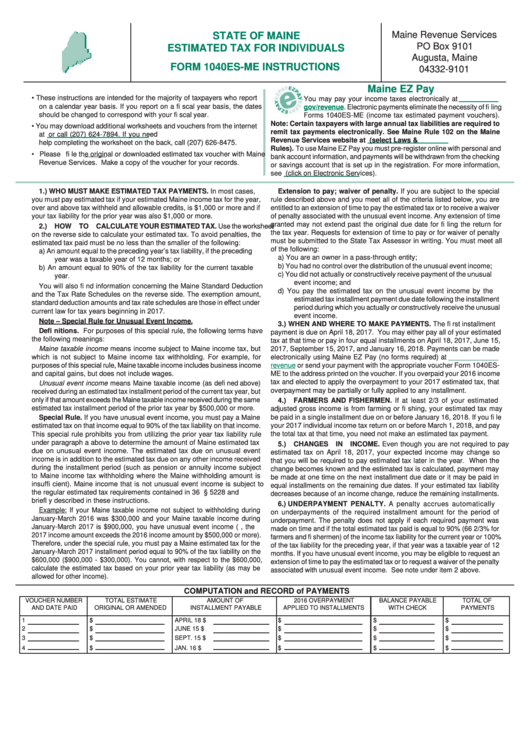

Form 1040es-Me - Estimated Tax Worksheet - 2017

ADVERTISEMENT

Maine Revenue Services

STATE OF MAINE

PO Box 9101

ESTIMATED TAX FOR INDIVIDUALS

Augusta, Maine

FORM 1040ES-ME INSTRUCTIONS

04332-9101

Maine EZ Pay

• These instructions are intended for the majority of taxpayers who report

You may pay your income taxes electronically at

on a calendar year basis. If you report on a fi scal year basis, the dates

gov/revenue. Electronic payments eliminate the necessity of fi ling

should be changed to correspond with your fi scal year.

Forms 1040ES-ME (income tax estimated payment vouchers).

Note: Certain taxpayers with large annual tax liabilities are required to

• You may download additional worksheets and vouchers from the internet

remit tax payments electronically. See Maine Rule 102 on the Maine

at

gov/revenue/forms

or call (207) 624-7894. If you need

Revenue Services website at

gov/revenue

(select Laws &

help completing the worksheet on the back, call (207) 626-8475.

Rules). To use Maine EZ Pay you must pre-register online with personal and

• Please fi le the original or downloaded estimated tax voucher with Maine

bank account information, and payments will be withdrawn from the checking

Revenue Services. Make a copy of the voucher for your records.

or savings account that is set up in the registration. For more information,

see

gov/revenue

(click on Electronic Services).

1.)

WHO MUST MAKE ESTIMATED TAX PAYMENTS. In most cases,

Extension to pay; waiver of penalty. If you are subject to the special

you must pay estimated tax if your estimated Maine income tax for the year,

rule described above and you meet all of the criteria listed below, you are

over and above tax withheld and allowable credits, is $1,000 or more and if

entitled to an extension of time to pay the estimated tax or to receive a waiver

your tax liability for the prior year was also $1,000 or more.

of penalty associated with the unusual event income. Any extension of time

granted may not extend past the original due date for fi ling the return for

2.)

HOW TO CALCULATE YOUR ESTIMATED TAX. Use the worksheet

the tax year. Requests for extension of time to pay or for waiver of penalty

on the reverse side to calculate your estimated tax. To avoid penalties, the

must be submitted to the State Tax Assessor in writing. You must meet all

estimated tax paid must be no less than the smaller of the following:

of the following:

a)

An amount equal to the preceding year’s tax liability, if the preceding

a)

You are an owner in a pass-through entity;

year was a taxable year of 12 months; or

b)

You had no control over the distribution of the unusual event income;

b)

An amount equal to 90% of the tax liability for the current taxable

c)

You did not actually or constructively receive payment of the unusual

year.

event income; and

You will also fi nd information concerning the Maine Standard Deduction

d)

You pay the estimated tax on the unusual event income by the

and the Tax Rate Schedules on the reverse side. The exemption amount,

estimated tax installment payment due date following the installment

standard deduction amounts and tax rate schedules are those in effect under

period during which you actually or constructively receive the unusual

current law for tax years beginning in 2017.

event income.

Note – Special Rule for Unusual Event Income.

3.)

WHEN AND WHERE TO MAKE PAYMENTS. The fi rst installment

Defi nitions. For purposes of this special rule, the following terms have

payment is due on April 18, 2017. You may either pay all of your estimated

the following meanings:

tax at that time or pay in four equal installments on April 18, 2017, June 15,

Maine taxable income means income subject to Maine income tax, but

2017, September 15, 2017, and January 16, 2018. Payments can be made

which is not subject to Maine income tax withholding. For example, for

electronically using Maine EZ Pay (no forms required) at

gov/

purposes of this special rule, Maine taxable income includes business income

revenue

or send your payment with the appropriate voucher Form 1040ES-

and capital gains, but does not include wages.

ME to the address printed on the voucher. If you overpaid your 2016 income

tax and elected to apply the overpayment to your 2017 estimated tax, that

Unusual event income means Maine taxable income (as defi ned above)

overpayment may be partially or fully applied to any installment.

received during an estimated tax installment period of the current tax year, but

only if that amount exceeds the Maine taxable income received during the same

4.)

FARMERS AND FISHERMEN. If at least 2/3 of your estimated

estimated tax installment period of the prior tax year by $500,000 or more.

adjusted gross income is from farming or fi shing, your estimated tax may

be paid in a single installment due on or before January 16, 2018. If you fi le

Special Rule. If you have unusual event income, you must pay a Maine

your 2017 individual income tax return on or before March 1, 2018, and pay

estimated tax on that income equal to 90% of the tax liability on that income.

the total tax at that time, you need not make an estimated tax payment.

This special rule prohibits you from utilizing the prior year tax liability rule

under paragraph a above to determine the amount of Maine estimated tax

5.)

CHANGES IN INCOME. Even though you are not required to pay

due on unusual event income. The estimated tax due on unusual event

estimated tax on April 18, 2017, your expected income may change so

income is in addition to the estimated tax due on any other income received

that you will be required to pay estimated tax later in the year. When the

during the installment period (such as pension or annuity income subject

change becomes known and the estimated tax is calculated, payment may

to Maine income tax withholding where the Maine withholding amount is

be made at one time on the next installment due date or it may be paid in

insuffi cient). Maine income that is not unusual event income is subject to

equal installments on the remaining due dates. If your estimated tax liability

the regular estimated tax requirements contained in 36 M.R.S. § 5228 and

decreases because of an income change, reduce the remaining installments.

briefl y described in these instructions.

6.)

UNDERPAYMENT PENALTY. A penalty accrues automatically

Example: If your Maine taxable income not subject to withholding during

on underpayments of the required installment amount for the period of

January-March 2016 was $300,000 and your Maine taxable income during

underpayment. The penalty does not apply if each required payment was

January-March 2017 is $900,000, you have unusual event income (i.e., the

made on time and if the total estimated tax paid is equal to 90% (66 2/3% for

2017 income amount exceeds the 2016 income amount by $500,000 or more).

farmers and fi shermen) of the income tax liability for the current year or 100%

Therefore, under the special rule, you must pay a Maine estimated tax for the

of the tax liability for the preceding year, if that year was a taxable year of 12

January-March 2017 installment period equal to 90% of the tax liability on the

months. If you have unusual event income, you may be eligible to request an

$600,000 ($900,000 - $300,000). You cannot, with respect to the $600,000,

extension of time to pay the estimated tax or to request a waiver of the penalty

calculate the estimated tax based on your prior year tax liability (as may be

associated with unusual event income. See note under item 2 above.

allowed for other income).

COMPUTATION and RECORD of PAYMENTS

VOUCHER NUMBER

TOTAL ESTIMATE

AMOUNT OF

2016 OVERPAYMENT

BALANCE PAYABLE

TOTAL OF

AND DATE PAID

ORIGINAL OR AMENDED

INSTALLMENT PAYABLE

APPLIED TO INSTALLMENTS

WITH CHECK

PAYMENTS

1

$

APRIL 18

$

$

$

$

2

$

JUNE 15

$

$

$

$

3

$

SEPT. 15

$

$

$

$

4

$

JAN. 16

$

$

$

$

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3