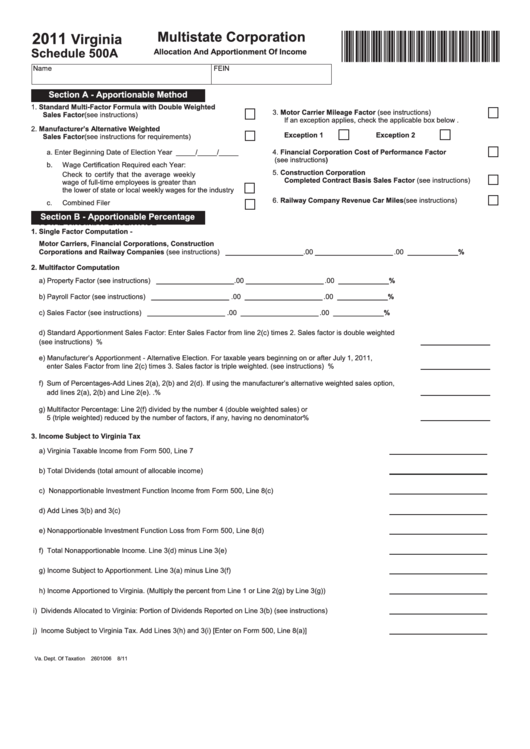

Virginia Schedule 500a - Multistate Corporation - Allocation And Apportionment Of Income - 2011

ADVERTISEMENT

Multistate Corporation

2011

Virginia

*VAcpsA111000*

Schedule 500A

Allocation And Apportionment Of Income

Name

FEIN

Section A - Apportionable Method

1. Standard Multi-Factor Formula with Double Weighted

3. Motor Carrier Mileage Factor (see instructions) ............................

Sales Factor (see instructions) .......................................................

If an exception applies, check the applicable box below .

2. Manufacturer’s Alternative Weighted

Exception 1

Exception 2

Sales Factor (see instructions for requirements) ...........................

4. Financial Corporation Cost of Performance Factor ...................

a.

Enter Beginning Date of Election Year

_____/_____/_____

(see instructions)

b.

Wage Certification Required each Year:

5. Construction Corporation

Check to certify that the average weekly

Completed Contract Basis Sales Factor (see instructions) .........

wage of full-time employees is greater than

the lower of state or local weekly wages for the industry .....

6. Railway Company Revenue Car Miles (see instructions) ............

c.

Combined Filer ......................................................................

Section B - Apportionable Percentage

TOTAL

VIRGINIA

PERCENTAGE

1. Single Factor Computation -

Motor Carriers, Financial Corporations, Construction

Corporations and Railway Companies (see instructions) ............. ____________________ .00 ____________________ .00

_____________%

2. Multifactor Computation

a) Property Factor (see instructions) ................................................. ____________________ .00 ____________________ .00

_____________%

b) Payroll Factor (see instructions) .................................................... ____________________ .00 ____________________ .00

_____________%

c) Sales Factor (see instructions) ...................................................... ____________________ .00 ____________________ .00

_____________%

d) Standard Apportionment Sales Factor: Enter Sales Factor from line 2(c) times 2. Sales factor is double weighted

(see instructions) .....................................................................................................................................................................

%

e) Manufacturer’s Apportionment - Alternative Election. For taxable years beginning on or after July 1, 2011,

enter Sales Factor from line 2(c) times 3. Sales factor is triple weighted. (see instructions) ..................................................

%

f) Sum of Percentages-Add Lines 2(a), 2(b) and 2(d). If using the manufacturer’s alternative weighted sales option,

add lines 2(a), 2(b) and Line 2(e). . .........................................................................................................................................

%

g) Multifactor Percentage: Line 2(f) divided by the number 4 (double weighted sales) or

5 (triple weighted) reduced by the number of factors, if any, having no denominator .............................................................

%

3. Income Subject to Virginia Tax

a) Virginia Taxable Income from Form 500, Line 7 ......................................................................................................

.00

b) Total Dividends (total amount of allocable income) ................................................................................................

.00

c) N onapportionable Investment Function Income from Form 500, Line 8(c) ............................................................

.00

d) Add Lines 3(b) and 3(c) ...........................................................................................................................................

.00

e) Nonapportionable Investment Function Loss from Form 500, Line 8(d) .................................................................

.00

f) Total Nonapportionable Income. Line 3(d) minus Line 3(e) .....................................................................................

.00

g) Income Subject to Apportionment. Line 3(a) minus Line 3(f) ..................................................................................

.00

h) Income Apportioned to Virginia. (Multiply the percent from Line 1 or Line 2(g) by Line 3(g)) ................................

.00

i) Dividends Allocated to Virginia: Portion of Dividends Reported on Line 3(b) (see instructions) .............................

.00

j) Income Subject to Virginia Tax. Add Lines 3(h) and 3(i) [Enter on Form 500, Line 8(a)].........................................

.00

Va. Dept. Of Taxation 2601006 8/ 11

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1