Sales And Use Tax Report - Wisconsin Department Of Revenue - 2013

ADVERTISEMENT

July 2013

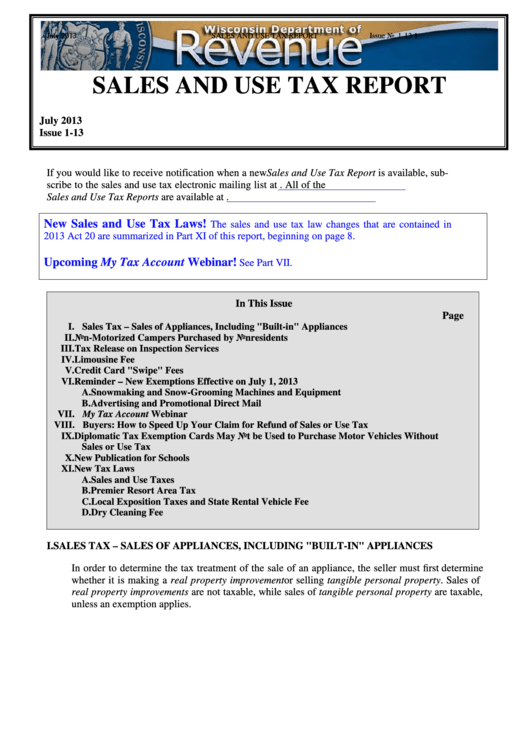

SALES AND USE TAX REPORT

Issue No. 1-13

1

SALES AND USE TAX REPORT

July 2013

Issue 1-13

If you would like to receive notification when a new Sales and Use Tax Report is available, sub-

scribe to the sales and use tax electronic mailing list at revenue.wi.gov/html/lists.html. All of the

Sales and Use Tax Reports are available at revenue.wi.gov/ise/sales/index.html.

New Sales and Use Tax Laws!

The sales and use tax law changes that are contained in

2013 Act 20 are summarized in Part XI of this report, beginning on page 8.

Upcoming My Tax Account Webinar!

See Part VII.

In This Issue

Page

I. Sales Tax – Sales of Appliances, Including "Built-in" Appliances............................................ 1

II. Non-Motorized Campers Purchased by Nonresidents ............................................................... 3

III. Tax Release on Inspection Services .............................................................................................. 4

IV. Limousine Fee ................................................................................................................................ 4

V. Credit Card "Swipe" Fees ............................................................................................................ 4

VI. Reminder – New Exemptions Effective on July 1, 2013 ............................................................. 5

A. Snowmaking and Snow-Grooming Machines and Equipment ............................................. 5

B. Advertising and Promotional Direct Mail .............................................................................. 5

VII. My Tax Account Webinar .............................................................................................................. 6

VIII. Buyers: How to Speed Up Your Claim for Refund of Sales or Use Tax ................................... 7

IX. Diplomatic Tax Exemption Cards May Not be Used to Purchase Motor Vehicles Without

Sales or Use Tax ............................................................................................................................. 8

X. New Publication for Schools ......................................................................................................... 8

XI. New Tax Laws ................................................................................................................................ 8

A. Sales and Use Taxes .................................................................................................................. 8

B. Premier Resort Area Tax ....................................................................................................... 14

C. Local Exposition Taxes and State Rental Vehicle Fee ......................................................... 15

D. Dry Cleaning Fee..................................................................................................................... 15

I.

SALES TAX – SALES OF APPLIANCES, INCLUDING "BUILT-IN" APPLIANCES

In order to determine the tax treatment of the sale of an appliance, the seller must first determine

whether it is making a real property improvement or selling tangible personal property. Sales of

real property improvements are not taxable, while sales of tangible personal property are taxable,

unless an exemption applies.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15