Form 74-075-991 - Petroleum Tax Surety Bond - Mississippi State Tax Commission

ADVERTISEMENT

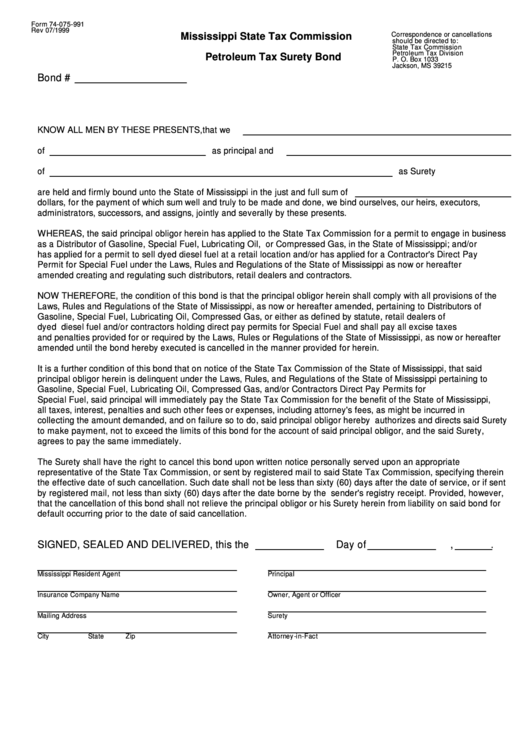

Form 74-075-991

Rev 07/1999

Mississippi State Tax Commission

Correspondence or cancellations

should be directed to:

State Tax Commission

Petroleum Tax Division

Petroleum Tax Surety Bond

P. O. Box 1033

Jackson, MS 39215

Bond #

KNOW ALL MEN BY THESE PRESENTS,that we

of

as principal and

of

as Surety

are held and firmly bound unto the State of Mississippi in the just and full sum of

dollars, for the payment of which sum well and truly to be made and done, we bind ourselves, our heirs, executors,

administrators, successors, and assigns, jointly and severally by these presents.

WHEREAS, the said principal obligor herein has applied to the State Tax Commission for a permit to engage in business

as a Distributor of Gasoline, Special Fuel, Lubricating Oil, or Compressed Gas, in the State of Mississippi; and/or

has applied for a permit to sell dyed diesel fuel at a retail location and/or has applied for a Contractor's Direct Pay

Permit for Special Fuel under the Laws, Rules and Regulations of the State of Mississippi as now or hereafter

amended creating and regulating such distributors, retail dealers and contractors.

NOW THEREFORE, the condition of this bond is that the principal obligor herein shall comply with all provisions of the

Laws, Rules and Regulations of the State of Mississippi, as now or hereafter amended, pertaining to Distributors of

Gasoline, Special Fuel, Lubricating Oil, Compressed Gas, or either as defined by statute, retail dealers of

dyed diesel fuel and/or contractors holding direct pay permits for Special Fuel and shall pay all excise taxes

and penalties provided for or required by the Laws, Rules or Regulations of the State of Mississippi, as now or hereafter

amended until the bond hereby executed is cancelled in the manner provided for herein.

It is a further condition of this bond that on notice of the State Tax Commission of the State of Mississippi, that said

principal obligor herein is delinquent under the Laws, Rules, and Regulations of the State of Mississippi pertaining to

Gasoline, Special Fuel, Lubricating Oil, Compressed Gas, and/or Contractors Direct Pay Permits for

Special Fuel, said principal will immediately pay the State Tax Commission for the benefit of the State of Mississippi,

all taxes, interest, penalties and such other fees or expenses, including attorney's fees, as might be incurred in

collecting the amount demanded, and on failure so to do, said principal obligor hereby authorizes and directs said Surety

to make payment, not to exceed the limits of this bond for the account of said principal obligor, and the said Surety,

agrees to pay the same immediately.

The Surety shall have the right to cancel this bond upon written notice personally served upon an appropriate

representative of the State Tax Commission, or sent by registered mail to said State Tax Commission, specifying therein

the effective date of such cancellation. Such date shall not be less than sixty (60) days after the date of service, or if sent

by registered mail, not less than sixty (60) days after the date borne by the sender's registry receipt. Provided, however,

that the cancellation of this bond shall not relieve the principal obligor or his Surety herein from liability on said bond for

default occurring prior to the date of said cancellation.

SIGNED, SEALED AND DELIVERED, this the

Day of

,

.

Mississippi Resident Agent

Principal

Insurance Company Name

Owner, Agent or Officer

Mailing Address

Surety

City

State

Zip

Attorney-in-Fact

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1