Meals Tax Remittance Form - Prince George County Commissioner Of The Revenue

ADVERTISEMENT

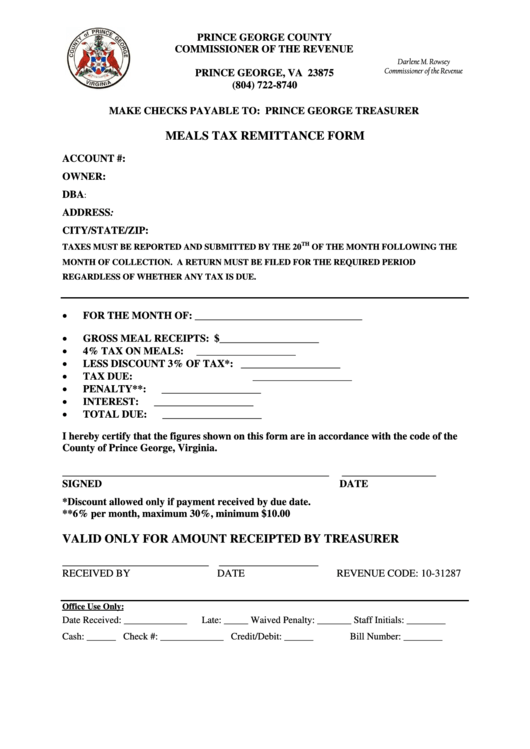

PRINCE GEORGE COUNTY

COMMISSIONER OF THE REVENUE

Darlene M. Rowsey

P.O. BOX 155

Commissioner of the Revenue

PRINCE GEORGE, VA 23875

(804) 722-8740

MAKE CHECKS PAYABLE TO: PRINCE GEORGE TREASURER

MEALS TAX REMITTANCE FORM

ACCOUNT #:

OWNER:

DBA

:

ADDRESS:

CITY/STATE/ZIP:

TH

TAXES MUST BE REPORTED AND SUBMITTED BY THE 20

OF THE MONTH FOLLOWING THE

MONTH OF COLLECTION. A RETURN MUST BE FILED FOR THE REQUIRED PERIOD

REGARDLESS OF WHETHER ANY TAX IS DUE.

FOR THE MONTH OF: ________________________________

GROSS MEAL RECEIPTS:

$___________________

4% TAX ON MEALS:

___________________

LESS DISCOUNT 3% OF TAX*:

___________________

TAX DUE:

___________________

PENALTY**:

___________________

INTEREST:

___________________

TOTAL DUE:

___________________

I hereby certify that the figures shown on this form are in accordance with the code of the

County of Prince George, Virginia.

___________________________________________________

__________________

SIGNED

DATE

*Discount allowed only if payment received by due date.

**6% per month, maximum 30%, minimum $10.00

VALID ONLY FOR AMOUNT RECEIPTED BY TREASURER

____________________________ ___________________

RECEIVED BY

DATE

REVENUE CODE: 10-31287

Office Use Only:

Date Received: _____________

Late: _____ Waived Penalty: _______

Staff Initials: ________

Cash: ______ Check #: _____________ Credit/Debit: ______

Bill Number: ________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1