Form Ct-592 - Athlete And Entertauner Withholding Tax Statement - Connecticut Department Of Revenue

ADVERTISEMENT

20

___

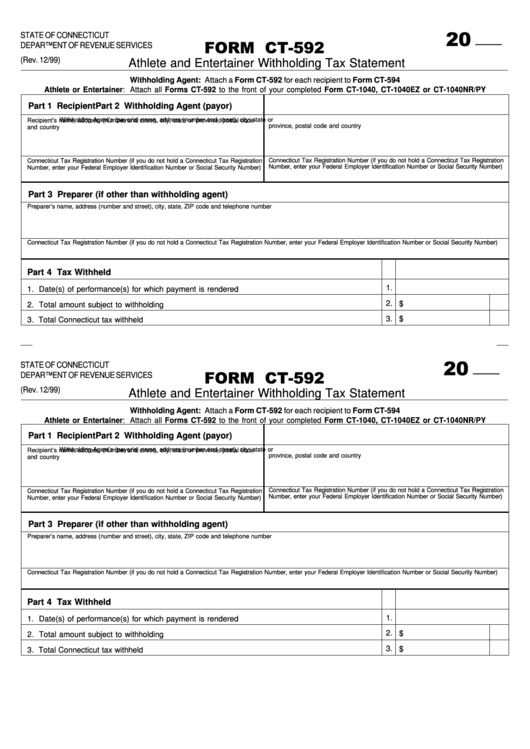

STATE OF CONNECTICUT

FORM CT-592

DEPARTMENT OF REVENUE SERVICES

(Rev. 12/99)

Athlete and Entertainer Withholding Tax Statement

Withholding Agent: Attach a Form CT-592 for each recipient to Form CT-594

Athlete or Entertainer: Attach all Forms CT-592 to the front of your completed Form CT-1040, CT-1040EZ or CT-1040NR/PY

Part 1 Recipient

Part 2 Withholding Agent (payor)

Withholding Agent’s (payor’s) name, address (number and street), city, state or

Recipient’s name, address, (number and street), city, state or province, postal code

province, postal code and country

and country

Connecticut Tax Registration Number (if you do not hold a Connecticut Tax Registration

Connecticut Tax Registration Number (if you do not hold a Connecticut Tax Registration

Number, enter your Federal Employer Identification Number or Social Security Number)

Number, enter your Federal Employer Identification Number or Social Security Number)

Part 3 Preparer (if other than withholding agent)

Preparer’s name, address (number and street), city, state, ZIP code and telephone number

Connecticut Tax Registration Number (if you do not hold a Connecticut Tax Registration Number, enter your Federal Employer Identification Number or Social Security Number)

Part 4 Tax Withheld

1.

1. Date(s) of performance(s) for which payment is rendered

2.

$

2. Total amount subject to withholding

3.

$

3. Total Connecticut tax withheld

20

___

STATE OF CONNECTICUT

FORM CT-592

DEPARTMENT OF REVENUE SERVICES

(Rev. 12/99)

Athlete and Entertainer Withholding Tax Statement

Withholding Agent: Attach a Form CT-592 for each recipient to Form CT-594

Athlete or Entertainer: Attach all Forms CT-592 to the front of your completed Form CT-1040, CT-1040EZ or CT-1040NR/PY

Part 1 Recipient

Part 2 Withholding Agent (payor)

Withholding Agent’s (payor’s) name, address (number and street), city, state or

Recipient’s name, address, (number and street), city, state or province, postal code

province, postal code and country

and country

Connecticut Tax Registration Number (if you do not hold a Connecticut Tax Registration

Connecticut Tax Registration Number (if you do not hold a Connecticut Tax Registration

Number, enter your Federal Employer Identification Number or Social Security Number)

Number, enter your Federal Employer Identification Number or Social Security Number)

Part 3 Preparer (if other than withholding agent)

Preparer’s name, address (number and street), city, state, ZIP code and telephone number

Connecticut Tax Registration Number (if you do not hold a Connecticut Tax Registration Number, enter your Federal Employer Identification Number or Social Security Number)

Part 4 Tax Withheld

1.

1. Date(s) of performance(s) for which payment is rendered

2.

$

2. Total amount subject to withholding

3.

$

3. Total Connecticut tax withheld

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1