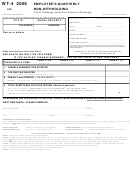

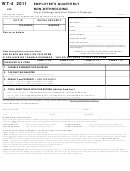

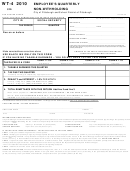

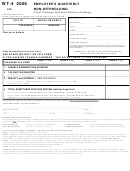

Form Wt-4 - Employee'S Quarterly Non-Withholding - 2002

ADVERTISEMENT

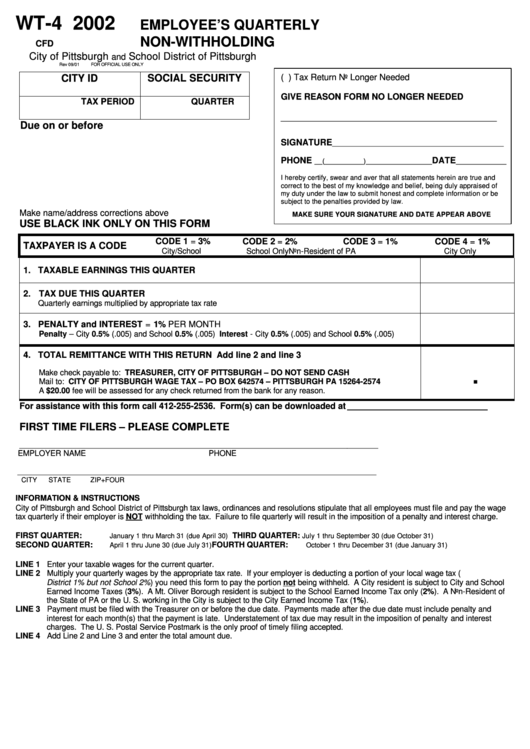

WT-4 2002

EMPLOYEE’ S QUARTERLY

NON-WITHHOLDING

CFD

City of Pittsburgh

School District of Pittsburgh

and

Rev 09/01

FOR OFFICIAL USE ONLY

CITY ID

SOCIAL SECURITY

( ) Tax Return No Longer Needed

GIVE REASON FORM NO LONGER NEEDED

TAX PERIOD

QUARTER

_____________________________________________

Due on or before

SIGNATURE

____________________________________________

PHONE

DATE

__(__________)_________________

_____________

I hereby certify, swear and aver that all statements herein are true and

correct to the best of my knowledge and belief, being duly appraised of

my duty under the law to submit honest and complete information or be

subject to the penalties provided by law.

Make name/address corrections above

MAKE SURE YOUR SIGNATURE AND DATE APPEAR ABOVE

USE BLACK INK ONLY ON THIS FORM

CODE 1 = 3%

CODE 2 = 2%

CODE 3 = 1%

CODE 4 = 1%

TAXPAYER IS A CODE

City/School

School Only

Non-Resident of PA

City Only

1. TAXABLE EARNINGS THIS QUARTER

2. TAX DUE THIS QUARTER

Quarterly earnings multiplied by appropriate tax rate

3. PENALTY and INTEREST = 1% PER MONTH

Penalty – City 0.5% (.005) and School 0.5% (.005) Interest - City 0.5% (.005) and School 0.5% (.005)

4. TOTAL REMITTANCE WITH THIS RETURN Add line 2 and line 3

.

Make check payable to: TREASURER, CITY OF PITTSBURGH – DO NOT SEND CASH

Mail to: CITY OF PITTSBURGH WAGE TAX – PO BOX 642574 – PITTSBURGH PA 15264-2574

A $20.00 fee will be assessed for any check returned from the bank for any reason.

For assistance with this form call 412-255-2536. Form(s) can be downloaded at

FIRST TIME FILERS – PLEASE COMPLETE

____________________________________________________________________________________________

EMPLOYER NAME

PHONE

____________________________________________________________________________________________

CITY

STATE

ZIP+FOUR

INFORMATION & INSTRUCTIONS

City of Pittsburgh and School District of Pittsburgh tax laws, ordinances and resolutions stipulate that all employees must file and pay the wage

tax quarterly if their employer is NOT withholding the tax. Failure to file quarterly will result in the imposition of a penalty and interest charge.

FIRST QUARTER:

THIRD QUARTER:

January 1 thru March 31 (due April 30)

July 1 thru September 30 (due October 31)

SECOND QUARTER:

FOURTH QUARTER:

April 1 thru June 30 (due July 31)

October 1 thru December 31 (due January 31)

LINE 1 Enter your taxable wages for the current quarter.

LINE 2 Multiply your quarterly wages by the appropriate tax rate. If your employer is deducting a portion of your local wage tax (i.e. City

District 1% but not School 2%) you need this form to pay the portion not being withheld. A City resident is subject to City and School

Earned Income Taxes (3%). A Mt. Oliver Borough resident is subject to the School Earned Income Tax only (2%). A Non-Resident of

the State of PA or the U. S. working in the City is subject to the City Earned Income Tax (1%).

LINE 3 Payment must be filed with the Treasurer on or before the due date. Payments made after the due date must include penalty and

interest for each month(s) that the payment is late. Understatement of tax due may result in the imposition of penalty and interest

charges. The U. S. Postal Service Postmark is the only proof of timely filing accepted.

LINE 4 Add Line 2 and Line 3 and enter the total amount due.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1