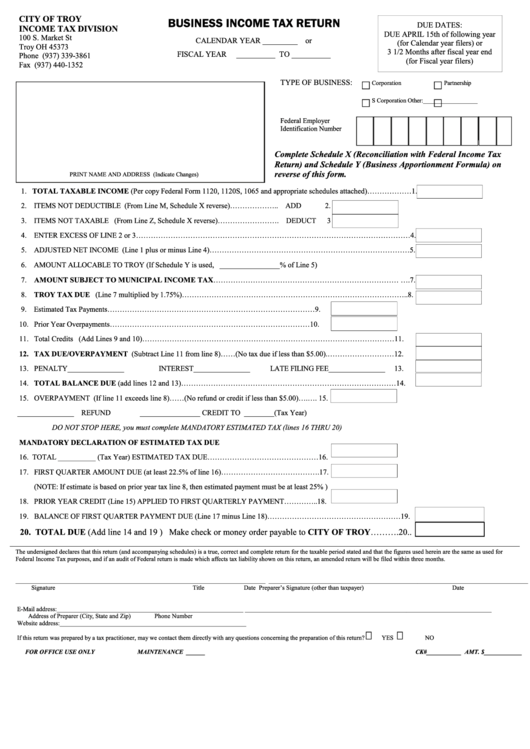

Business Income Tax Return Form - City Of Troy Income Tax Division

ADVERTISEMENT

CITY OF TROY

BUSINESS INCOME TAX RETURN

DUE DATES:

INCOME TAX DIVISION

DUE APRIL 15th of following year

100 S. Market St

CALENDAR YEAR _________ or

(for Calendar year filers) or

Troy OH 45373

3 1/2 Months after fiscal year end

FISCAL YEAR

__________ TO __________

Phone (937) 339-3861

(for Fiscal year filers)

Fax (937) 440-1352

TYPE OF BUSINESS:

Corporation

Partnership

S Corporation

Other:__________________

Federal Employer

Identification Number

Complete Schedule X (Reconciliation with Federal Income Tax

Return) and Schedule Y (Business Apportionment Formula) on

reverse of this form.

PRINT NAME AND ADDRESS (Indicate Changes)

1. TOTAL TAXABLE INCOME (Per copy Federal Form 1120, 1120S, 1065 and appropriate schedules attached)………………1.

2. ITEMS NOT DEDUCTIBLE (From Line M, Schedule X reverse)……………….. ADD

2.

3. ITEMS NOT TAXABLE (From Line Z, Schedule X reverse)……………………. DEDUCT

3

4. ENTER EXCESS OF LINE 2 or 3…………………………………………………………………………………………………4.

5. ADJUSTED NET INCOME (Line 1 plus or minus Line 4)………………………………………………………………………5.

6. AMOUNT ALLOCABLE TO TROY (If Schedule Y is used, ________________% of Line 5)

7. AMOUNT SUBJECT TO MUNICIPAL INCOME TAX………………………………………………………………… ….7.

8. TROY TAX DUE (Line 7 multiplied by 1.75%)………………………………………………………………………………..8.

9. Estimated Tax Payments…………………………………………………………………………9.

10. Prior Year Overpayments………………………………………………………………………10.

11. Total Credits (Add Lines 9 and 10)…………………………………………………………………………………………11.

12. TAX DUE/OVERPAYMENT (Subtract Line 11 from line 8)……(No tax due if less than $5.00).………………………12.

13. PENALTY_______________

INTEREST_______________

LATE FILING FEE_______________

13.

14. TOTAL BALANCE DUE (add lines 12 and 13)……………………………………………………………………………14.

15. OVERPAYMENT (If line 11 exceeds line 8)……(No refund or credit if less than $5.00)….…. 15.

_______________ REFUND

________________ CREDIT TO ________(Tax Year)

DO NOT STOP HERE, you must complete MANDATORY ESTIMATED TAX (lines 16 THRU 20)

MANDATORY DECLARATION OF ESTIMATED TAX DUE

16. TOTAL __________ (Tax Year) ESTIMATED TAX DUE………………………………………16.

17. FIRST QUARTER AMOUNT DUE (at least 22.5% of line 16)………………………………….17.

(NOTE: If estimate is based on prior year tax line 8, then estimated payment must be at least 25% )

18. PRIOR YEAR CREDIT (Line 15) APPLIED TO FIRST QUARTERLY PAYMENT…………..18.

19. BALANCE OF FIRST QUARTER PAYMENT DUE (Line 17 minus Line 18)………………………………………………19.

20. TOTAL DUE (Add line 14 and 19 ) Make check or money order payable to CITY OF TROY……….20..

The undersigned declares that this return (and accompanying schedules) is a true, correct and complete return for the taxable period stated and that the figures used herein are the same as used for

Federal Income Tax purposes, and if an audit of Federal return is made which affects tax liability shown on this return, an amended return will be filed within three months.

_______________________________________________________________________________ __________________________________________________________________________________

Signature

Title

Date

Preparer’s Signature (other than taxpayer)

Date

E-Mail address:___________________________________________________________

______________________________________________________________________________

Address of Preparer (City, State and Zip)

Phone Number

Website address:___________________________________________________________

If this return was prepared by a tax practitioner, may we contact them directly with any questions concerning the preparation of this return?

YES

NO

FOR OFFICE USE ONLY

MAINTENANCE ______

CK#___________ AMT. $____________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2