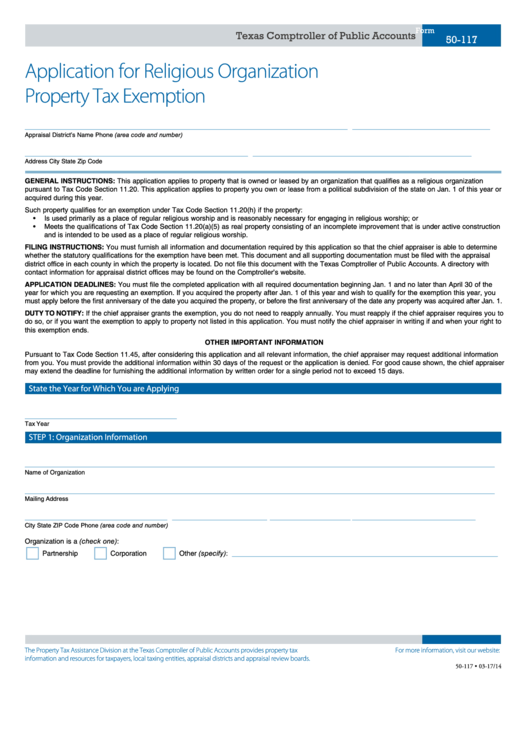

Form

Texas Comptroller of Public Accounts

50-117

Application for Religious Organization

Property Tax Exemption

____________________________________________________________________

_____________________________

Appraisal District’s Name

Phone (area code and number)

_______________________________________________

___________________

______________

_____________

Address

City

State

Zip Code

GENERAL INSTRUCTIONS: This application applies to property that is owned or leased by an organization that qualifies as a religious organization

pursuant to Tax Code Section 11.20. This application applies to property you own or lease from a political subdivision of the state on Jan. 1 of this year or

acquired during this year.

Such property qualifies for an exemption under Tax Code Section 11.20(h) if the property:

•

Is used primarily as a place of regular religious worship and is reasonably necessary for engaging in religious worship; or

•

Meets the qualifications of Tax Code Section 11.20(a)(5) as real property consisting of an incomplete improvement that is under active construction

and is intended to be used as a place of regular religious worship.

FILING INSTRUCTIONS: You must furnish all information and documentation required by this application so that the chief appraiser is able to determine

whether the statutory qualifications for the exemption have been met. This document and all supporting documentation must be filed with the appraisal

district office in each county in which the property is located. Do not file this document with the Texas Comptroller of Public Accounts. A directory with

contact information for appraisal district offices may be found on the Comptroller’s website.

APPLICATION DEADLINES: You must file the completed application with all required documentation beginning Jan. 1 and no later than April 30 of the

year for which you are requesting an exemption. If you acquired the property after Jan. 1 of this year and wish to qualify for the exemption this year, you

must apply before the first anniversary of the date you acquired the property, or before the first anniversary of the date any property was acquired after Jan. 1.

DUTY TO NOTIFY: If the chief appraiser grants the exemption, you do not need to reapply annually. You must reapply if the chief appraiser requires you to

do so, or if you want the exemption to apply to property not listed in this application. You must notify the chief appraiser in writing if and when your right to

this exemption ends.

OTHER IMPORTANT INFORMATION

Pursuant to Tax Code Section 11.45, after considering this application and all relevant information, the chief appraiser may request additional information

from you. You must provide the additional information within 30 days of the request or the application is denied. For good cause shown, the chief appraiser

may extend the deadline for furnishing the additional information by written order for a single period not to exceed 15 days.

State the Year for Which You are Applying

________________________________

Tax Year

STEP 1: Organization Information

___________________________________________________________________________________________________

Name of Organization

___________________________________________________________________________________________________

Mailing Address

______________________________

____________________

_________________

__________________________

City

State

ZIP Code

Phone (area code and number)

Organization is a (check one):

________________________________________________________

Partnership

Corporation

Other (specify):

The Property Tax Assistance Division at the Texas Comptroller of Public Accounts provides property tax

For more information, visit our website:

comptroller.texas.gov/taxes/property-tax

information and resources for taxpayers, local taxing entities, appraisal districts and appraisal review boards.

50-117 • 03-17/14

1

1 2

2 3

3 4

4 5

5