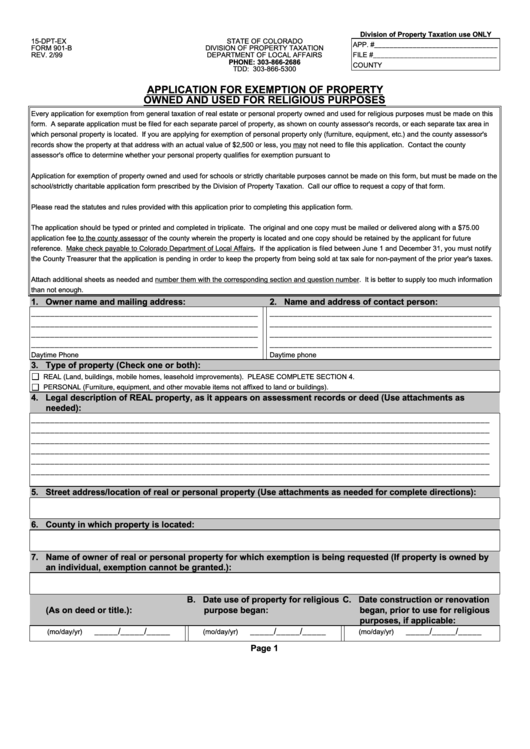

Form 901-B - Application For Exemption Of Property Owned And Used For Religious Purposes - Colorado Division Of Property Taxation

ADVERTISEMENT

Division of Property Taxation use ONLY

15-DPT-EX

STATE OF COLORADO

APP. #________________________________

FORM 901-B

DIVISION OF PROPERTY TAXATION

REV. 2/99

DEPARTMENT OF LOCAL AFFAIRS

FILE #________________________________

PHONE: 303-866-2686

COUNTY

TDD: 303-866-5300

APPLICATION FOR EXEMPTION OF PROPERTY

OWNED AND USED FOR RELIGIOUS PURPOSES

Every application for exemption from general taxation of real estate or personal property owned and used for religious purposes must be made on this

form. A separate application must be filed for each separate parcel of property, as shown on county assessor's records, or each separate tax area in

which personal property is located. If you are applying for exemption of personal property only (furniture, equipment, etc.) and the county assessor's

records show the property at that address with an actual value of $2,500 or less, you may not need to file this application. Contact the county

assessor's office to determine whether your personal property qualifies for exemption pursuant to C.R.S. 39-3-119.5.

Application for exemption of property owned and used for schools or strictly charitable purposes cannot be made on this form, but must be made on the

school/strictly charitable application form prescribed by the Division of Property Taxation. Call our office to request a copy of that form.

Please read the statutes and rules provided with this application prior to completing this application form.

The application should be typed or printed and completed in triplicate. The original and one copy must be mailed or delivered along with a $75.00

application fee to the county assessor of the county wherein the property is located and one copy should be retained by the applicant for future

reference. Make check payable to Colorado Department of Local Affairs. If the application is filed between June 1 and December 31, you must notify

the County Treasurer that the application is pending in order to keep the property from being sold at tax sale for non-payment of the prior year's taxes.

Attach additional sheets as needed and number them with the corresponding section and question number. It is better to supply too much information

than not enough.

1. Owner name and mailing address:

2. Name and address of contact person:

________________________________________________

_______________________________________________

________________________________________________

_______________________________________________

________________________________________________

_______________________________________________

________________________________________________

_______________________________________________

Daytime Phone

Daytime phone

3. Type of property (Check one or both):

REAL (Land, buildings, mobile homes, leasehold improvements). PLEASE COMPLETE SECTION 4.

PERSONAL (Furniture, equipment, and other movable items not affixed to land or buildings).

4. Legal description of REAL property, as it appears on assessment records or deed (Use attachments as

needed):

_________________________________________________________________________________________________

_________________________________________________________________________________________________

_________________________________________________________________________________________________

_________________________________________________________________________________________________

_________________________________________________________________________________________________

_________________________________________________________________________________________________

5. Street address/location of real or personal property (Use attachments as needed for complete directions):

6. County in which property is located:

7. Name of owner of real or personal property for which exemption is being requested (If property is owned by

an individual, exemption cannot be granted.):

8.A. Date property was acquired

B. Date use of property for religious

C. Date construction or renovation

(As on deed or title.):

purpose began:

began, prior to use for religious

purposes, if applicable:

_____/_____/_____

_____/_____/_____

_____/_____/_____

(mo/day/yr)

(mo/day/yr)

(mo/day/yr)

Page 1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3