Form Il-941-X - Amended Illinois Quarterly Withholding Tax Return

ADVERTISEMENT

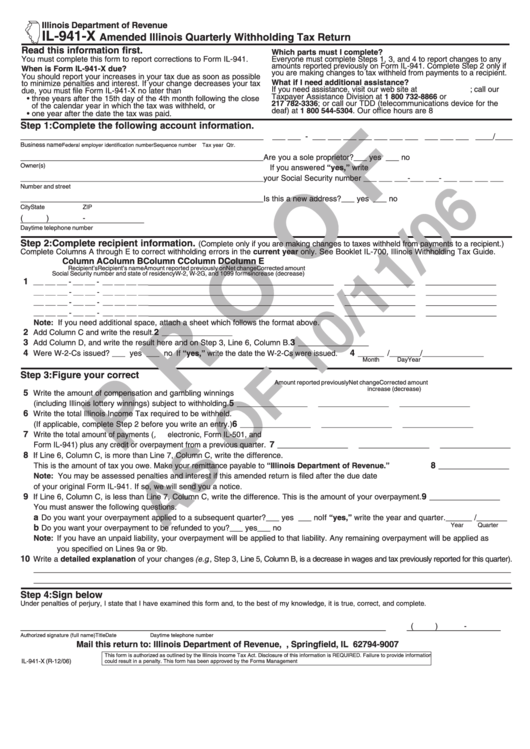

Illinois Department of Revenue

IL-941-X

Amended Illinois Quarterly Withholding Tax Return

Read this information first.

Which parts must I complete?

You must complete this form to report corrections to Form IL-941.

Everyone must complete Steps 1, 3, and 4 to report changes to any

amounts reported previously on Form IL-941. Complete Step 2 only if

When is Form IL-941-X due?

you are making changes to tax withheld from payments to a recipient.

You should report your increases in your tax due as soon as possible

What if I need additional assistance?

to minimize penalties and interest. If your change decreases your tax

If you need assistance, visit our web site at tax.illinois.gov ; call our

due, you must file Form IL-941-X no later than

Taxpayer Assistance Division at 1 800 732-8866 or

• three years after the 15th day of the 4th month following the close

217 782-3336 ; or call our TDD (telecommunications device for the

of the calendar year in which the tax was withheld, or

deaf) at 1 800 544-5304 . Our office hours are 8 a.m. to 5 p.m.

• one year after the date the tax was paid.

Step 1: Complete the following account information.

_______________________________________________________

___ ___ - ___ ___ ___ ___ ___ ___ ___ ___ ___ ___ ____/____

Business name

Federal employer identification number

Sequence number

Tax year Qtr.

_______________________________________________________

Are you a sole proprietor?

___ yes ___ no

Owner(s)

If you answered “yes,” write

_______________________________________________________

your Social Security number ___ ___ ___-___ ___- ___ ___ ___ ___

Number and street

_______________________________________________________

Is this a new address?

___ yes ___ no

City

State

ZIP

(

)

-

____________________________

Daytime telephone number

Step 2: Complete recipient information.

(Complete only if you are making changes to taxes withheld from payments to a recipient.)

Complete Columns A through E to correct withholding errors in the current year only. See Booklet IL-700, Illinois Withholding Tax Guide.

Column A

Column B

Column C

Column D

Column E

Recipient’s

Recipient’s name

Amount reported previously on

Net change

Corrected amount

Social Security number

and state of residency

W-2, W-2G, and 1099 forms

increase (decrease)

1

-

-

__________________________

________________

________________

________________

___ ___ ___

___ ___

___ ___ ___ ___

-

-

__________________________

________________

________________

________________

___ ___ ___

___ ___

___ ___ ___ ___

-

-

__________________________

________________

________________

________________

___ ___ ___

___ ___

___ ___ ___ ___

-

-

__________________________

________________

________________

________________

___ ___ ___

___ ___

___ ___ ___ ___

Note: If you need additional space, attach a sheet which follows the format above.

2

2

Add Column C and write the result.

________________

3

3

Add Column D, and write the result here and on Step 3, Line 6, Column B.

________________

4

4

Were W-2-Cs issued? ___ yes ___ no If “yes,” write the date the W-2-Cs were issued.

______ /_______/______________

Month

Day

Year

Step 3: Figure your correct withholding.

Column A

Column B

Column C

Amount reported previously

Net change

Corrected amount

increase (decrease)

5

Write the amount of compensation and gambling winnings

5

(including Illinois lottery winnings) subject to withholding.

________________

________________

________________

6

Write the total Illinois Income Tax required to be withheld.

6

(If applicable, complete Step 2 before you write an entry.)

________________

________________

________________

7

Write the total amount of payments ( i.e., electronic, Form IL-501, and

7

Form IL-941) plus any credit or overpayment from a previous quarter.

________________

________________

________________

8

If Line 6, Column C, is more than Line 7, Column C, write the difference.

8

This is the amount of tax you owe. Make your remittance payable to “Illinois Department of Revenue.”

________________

Note: You may be assessed penalties and interest if this amended return is filed after the due date

of your original Form IL-941. If so, we will send you a notice.

9

9

If Line 6, Column C, is less than Line 7, Column C, write the difference. This is the amount of your overpayment.

________________

You must answer the following questions.

a

Do you want your overpayment applied to a subsequent quarter? ___ yes ___ no If “yes,” write the year and quarter.______ /_______

Year

Quarter

b

Do you want your overpayment to be refunded to you?

___ yes ___ no

Note: If you have an unpaid liability, your overpayment will be applied to that liability. Any remaining overpayment will be applied as

you specified on Lines 9a or 9b.

10

Write a detailed explanation of your changes (e.g ., Step 3, Line 5, Column B, is a decrease in wages and tax previously reported for this quarter).

____________________________________________________________________________________________________________

____________________________________________________________________________________________________________

Step 4: Sign below

Under penalties of perjury, I state that I have examined this form and, to the best of my knowledge, it is true, correct, and complete.

______________________________________________________________________

__________________

(

)

-

Authorized signature (full name)

Title

Date

Daytime telephone number

Mail this return to: Illinois Department of Revenue, P.O. Box 19007, Springfield, IL 62794-9007

This form is authorized as outlined by the Illinois Income Tax Act. Disclosure of this information is REQUIRED. Failure to provide information

IL-941-X (R-12/06)

could result in a penalty. This form has been approved by the Forms Management Center.

IL-492-0048

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1