Form Es-40 - Estimated Tax Payment Form - 2012

ADVERTISEMENT

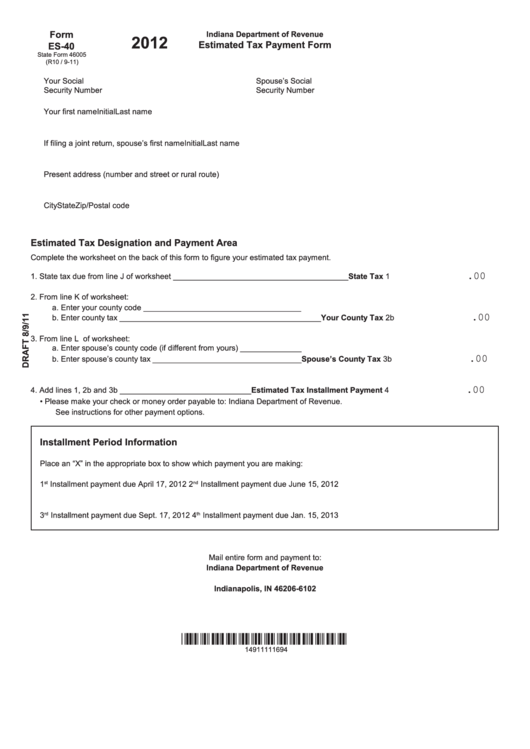

Form

Indiana Department of Revenue

2012

Estimated Tax Payment Form

ES-40

State Form 46005

(R10 / 9-11)

Your Social

Spouse’s Social

Security Number

Security Number

Your first name

Initial

Last name

If filing a joint return, spouse’s first name

Initial

Last name

Present address (number and street or rural route)

City

State

Zip/Postal code

Estimated Tax Designation and Payment Area

Complete the worksheet on the back of this form to figure your estimated tax payment.

.00

1. State tax due from line J of worksheet ________________________________________State Tax

1

2. From line K of worksheet:

a. Enter your county code ____________________________________

.00

b. Enter county tax ______________________________________________ Your County Tax

2b

3. From line L of worksheet:

a. Enter spouse’s county code (if different from yours) ______________

.00

b. Enter spouse’s county tax __________________________________ Spouse’s County Tax

3b

.00

4. Add lines 1, 2b and 3b ______________________________ Estimated Tax Installment Payment

4

•

Please make your check or money order payable to: Indiana Department of Revenue.

See instructions for other payment options.

Installment Period Information

Place an “X” in the appropriate box to show which payment you are making:

1

Installment payment due April 17, 2012

2

Installment payment due June 15, 2012

st

nd

3

Installment payment due Sept. 17, 2012

4

Installment payment due Jan. 15, 2013

rd

th

Mail entire form and payment to:

Indiana Department of Revenue

P.O. Box 6102

Indianapolis, IN 46206-6102

*14911111694*

14911111694

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2