Instructions For Walbridge Income Tax Returns 2003 Return

ADVERTISEMENT

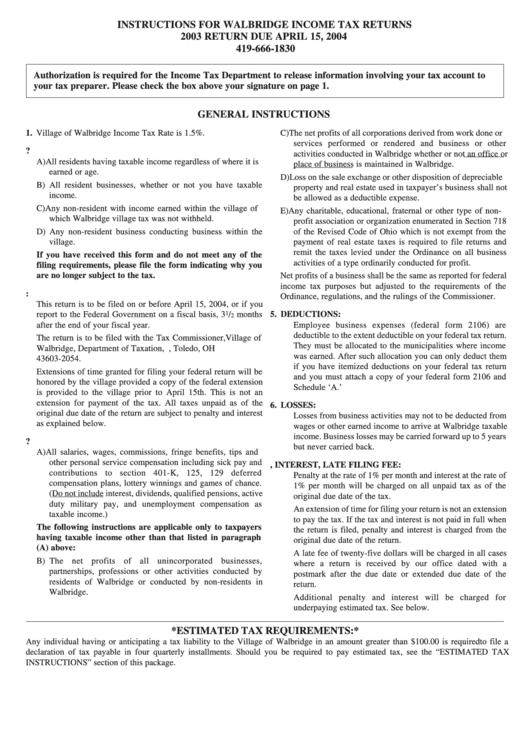

INSTRUCTIONS FOR WALBRIDGE INCOME TAX RETURNS

2003 RETURN DUE APRIL 15, 2004

419-666-1830

Authorization is required for the Income Tax Department to release information involving your tax account to

your tax preparer. Please check the box above your signature on page 1.

GENERAL INSTRUCTIONS

1. Village of Walbridge Income Tax Rate is 1.5%.

C) The net profits of all corporations derived from work done or

services performed or rendered and business or other

2. WHO IS REQUIRED TO FILE A RETURN?

activities conducted in Walbridge whether or not an office or

A) All residents having taxable income regardless of where it is

place of business is maintained in Walbridge.

earned or age.

D) Loss on the sale exchange or other disposition of depreciable

B) All resident businesses, whether or not you have taxable

property and real estate used in taxpayer’s business shall not

income.

be allowed as a deductible expense.

C) Any non-resident with income earned within the village of

E) Any charitable, educational, fraternal or other type of non-

which Walbridge village tax was not withheld.

profit association or organization enumerated in Section 718

D) Any non-resident business conducting business within the

of the Revised Code of Ohio which is not exempt from the

village.

payment of real estate taxes is required to file returns and

remit the taxes levied under the Ordinance on all business

If you have received this form and do not meet any of the

activities of a type ordinarily conducted for profit.

filing requirements, please file the form indicating why you

are no longer subject to the tax.

Net profits of a business shall be the same as reported for federal

income tax purposes but adjusted to the requirements of the

3. WHEN AND WHERE TO FILE RETURN:

Ordinance, regulations, and the rulings of the Commissioner.

This return is to be filed on or before April 15, 2004, or if you

report to the Federal Government on a fiscal basis, 3

1

/

months

5. DEDUCTIONS:

2

after the end of your fiscal year.

Employee business expenses (federal form 2106) are

deductible to the extent deductible on your federal tax return.

The return is to be filed with the Tax Commissioner, Village of

They must be allocated to the municipalities where income

Walbridge, Department of Taxation, P.O. Box 2054, Toledo, OH

was earned. After such allocation you can only deduct them

43603-2054.

if you have itemized deductions on your federal tax return

Extensions of time granted for filing your federal return will be

and you must attach a copy of your federal form 2106 and

honored by the village provided a copy of the federal extension

Schedule ‘A.’

is provided to the village prior to April 15th. This is not an

extension for payment of the tax. All taxes unpaid as of the

6. LOSSES:

original due date of the return are subject to penalty and interest

Losses from business activities may not to be deducted from

as explained below.

wages or other earned income to arrive at Walbridge taxable

income. Business losses may be carried forward up to 5 years

4. WHAT IS TAXABLE INCOME?

but never carried back.

A) All salaries, wages, commissions, fringe benefits, tips and

other personal service compensation including sick pay and

7. PENALTY, INTEREST, LATE FILING FEE:

contributions to section 401-K, 125, 129 deferred

Penalty at the rate of 1% per month and interest at the rate of

compensation plans, lottery winnings and games of chance.

1% per month will be charged on all unpaid tax as of the

(Do not include interest, dividends, qualified pensions, active

original due date of the tax.

duty military pay, and unemployment compensation as

An extension of time for filing your return is not an extension

taxable income.)

to pay the tax. If the tax and interest is not paid in full when

The following instructions are applicable only to taxpayers

the return is filed, penalty and interest is charged from the

having taxable income other than that listed in paragraph

original due date of the return.

(A) above:

A late fee of twenty-five dollars will be charged in all cases

B) The net profits of all unincorporated businesses,

where a return is received by our office dated with a

partnerships, professions or other activities conducted by

postmark after the due date or extended due date of the

residents of Walbridge or conducted by non-residents in

return.

Walbridge.

Additional penalty and interest will be charged for

underpaying estimated tax. See below.

*ESTIMATED TAX REQUIREMENTS:*

Any individual having or anticipating a tax liability to the Village of Walbridge in an amount greater than $100.00 is required to file a

declaration of tax payable in four quarterly installments. Should you be required to pay estimated tax, see the “ESTIMATED TAX

INSTRUCTIONS” section of this package.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2