Business Income Tax Return Form - City Of Troy Income Tax Division Page 2

ADVERTISEMENT

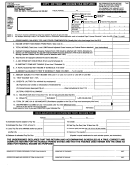

BUSINESS INCOME TAX RETURN—CITY OF TROY INCOME TAX DIVISION (page 2)

Questions regarding Schedule X and Schedule Y? Refer to Ohio Revised Code Section 718 for assistance. In preparing your City of Troy Business Income Tax Return,

you must arrive at “Adjusted Federal Taxable Income” as outlined in ORC 718.01. Refer to ORC 718.02 for instructions regarding Business Apportionment Formula.

SCHEDULE X—RECONCILIATION WITH FEDERAL INCOME TAX RETURN

ITEMS NOT DEDUCTIBLE

ADD

ITEMS NOT TAXABLE

DEDUCT

a. Capital Losses and 1231 losses……………………………………….._________________

n. Capital Gains (Do not include ordinary gains from

b. Interest and/or other expenses incurred in the production of

Federal Form 4797)……………………………………..________________

non-taxable income (at least 5% of line z, not including line n)……._________________

o. Interest earned or accrued……………………………….________________

c. Taxes on net income deducted to compute federal taxable income….._________________

p. Dividends (less Federal exclusion)………………………________________

d. Guaranteed payments to partners and retired partners…………………________________

q. Other items not taxable (full explanation required)

e. Net operating loss deduction per Federal return……………………….________________

_________________________________...........________________

f. Payments to Self-Employed Retirement plans, health insurance and

_________________________________...........________________

life insurance payments to owners or owner-employees………………________________

_________________________________...........________________

g. Distributions to investors of REIT Real Estate Investment Trusts…….________________

_________________________________...........________________

h. Other items not deductible (full explanation required)………………...________________

r. Royalties (intangible)…………………………..…..........________________

_________________________________________ ___................________________

z. TOTAL DEDUCTIONS………………………………...________________

____________________________________________.................________________

I. Contributions in excess of Federal Limit……………………................_________________

m. TOTAL ADDITIONS………………………………………...……….________________

SCHEDULE Y—BUSINESS APPORTIONMENT FORMULA

The business apportionment formula is to be used only in the absence of books and records

which will disclose within reasonable accuracy that portion of the net profits which is

A. LOCATED EVERYWHERE

B. LOCATED IN TROY

C. PERCENTAGE (B + A)

attributable to that part of the business within Troy.

STEP 1. Average value of real and tangible personal property…………………………………….$___________________________

$____________________________

Gross annual rents multiplied by 8……………………………………………………….$____________________________

$______________________________

Total Step 1……………………………………………………………………………….$____________________________

$______________________________

__________________________%

STEP 2. Gross receipts from sales and work or services performed ………………………………$____________________________

$______________________________

__________________________%

STEP 3. Total wages, salaries, commissions, and other compensation of all employees…………$_____________________________

$______________________________

__________________________%

STEP 4. Total percentages…………………………………………………………………………

__________________________%

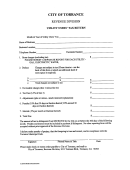

ACCOUNT INFORMATION UPDATE QUESTIONNAIRE

Please complete all questions fully. The information below will be used to update information currently on file.

BUSINESS NAME (Trade name if different from front of return):__________________________________________________________________________

NATURE OF BUSINESS:_________________________________________________________________________________________________________

TROY LOCATION (If different from address shown on front of return):____________________________________________________________________

PHONE NUMBER (Corporate):_______________________________________ PHONE NUMBER (Troy location):_______________________________

DATE EMPLOYEES BEGAN WORKING IN TROY:_______________

NUMBER OF EMPLOYEES WORKING IN TROY:_____________________

(Reminder: Employee withholding is required. An Annual Reconciliation of Returns is due by Feb 28th of each year.)

ACCOUNTING PERIOD:

_________

Calendar Year

_________

Fiscal Year

(Month ending__________________)

NAME AND ADDRESS OF PARTY IN CHARGE OF BOOKS:

_______________________________________________________________________________________________________________________

PHONE NUMBER OF PARTY IN CHARGE OF BOOKS:_______________________________________________________________________

DO YOU USE SUBCONTRACT LABOR IN TROY?______________________

(If yes, copies of 1099 forms due by Feb 28th of each year)

DO YOU LEASE EMPLOYEES? ________________ (If yes, provide name, address, phone number and federal identification number of leasing agent:

_______________________________________________________________________________________________________________________

_______________________________________________________________________________________________________________________

COMPLETED BY:

_____________________________________________________

______________________________________

__________________________

SIGNATURE

TITLE

DATE

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2