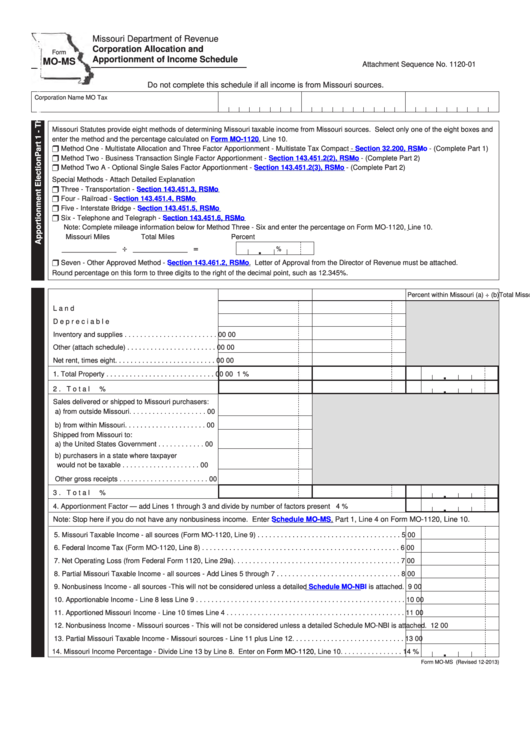

Missouri Department of Revenue

Corporation Allocation and

Form

Apportionment of Income Schedule

MO-MS

Attachment Sequence No. 1120-01

Do not complete this schedule if all income is from Missouri sources.

Corporation Name

MO Tax I.D. Number

Charter Number

Federal I.D. Number

Missouri Statutes provide eight methods of determining Missouri taxable income from Missouri sources. Select only one of the eight boxes and

enter the method and the percentage calculated on

Form

MO-1120, Line 10.

r Method One - Multistate Allocation and Three Factor Apportionment - Multistate Tax Compact -

Section 32.200, RSMo

- (Complete Part 1)

r Method Two - Business Transaction Single Factor Apportionment -

Section 143.451.2(2), RSMo

- (Complete Part 2)

r Method Two A - Optional Single Sales Factor Apportionment -

Section 143.451.2(3), RSMo

- (Complete Part 2)

Special Methods - Attach Detailed Explanation

r Three - Transportation -

Section 143.451.3, RSMo

r Four - Railroad -

Section 143.451.4, RSMo

r Five - Interstate Bridge -

Section 143.451.5, RSMo

r Six - Telephone and Telegraph -

Section 143.451.6, RSMo

Note: Complete mileage information below for Method Three - Six and enter the percentage on Form MO-1120, Line 10.

Missouri Miles

Total Miles

Percent

.

÷

=

%

______________

______________

r Seven - Other Approved Method -

Section 143.461.2,

RSMo. Letter of Approval from the Director of Revenue must be attached.

Round percentage on this form to three digits to the right of the decimal point, such as 12.345%.

Total Missouri (a)

Total Everywhere (b)

Percent within Missouri (a) ÷ (b)

Land . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

00

00

Depreciable assets . . . . . . . . . . . . . . . . . . . . . . . . . . .

00

00

Inventory and supplies . . . . . . . . . . . . . . . . . . . . . . . .

00

00

Other (attach schedule) . . . . . . . . . . . . . . . . . . . . . . .

00

00

Net rent, times eight . . . . . . . . . . . . . . . . . . . . . . . . . .

00

00

.

1. Total Property . . . . . . . . . . . . . . . . . . . . . . . . . . . .

00

00

1

%

.

2. Total Wages. . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

00

00

2

%

Sales delivered or shipped to Missouri purchasers:

a) from outside Missouri. . . . . . . . . . . . . . . . . . . .

00

b) from within Missouri . . . . . . . . . . . . . . . . . . . . .

00

Shipped from Missouri to:

a) the United States Government . . . . . . . . . . . .

00

b) purchasers in a state where taxpayer

would not be taxable . . . . . . . . . . . . . . . . . . . .

00

Other gross receipts . . . . . . . . . . . . . . . . . . . . . . .

00

.

3. Total Sales. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

00

00

3

%

.

4. Apportionment Factor — add Lines 1 through 3 and divide by number of factors present

4

%

Note: Stop here if you do not have any nonbusiness income. Enter

Schedule

MO-MS, Part 1, Line 4 on Form MO-1120, Line 10.

5. Missouri Taxable Income - all sources (Form MO-1120, Line 9) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5

00

6. Federal Income Tax (Form MO-1120, Line 8) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6

00

7. Net Operating Loss (from Federal Form 1120, Line 29a). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7

00

8. Partial Missouri Taxable Income - all sources - Add Lines 5 through 7 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8

00

9. Nonbusiness Income - all sources - This will not be considered unless a detailed

Schedule MO-NBI

is attached.

9

00

10. Apportionable Income - Line 8 less Line 9 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

10

00

11. Apportioned Missouri Income - Line 10 times Line 4 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

11

00

12. Nonbusiness Income - Missouri sources - This will not be considered unless a detailed Schedule MO-NBI is attached.

12

00

13. Partial Missouri Taxable Income - Missouri sources - Line 11 plus Line 12. . . . . . . . . . . . . . . . . . . . . . . . . . . . .

13

00

.

14. Missouri Income Percentage - Divide Line 13 by Line 8. Enter on

Form

MO-1120, Line 10. . . . . . . . . . . . . . . .

14

%

Form MO-MS (Revised 12-2013)

1

1 2

2