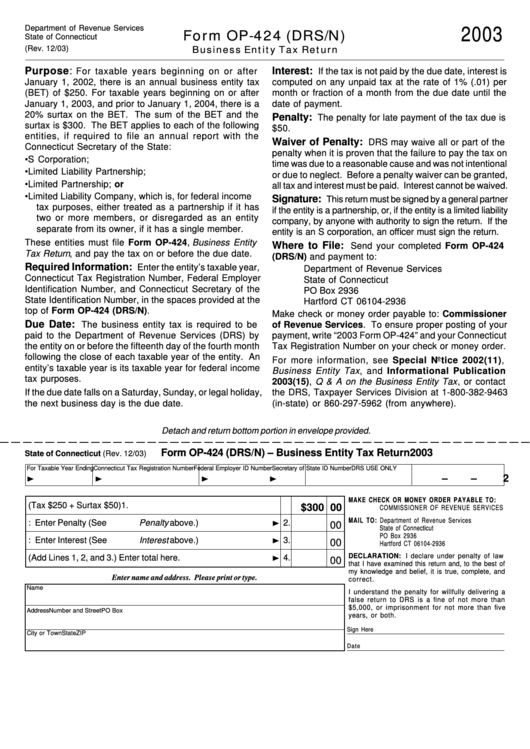

Form Op-424 (Drs/n) - Business Entity Tax Return - Connecticut Department Of Revenue Services - 2003

ADVERTISEMENT

2003

Department of Revenue Services

Form OP-424 (DRS/N)

State of Connecticut

Business Entity Tax Return

(Rev. 12/03)

Purpose:

Interest:

For taxable years beginning on or after

If the tax is not paid by the due date, interest is

January 1, 2002, there is an annual business entity tax

computed on any unpaid tax at the rate of 1% (.01) per

(BET) of $250. For taxable years beginning on or after

month or fraction of a month from the due date until the

January 1, 2003, and prior to January 1, 2004, there is a

date of payment.

20% surtax on the BET. The sum of the BET and the

Penalty:

The penalty for late payment of the tax due is

surtax is $300. The BET applies to each of the following

$50.

entities, if required to file an annual report with the

Waiver of Penalty:

DRS may waive all or part of the

Connecticut Secretary of the State:

penalty when it is proven that the failure to pay the tax on

• S Corporation;

time was due to a reasonable cause and was not intentional

• Limited Liability Partnership;

or due to neglect. Before a penalty waiver can be granted,

• Limited Partnership; or

all tax and interest must be paid. Interest cannot be waived.

• Limited Liability Company, which is, for federal income

Signature:

This return must be signed by a general partner

tax purposes, either treated as a partnership if it has

if the entity is a partnership, or, if the entity is a limited liability

two or more members, or disregarded as an entity

company, by anyone with authority to sign the return. If the

separate from its owner, if it has a single member.

entity is an S corporation, an officer must sign the return.

These entities must file Form OP-424, Business Entity

Where to File:

Send your completed Form OP-424

Tax Return , and pay the tax on or before the due date.

(DRS/N) and payment to:

Required Information:

Enter the entity’s taxable year,

Department of Revenue Services

Connecticut Tax Registration Number, Federal Employer

State of Connecticut

Identification Number, and Connecticut Secretary of the

PO Box 2936

State Identification Number, in the spaces provided at the

Hartford CT 06104-2936

top of Form OP-424 (DRS/N).

Make check or money order payable to: Commissioner

Due Date:

The business entity tax is required to be

of Revenue Services. To ensure proper posting of your

paid to the Department of Revenue Services (DRS) by

payment, write “2003 Form OP-424” and your Connecticut

the entity on or before the fifteenth day of the fourth month

Tax Registration Number on your check or money order.

following the close of each taxable year of the entity. An

For more information, see Special Notice 2002(11),

entity’s taxable year is its taxable year for federal income

Business Entity Tax , and Informational Publication

tax purposes.

2003(15), Q & A on the Business Entity Tax , or contact

If the due date falls on a Saturday, Sunday, or legal holiday,

the DRS, Taxpayer Services Division at 1-800-382-9463

the next business day is the due date.

(in-state) or 860-297-5962 (from anywhere).

Detach and return bottom portion in envelope provided.

Form OP-424 (DRS/N) – Business Entity Tax Return

2003

State of Connecticut (Rev. 12/03)

For Taxable Year Ending Connecticut Tax Registration Number Federal Employer ID Number

Secretary of State ID Number

DRS USE ONLY

–

– 20

MAKE CHECK OR MONEY ORDER PAYABLE TO:

1. Business Entity Tax (Tax $250 + Surtax $50)

1.

$300 00

COMMISSIONER OF REVENUE SERVICES

MAIL TO: Department of Revenue Services

2. If late: Enter Penalty (See Penalty above.)

2.

00

State of Connecticut

PO Box 2936

3. If late: Enter Interest (See Interest above.)

3.

00

Hartford CT 06104-2936

DECLARATION: I declare under penalty of law

4. Total amount due. (Add Lines 1, 2, and 3.) Enter total here.

4.

00

that I have examined this return and, to the best of

my knowledge and belief, it is true, complete, and

Enter name and address. Please print or type.

correct.

Name

I understand the penalty for willfully delivering a

false return to DRS is a fine of not more than

$5,000, or imprisonment for not more than five

Address

Number and Street

PO Box

years, or both.

Sign Here

City or Town

State

ZIP

Date

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1