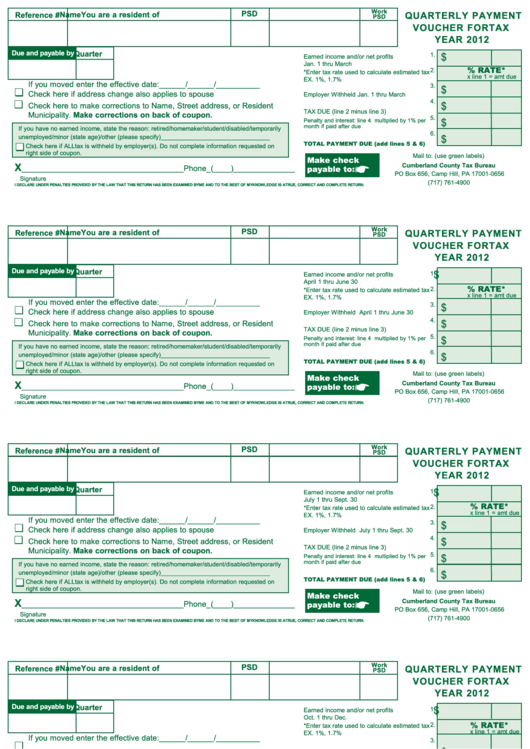

Quarterly Payment Voucher For Tax Year 2012 - Cumberland County Tax Bureau

ADVERTISEMENT

Work

PSD

Name

You are a resident of

QUARTERLY PAYMENT

Reference #

PSD

VOUCHER FOR TAX

YEAR 2012

Due and payable by

Quarter

$

1.

Earned income and/or net profits

Jan. 1 thru March 31.............................................

% RATE*

2.

*Enter tax rate used to calculate estimated tax

x line 1 = amt due

EX. 1%, 1.7% etc..................................................

If you moved enter the effective date:______/______/__________

3.

$

Check here if address change also applies to spouse

Employer Withheld Jan. 1 thru March 31...............

4.

$

Check here to make corrections to Name, Street address, or Resident

TAX DUE (line 2 minus line 3)...............................

Municipality. Make corrections on back of coupon.

5.

Penalty and interest: line 4 multiplied by 1% per

$

month if paid after due date........................................

If you have no earned income, state the reason: retired/homemaker/student/disabled/temporarily

6.

$

unemployed/minor (state age)/other (please specify)________________________________

TOTAL PAYMENT DUE (add lines 5 & 6).......

Check here if ALL tax is withheld by employer(s). Do not complete information requested on

right side of coupon.

Mail to: (use green labels)

Make check

☛

X

Cumberland County Tax Bureau

payable to:

_____________________________________Phone_(____)______________

PO Box 656, Camp Hill, PA 17001-0656

Signature

(717) 761-4900

I DECLARE UNDER PENALTIES PROVIDED BY THE LAW THAT THIS RETURN HAS BEEN EXAMINED BY ME AND TO THE BEST OF MY KNOWLEDGE IS A TRUE, CORRECT AND COMPLETE RETURN.

Work

PSD

QUARTERLY PAYMENT

Reference #

Name

You are a resident of

PSD

VOUCHER FOR TAX

YEAR 2012

Due and payable by

Quarter

$

1.

Earned income and/or net profits

April 1 thru June 30 .............................................

% RATE*

2.

*Enter tax rate used to calculate estimated tax

x line 1 = amt due

EX. 1%, 1.7% etc..................................................

If you moved enter the effective date:______/______/__________

3.

$

Check here if address change also applies to spouse

Employer Withheld April 1 thru June 30 ...............

4.

$

Check here to make corrections to Name, Street address, or Resident

TAX DUE (line 2 minus line 3)...............................

Municipality. Make corrections on back of coupon.

5.

$

Penalty and interest: line 4 multiplied by 1% per

month if paid after due date........................................

If you have no earned income, state the reason: retired/homemaker/student/disabled/temporarily

6.

$

unemployed/minor (state age)/other (please specify)________________________________

TOTAL PAYMENT DUE (add lines 5 & 6).......

Check here if ALL tax is withheld by employer(s). Do not complete information requested on

right side of coupon.

Mail to: (use green labels)

Make check

☛

X

Cumberland County Tax Bureau

payable to:

_____________________________________Phone_(____)______________

PO Box 656, Camp Hill, PA 17001-0656

Signature

(717) 761-4900

I DECLARE UNDER PENALTIES PROVIDED BY THE LAW THAT THIS RETURN HAS BEEN EXAMINED BY ME AND TO THE BEST OF MY KNOWLEDGE IS A TRUE, CORRECT AND COMPLETE RETURN.

Work

PSD

Name

You are a resident of

QUARTERLY PAYMENT

Reference #

PSD

VOUCHER FOR TAX

YEAR 2012

Due and payable by

Quarter

$

1.

Earned income and/or net profits

July 1 thru Sept. 30 .............................................

% RATE*

2.

*Enter tax rate used to calculate estimated tax

x line 1 = amt due

EX. 1%, 1.7% etc..................................................

If you moved enter the effective date:______/______/__________

3.

$

Check here if address change also applies to spouse

Employer Withheld July 1 thru Sept. 30 ..............

4.

$

Check here to make corrections to Name, Street address, or Resident

TAX DUE (line 2 minus line 3)...............................

Municipality. Make corrections on back of coupon.

5.

$

Penalty and interest: line 4 multiplied by 1% per

month if paid after due date........................................

If you have no earned income, state the reason: retired/homemaker/student/disabled/temporarily

6.

$

unemployed/minor (state age)/other (please specify)________________________________

TOTAL PAYMENT DUE (add lines 5 & 6).......

Check here if ALL tax is withheld by employer(s). Do not complete information requested on

right side of coupon.

Mail to: (use green labels)

Make check

☛

X

Cumberland County Tax Bureau

payable to:

_____________________________________Phone_(____)______________

PO Box 656, Camp Hill, PA 17001-0656

Signature

(717) 761-4900

I DECLARE UNDER PENALTIES PROVIDED BY THE LAW THAT THIS RETURN HAS BEEN EXAMINED BY ME AND TO THE BEST OF MY KNOWLEDGE IS A TRUE, CORRECT AND COMPLETE RETURN.

Work

PSD

Name

You are a resident of

QUARTERLY PAYMENT

Reference #

PSD

VOUCHER FOR TAX

YEAR 2012

Due and payable by

Quarter

$

1.

Earned income and/or net profits

Oct. 1 thru Dec. 31.............................................

% RATE*

2.

*Enter tax rate used to calculate estimated tax

x line 1 = amt due

EX. 1%, 1.7% etc..................................................

If you moved enter the effective date:______/______/__________

3.

$

Check here if address change also applies to spouse

Employer Withheld Oct. 1 thru Dec. 31...............

4.

$

Check here to make corrections to Name, Street address, or Resident

TAX DUE (line 2 minus line 3)...............................

Municipality. Make corrections on back of coupon.

5.

$

Penalty and interest: line 4 multiplied by 1% per

month if paid after due date........................................

If you have no earned income, state the reason: retired/homemaker/student/disabled/temporarily

6.

$

unemployed/minor (state age)/other (please specify)________________________________

TOTAL PAYMENT DUE (add lines 5& 6).......

Check here if ALL tax is withheld by employer(s). Do not complete information requested on

right side of coupon.

Mail to: (use green labels)

Make check

☛

X

Cumberland County Tax Bureau

payable to:

_____________________________________Phone_(____)______________

PO Box 656, Camp Hill, PA 17001-0656

Signature

(717) 761-4900

I DECLARE UNDER PENALTIES PROVIDED BY THE LAW THAT THIS RETURN HAS BEEN EXAMINED BY ME AND TO THE BEST OF MY KNOWLEDGE IS A TRUE, CORRECT AND COMPLETE RETURN.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1