Form I-1040es - Ionia Estimated Income Tax Payment Voucher (2015)

ADVERTISEMENT

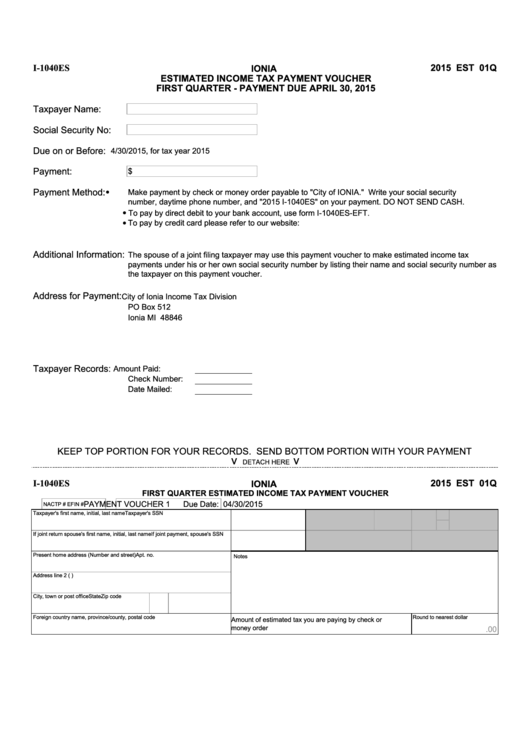

I-1040ES

2015 EST 01Q

IONIA

ESTIMATED INCOME TAX PAYMENT VOUCHER

FIRST QUARTER - PAYMENT DUE APRIL 30, 2015

Taxpayer Name:

Social Security No:

Due on or Before:

4/30/2015, for tax year 2015

Payment:

$

Payment Method:

Make payment by check or money order payable to "City of IONIA." Write your social security

•

number, daytime phone number, and "2015 I-1040ES" on your payment. DO NOT SEND CASH.

To pay by direct debit to your bank account, use form I-1040ES-EFT.

•

To pay by credit card please refer to our website:

•

Additional Information:

The spouse of a joint filing taxpayer may use this payment voucher to make estimated income tax

payments under his or her own social security number by listing their name and social security number as

the taxpayer on this payment voucher.

Address for Payment:

City of Ionia Income Tax Division

PO Box 512

Ionia MI 48846

Taxpayer Records:

Amount Paid:

Check Number:

Date Mailed:

Revised: 10/22/2012

KEEP TOP PORTION FOR YOUR RECORDS. SEND BOTTOM PORTION WITH YOUR PAYMENT

v

v

DETACH HERE

Revised: 10/22/2012

I-1040ES

2015 EST 01Q

IONIA

FIRST QUARTER ESTIMATED INCOME TAX PAYMENT VOUCHER

PAYMENT VOUCHER 1

Due Date: 04/30/2015

NACTP #

EFIN #

Taxpayer's first name, initial, last name

Taxpayer's SSN

If joint return spouse's first name, initial, last name

If joint payment, spouse's SSN

Present home address (Number and street)

Apt. no.

Notes

Address line 2 (P.O. Box address for mailing use only)

City, town or post office

State

Zip code

Foreign country name, province/county, postal code

Round to nearest dollar

Amount of estimated tax you are paying by check or

money order

.00

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4