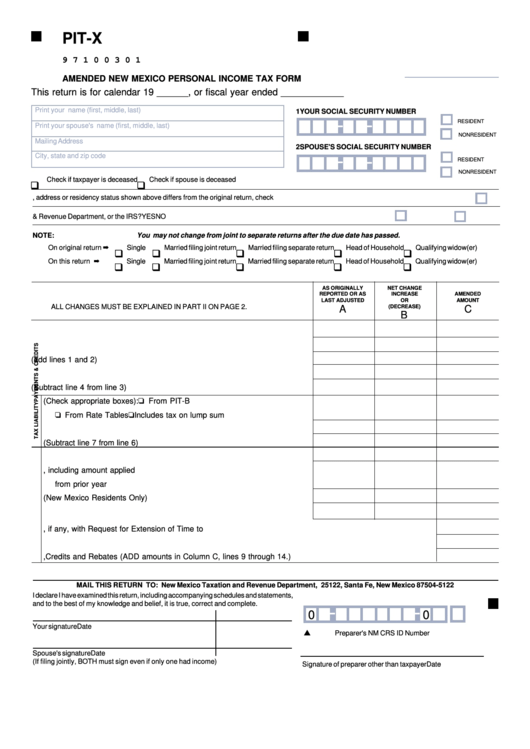

PIT-X

9 7 1 0 0 3 0 1

AMENDED NEW MEXICO PERSONAL INCOME TAX FORM

This return is for calendar 19 ______, or fiscal year ended ____________

Print your name (first, middle, last)

1 YOUR SOCIAL SECURITY NUMBER

-

-

RESIDENT

Print your spouse's name (first, middle, last)

NONRESIDENT

Mailing Address

2 SPOUSE'S SOCIAL SECURITY NUMBER

City, state and zip code

-

-

RESIDENT

NONRESIDENT

Check if taxpayer is deceased

Check if spouse is deceased

A.

If the name, address or residency status shown above differs from the original return, check here. ..................................................................

B.

Has the original return been changed or audited by Taxation & Revenue Department, or the IRS?

YES

NO

C.

Filing status claimed. NOTE: You may not change from joint to separate returns after the due date has passed.

On original return

Single

Married filing joint return

Married filing separate return

Head of Household

Qualifying widow(er)

On this return

Single

Married filing joint return

Married filing separate return

Head of Household

Qualifying widow(er)

AS ORIGINALLY

NET CHANGE

REPORTED OR AS

INCREASE

AMENDED

LAST ADJUSTED

OR

AMOUNT

ALL CHANGES MUST BE EXPLAINED IN PART II ON PAGE 2.

(DECREASE)

A

C

B

1. Federal adjusted gross income ......................................................................

2. New Mexico adjustments to income ..............................................................

3. New Mexico base income (add lines 1 and 2) ...............................................

4. Deductions from base income .......................................................................

5. New Mexico Taxable Income (Subtract line 4 from line 3) ............................

6. New Mexico Tax (Check appropriate boxes):

From PIT-B

From Rate Tables

Includes tax on lump sum distributions ........

7. Non-refundable credits .............................................................................

8. Net New Mexico Tax (Subtract line 7 from line 6) ....................................

9. New Mexico income tax withheld .............................................................

10.New Mexico estimated tax payments made, including amount applied

from prior year return. ...............................................................................

11.Credit for prescription drugs (New Mexico Residents Only) ....................

12.Refundable rebates and credits ................................................................

13.Amount paid, if any, with Request for Extension of Time to File .........................................................................

14.Amount of tax paid with original return plus additional tax paid after it was filed ................................................

15.Total Payments,Credits and Rebates (ADD amounts in Column C, lines 9 through 14.) ...................................

MAIL THIS RETURN TO: New Mexico Taxation and Revenue Department, P.O. Box 25122, Santa Fe, New Mexico 87504-5122

I declare I have examined this return, including accompanying schedules and statements,

and to the best of my knowledge and belief, it is true, correct and complete.

-

-

0

0 0

Your signature

Date

Preparer's NM CRS ID Number

Spouse's signature

Date

(If filing jointly, BOTH must sign even if only one had income)

Signature of preparer other than taxpayer

Date

1

1 2

2