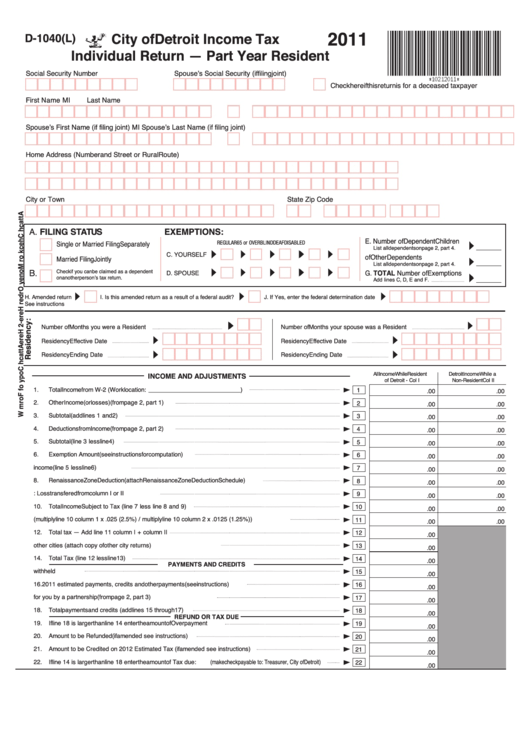

Form D-1040(L) - City Of Detroit Income Tax Individual Return - Part Year Resident - 2011

ADVERTISEMENT

2011

City of Detroit Income Tax

D-1040(L)

Individual Return — Part Year Resident

Social Security Number

Spouse’s Social Security (if filing joint)

Check here if this return is for a deceased taxpayer

First Name

MI

Last Name

Spouse’s First Name (if filing joint)

MI

Spouse’s Last Name (if filing joint)

Home Address (Number and Street or Rural Route)

City or Town

State

Zip Code

A. FILING STATUS

EXEMPTIONS:

E. Number of Dependent Children

Single or Married Filing Separately

REGULAR

65 or OVER

BLIND

DEAF

DISABLED

List all dependents on page 2, part 4.

C. YOURSELF

F. Number of Other Dependents

Married Filing Jointly

List all dependents on page 2, part 4.

B.

Check if you can be claimed as a dependent

G. TOTAL Number of Exemptions

D. SPOUSE

on another person’s tax return.

Add lines C, D, E and F.

H. Amended return

I. Is this amended return as a result of a federal audit?

J. If Yes, enter the federal determination date

See instructions

Number of Months you were a Resident

Number of Months your spouse was a Resident

Residency Effective Date

Residency Effective Date

Residency Ending Date

Residency Ending Date

All Income While Resident

Detroit Income While a

INCOME AND ADJUSTMENTS

of Detroit - Col I

Non-Resident Col II

1.

Total Income from W-2 (Work location: ___________________________)

1

.00

.00

2.

Other Income (or losses) (from page 2, part 1)

2

.00

.00

3.

Subtotal (add lines 1 and 2)

3

.00

.00

4.

Deductions from Income (from page 2, part 2)

4

.00

.00

5.

Subtotal (line 3 less line 4)

5

.00

.00

6.

Exemption Amount (see instructions for computation)

6

.00

.00

7.

Net income (line 5 less line 6)

7

.00

.00

8.

Renaissance Zone Deduction (attach Renaissance Zone Deduction Schedule)

8

.00

.00

9.

Less: Loss transfered from column I or II

9

.00

.00

10.

Total Income Subject to Tax (line 7 less line 8 and 9)

10

.00

.00

11.

Tax (multiply line 10 column 1 x .025 (2.5%) / multiply line 10 column 2 x .0125 (1.25%))

11

.00

.00

12.

Total tax — Add line 11 column I + column II

12

.00

13.

Credit tax paid to other cities (attach copy of other city returns)

13

.00

14.

Total Tax (line 12 less line 13)

14

.00

PAYMENTS AND CREDITS

15.

Tax withheld

15

.00

16.

2011 estimated payments, credits and other payments (see instructions)

16

.00

17.

Detroit tax paid for you by a partnership (from page 2, part 3)

17

.00

18.

Total payments and credits (add lines 15 through 17)

18

.00

REFUND OR TAX DUE

19.

If line 18 is larger than line 14 enter the amount of Overpayment

19

.00

20.

Amount to be Refunded (if amended see instructions)

20

.00

21.

Amount to be Credited on 2012 Estimated Tax (if amended see instructions)

21

.00

22.

If line 14 is larger than line 18 enter the amount of Tax due: (make check payable to: Treasurer, City of Detroit)

22

.00

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2