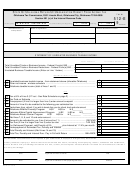

EXAMPLE FOR FILING A MULTIPLE NONRESIDENT RETURN

XYZ, Inc., a fictitious California S corporation, has a fiscal year end

Taxpayer “D” —

1

⁄

of $51,000 = $12,750

4

of March 31, 1998. XYZ, Inc.’s Oregon nonresident shareholders

Compute the tax using Oregon’s tax rate

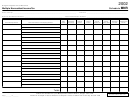

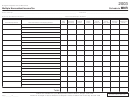

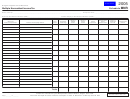

elect to file a multiple nonresident return (MNR) by completing a 1998

chart for “married filing joint” ........................ $ 824.00

Form 40N and Schedule MNR.

Total Oregon tax for multiple

nonresident return ........................................ $1,810.00

XYZ, Inc.’s total federal taxable income from Schedule K is $400,000.

Credits allowed on individual returns (e.g. exemption credit or eld-

Using property, payroll and sales apportionment factors, the Oregon

erly or disabled credit) are not allowed on the multiple nonresident

apportionment percentage is determined to be 12.5 percent.

return. However, credits directly attributable to the entity may be

Charitable contributions of $5,000 and other states’ income taxes of

claimed.

$3,000 are not allowable deductions on the Oregon multiple

nonresident return and must be added back to determine Oregon

XYZ, Inc. has $400,000 of taxable income. Total California tax

modified taxable income.

after credits is $35,000. California and Oregon mutually tax $51,000

of XYZ, Inc. income. XYZ, Inc. will compute their Oregon credit

Oregon’s modified taxable income and Oregon source income are

for taxes paid to another state using the formula in OAR 150-

computed as follows:

316.082. The credit for taxes paid to another state is the lesser of

Federal taxable income................................... $ 400,000

the following:

Add back:

• $ 1,810 — Oregon tax liability, after all other credits,

Charitable contributions ..............................

5,000

based on mutually taxed income:

÷

$51,000) × $1,810 = $1,810

Other states’ income taxes .........................

3,000

(

)

($51,000

.

Oregon modified taxable income .................... $ 408,000

• $ 4,463 — Other states’ paid tax liability, after all other

× .1250

Apportionment percentage, 12.5% .................

credits, based on mutually taxed income:

÷

$400,000) × $35,000 = $4,463

(

)

($51,000

.

Oregon source income .................................... $ 51,000

• $35,000 — Income tax actually paid to the another state,

XYZ, Inc. has four equal shareholders. Shareholders “A” and “B” are

or

full-year Oregon residents. Shareholders “C” and “D” are nonresi-

• $ 1,810 — Oregon income tax liability after all other

dents. Neither “C” nor “D” have any other Oregon source income and

credits.

elect to participate in a multiple nonresident return. “C” is single and

“D” is married and files joint with her spouse. Oregon income tax is

Net tax after credits for XYZ, Inc.’s multiple nonresident return is

first computed on each individual participating in the multiple non-

computed as follows:

resident return and then added together.

Oregon income tax............................................. $ 1,810

Taxpayer “C” —

1

⁄

of $51,000 = $12,750

4

Less: Credit for taxes paid to another state ...... –1,810

Compute the tax using Oregon’s tax rate

Tax liability .......................................................... $ 0.00

chart for “single” ............................................ $ 986.00

1

1 2

2