Form Il-941-X Draft - Amended Illinois Quarterly Withholding Tax Return - 2009

ADVERTISEMENT

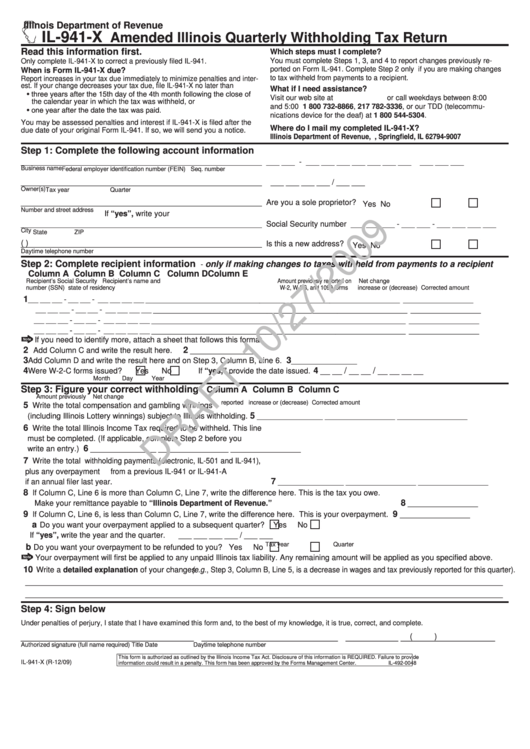

Illinois Department of Revenue

IL-941-X

Amended Illinois Quarterly Withholding Tax Return

Read this information first.

Which steps must I complete?

You must complete Steps 1, 3, and 4 to report changes previously re-

Only complete IL-941-X to correct a previously filed IL-941.

ported on Form IL-941. Complete Step 2 only if you are making changes

When is Form IL-941-X due?

to tax withheld from payments to a recipient.

Report increases in your tax due immediately to minimize penalties and inter-

est. If your change decreases your tax due, file IL-941-X no later than

What if I need assistance?

• three years after the 15th day of the 4th month following the close of

Visit our web site at tax.illinois.gov or call weekdays between 8:00 a.m.

the calendar year in which the tax was withheld, or

and 5:00 p.m. at 1 800 732-8866, 217 782-3336, or our TDD (telecommu-

• one year after the date the tax was paid.

nications device for the deaf) at 1 800 544-5304.

You may be assessed penalties and interest if IL-941-X is filed after the

Where do I mail my completed IL-941-X?

due date of your original Form IL-941. If so, we will send you a notice.

Illinois Department of Revenue, P.O. Box 19007, Springfield, IL 62794-9007

Step 1: Complete the following account information

_______________________________________________________

___ ___ - ___ ___ ___ ___ ___ ___ ___

___ ___ ___

Business name

Federal employer identification number (FEIN)

Seq. number

_______________________________________________________

___ ___ ___ ___ / ___ ___

Owner(s)

Tax year

Quarter

_______________________________________________________

Are you a sole proprietor?

Yes

No

Number and street address

If “yes”, write your

_______________________________________________________

Social Security number ___ ___ ___ - ___ ___ - ___ ___ ___ ___

City

State

ZIP

(

)

_______________________________________________________

Is this a new address?

Yes

No

Daytime telephone number

Step 2: Complete recipient information

only if making changes to taxes withheld from payments to a recipient

-

Column A

Column B

Column C

Column D

Column E

Recipient’s Social Security

Recipient’s name and

Amount previously reported on

Net change

number (SSN)

state of residency

W-2, W-2G, and 1099 forms

increase or (decrease)

Corrected amount

1

-

-

__________________________

________________

________________

________________

___ ___ ___

___ ___

___ ___ ___ ___

-

-

__________________________

________________

________________

________________

___ ___ ___

___ ___

___ ___ ___ ___

-

-

__________________________

________________

________________

________________

___ ___ ___

___ ___

___ ___ ___ ___

-

-

__________________________

________________

________________

________________

___ ___ ___

___ ___

___ ___ ___ ___

If you need to identify more, attach a sheet that follows this format.

2

2

Add Column C and write the result here.

_______________

3

3

Add Column D and write the result here and on Step 3, Column B, Line 6.

_______________

4

4 __ __ / __ __ / __ __ __ __

Were W-2-C forms issued?

Yes

No If “yes,” provide the date issued.

Month

Day

Year

Step 3: Figure your correct withholding

Column A

Column B

Column C

Amount previously

Net change

reported

increase or (decrease)

Corrected amount

5

Write the total compensation and gambling winnings

5

(including Illinois Lottery winnings) subject to Illinois withholding.

_______________

________________ ________________

6

Write the total Illinois Income Tax required to be withheld. This line

must be completed. (If applicable, complete Step 2 before you

6

write an entry.)

_______________

________________

________________

7

Write the total withholding payments (electronic, IL-501 and IL-941),

plus any overpayment from a previous IL-941 or IL-941-A

7

if an annual filer last year.

_______________

________________

________________

8

If Column C, Line 6 is more than Column C, Line 7, write the difference here. This is the tax you owe.

8

Make your remittance payable to “Illinois Department of Revenue.”

________________

9

9

If Column C, Line 6, is less than Column C, Line 7, write the difference here. This is your overpayment.

________________

a

Do you want your overpayment applied to a subsequent quarter?

Yes

No

If “yes”, write the year and the quarter.

___ ___ ___ ___ / ___ ___

Tax year

Quarter

b

Do you want your overpayment to be refunded to you?

Yes

No

Your overpayment will first be applied to any unpaid Illinois tax liability. Any remaining amount will be applied as you specified above.

10

Write a detailed explanation of your changes (e.g., Step 3, Column B, Line 5, is a decrease in wages and tax previously reported for this quarter).

_____________________________________________________________________________________________________________

_____________________________________________________________________________________________________________

Step 4: Sign below

Under penalties of perjury, I state that I have examined this form and, to the best of my knowledge, it is true, correct, and complete.

_________________________________ __________________________ __________ __________________

(

)

Authorized signature (full name required)

Title

Date

Daytime telephone number

This form is authorized as outlined by the Illinois Income Tax Act. Disclosure of this information is REQUIRED. Failure to provide

IL-941-X (R-12/09)

information could result in a penalty. This form has been approved by the Forms Management Center.

IL-492-0048

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1