Toledo Resident Individual Tax Return Form Instructions - 2016

ADVERTISEMENT

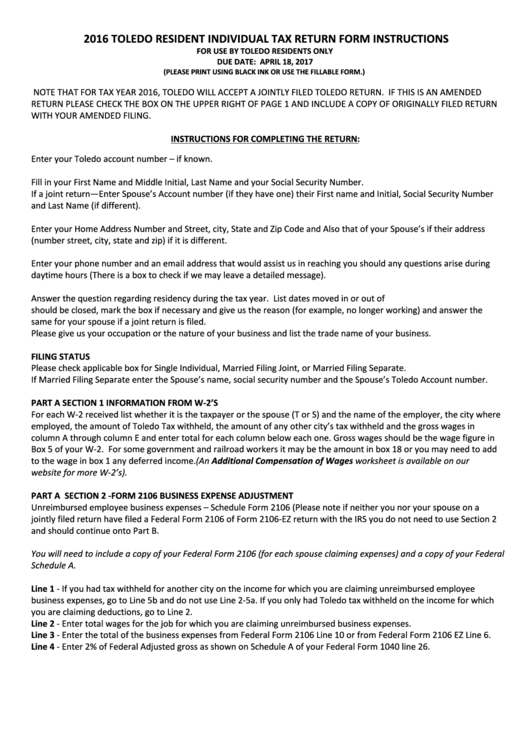

2016 TOLEDO RESIDENT INDIVIDUAL TAX RETURN FORM INSTRUCTIONS

FOR USE BY TOLEDO RESIDENTS ONLY

DUE DATE: APRIL 18, 2017

(PLEASE PRINT USING BLACK INK OR USE THE FILLABLE FORM.)

NOTE THAT FOR TAX YEAR 2016, TOLEDO WILL ACCEPT A JOINTLY FILED TOLEDO RETURN. IF THIS IS AN AMENDED

RETURN PLEASE CHECK THE BOX ON THE UPPER RIGHT OF PAGE 1 AND INCLUDE A COPY OF ORIGINALLY FILED RETURN

WITH YOUR AMENDED FILING.

INSTRUCTIONS FOR COMPLETING THE RETURN:

Enter your Toledo account number – if known.

Fill in your First Name and Middle Initial, Last Name and your Social Security Number.

If a joint return—Enter Spouse’s Account number (if they have one) their First name and Initial, Social Security Number

and Last Name (if different).

Enter your Home Address Number and Street, city, State and Zip Code and Also that of your Spouse’s if their address

(number street, city, state and zip) if it is different.

Enter your phone number and an email address that would assist us in reaching you should any questions arise during

daytime hours (There is a box to check if we may leave a detailed message).

Answer the question regarding residency during the tax year. List dates moved in or out of Toledo. If your account

should be closed, mark the box if necessary and give us the reason (for example, no longer working) and answer the

same for your spouse if a joint return is filed.

Please give us your occupation or the nature of your business and list the trade name of your business.

FILING STATUS

Please check applicable box for Single Individual, Married Filing Joint, or Married Filing Separate.

If Married Filing Separate enter the Spouse’s name, social security number and the Spouse’s Toledo Account number.

PART A SECTION 1 INFORMATION FROM W-2’S

For each W-2 received list whether it is the taxpayer or the spouse (T or S) and the name of the employer, the city where

employed, the amount of Toledo Tax withheld, the amount of any other city’s tax withheld and the gross wages in

column A through column E and enter total for each column below each one. Gross wages should be the wage figure in

Box 5 of your W-2. For some government and railroad workers it may be the amount in box 18 or you may need to add

to the wage in box 1 any deferred income. (An Additional Compensation of Wages worksheet is available on our

website for more W-2’s).

PART A SECTION 2 - FORM 2106 BUSINESS EXPENSE ADJUSTMENT

Unreimbursed employee business expenses – Schedule Form 2106 (Please note if neither you nor your spouse on a

jointly filed return have filed a Federal Form 2106 of Form 2106-EZ return with the IRS you do not need to use Section 2

and should continue onto Part B.

You will need to include a copy of your Federal Form 2106 (for each spouse claiming expenses) and a copy of your Federal

Schedule A.

Line 1 - If you had tax withheld for another city on the income for which you are claiming unreimbursed employee

business expenses, go to Line 5b and do not use Line 2-5a. If you only had Toledo tax withheld on the income for which

you are claiming deductions, go to Line 2.

Line 2 - Enter total wages for the job for which you are claiming unreimbursed business expenses.

Line 3 - Enter the total of the business expenses from Federal Form 2106 Line 10 or from Federal Form 2106 EZ Line 6.

Line 4 - Enter 2% of Federal Adjusted gross as shown on Schedule A of your Federal Form 1040 line 26.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3