the two tribes residing on the Wind River

Indian Reservation, and your reservation address, if applicable.

5. A copy of the Title.

6. A copy of the lease agreement, if applicable.

7. A copy of Motor Vehicle Vendor Form “Wyoming Sales/Use Tax Statement” provided

to you by the dealer.

______________________________________________________ _____________________

Signature of Claimant

Date

Revised Mvrefund 106, 9/08/03

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1