Form 41a720-S29 - Schedule Kjda-Sp - Tax Computation Schedule (For A Kjda Project Of A General Partnership)

ADVERTISEMENT

*0600010249*

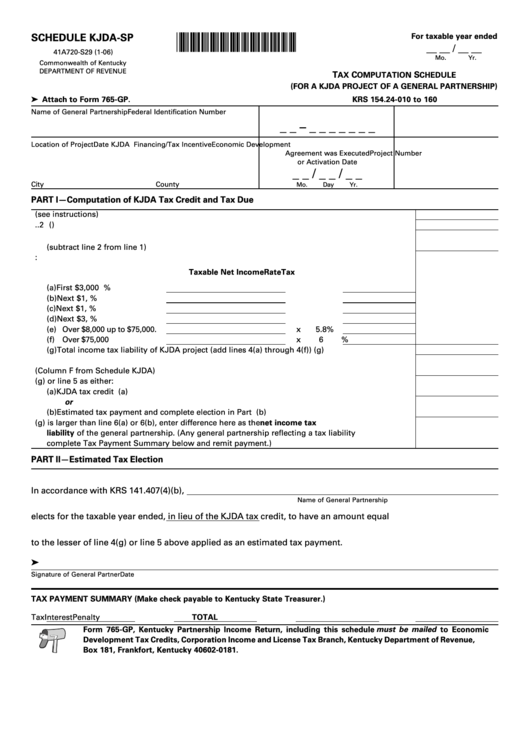

For taxable year ended

SCHEDULE KJDA-SP

__ __ / __ __

41A720-S29 (1-06)

Mo.

Yr.

Commonwealth of Kentucky

DEPARTMENT OF REVENUE

T

C

S

AX

OMPUTATION

CHEDULE

(FOR A KJDA PROJECT OF A GENERAL PARTNERSHIP)

➤ Attach to Form 765-GP.

KRS 154.24-010 to 160

Name of General Partnership

Federal Identification Number

_ _ – _ _ _ _ _ _ _

Location of Project

Date KJDA Financing/Tax Incentive

Economic Development

Agreement was Executed

Project Number

or Activation Date

_ _ / _ _ / _ _

City

County

Mo.

Day

Yr.

PART I—Computation of KJDA Tax Credit and Tax Due

1. Kentucky taxable net income from KJDA project (see instructions) ................................................... 1

2. Net operating loss deduction from KJDA project ................................................................................. 2 (

)

3. Kentucky taxable net income from KJDA project after net operating loss deduction

(subtract line 2 from line 1) ..................................................................................................................... 3

4. Compute tax on amount from line 3:

Taxable Net Income

Rate

Tax

(a) First $3,000 ........................

x

2%

(b) Next $1,000 ........................

x

3%

(c) Next $1,000 ........................

x

4%

(d) Next $3,000 ........................

x

5%

(e) Over $8,000 up to $75,000 .

x

5.8%

(f) Over $75,000 .......................

x

6%

(g) Total income tax liability of KJDA project (add lines 4(a) through 4(f)) ................................... 4(g)

5. Limitation (Column F from Schedule KJDA) ......................................................................................... 5

6. Enter lesser of line 4(g) or line 5 as either:

(a) KJDA tax credit .............................................................................................................................. 6(a)

or

(b) Estimated tax payment and complete election in Part II ............................................................ 6(b)

7. If line 4(g) is larger than line 6(a) or 6(b), enter difference here as the net income tax

liability of the general partnership. (Any general partnership reflecting a tax liability

complete Tax Payment Summary below and remit payment.) ........................................................... 7

PART II—Estimated Tax Election

In accordance with KRS 141.407(4)(b),

Name of General Partnership

elects for the taxable year ended

, in lieu of the KJDA tax credit, to have an amount equal

to the lesser of line 4(g) or line 5 above applied as an estimated tax payment.

➤

Signature of General Partner

Date

TAX PAYMENT SUMMARY (Make check payable to Kentucky State Treasurer.)

Tax

Interest

Penalty

TOTAL

Form 765-GP, Kentucky Partnership Income Return, including this schedule must be mailed to Economic

Development Tax Credits, Corporation Income and License Tax Branch, Kentucky Department of Revenue, P.O.

Box 181, Frankfort, Kentucky 40602-0181.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1